Question: PLEASE ANSWER THE TWO QUESTIONS. 4 questions per cheg Policy Homework: Make-Up Homework Question 5, Problem 11 HW Score: 30%, 3 of 10 points O

PLEASE ANSWER THE TWO QUESTIONS. 4 questions per cheg Policy

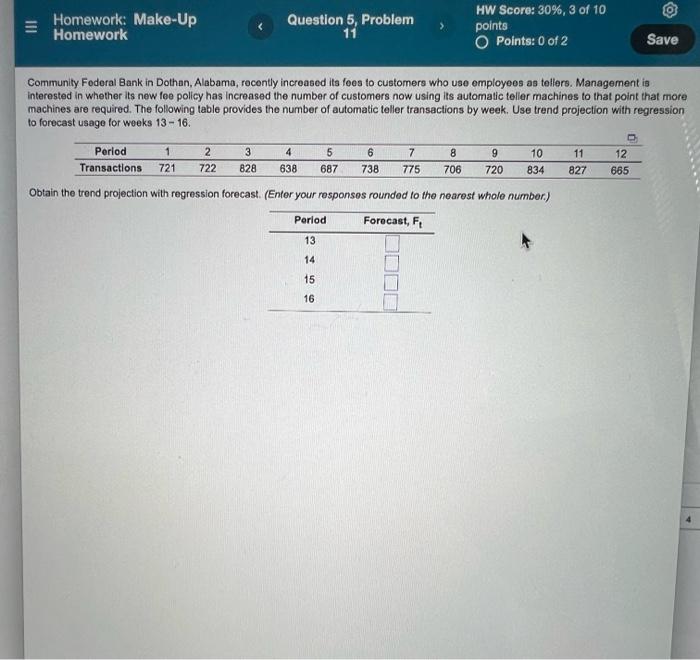

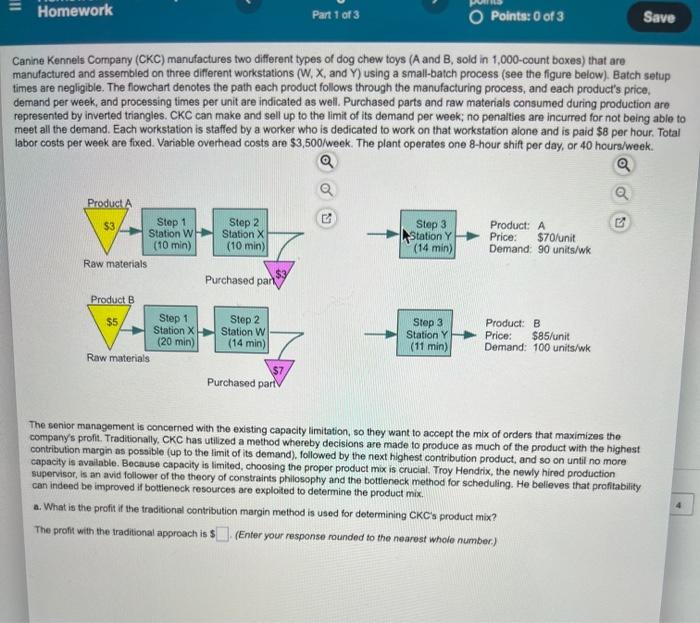

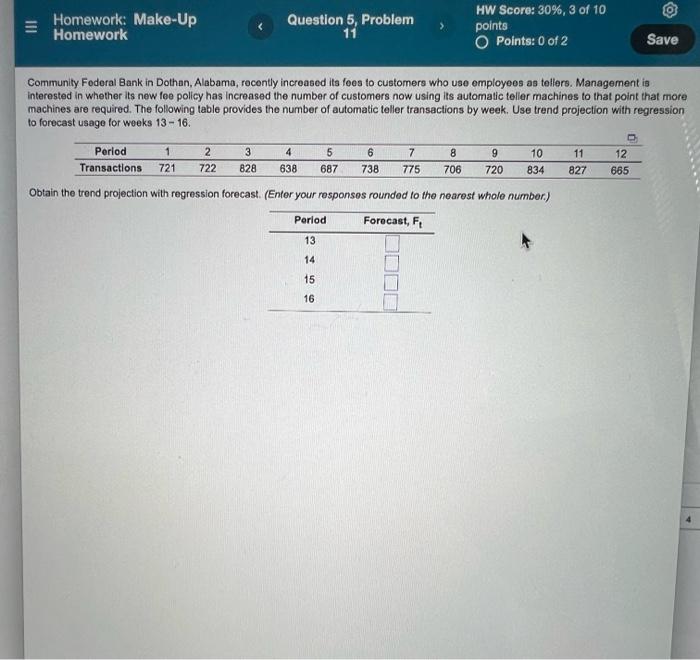

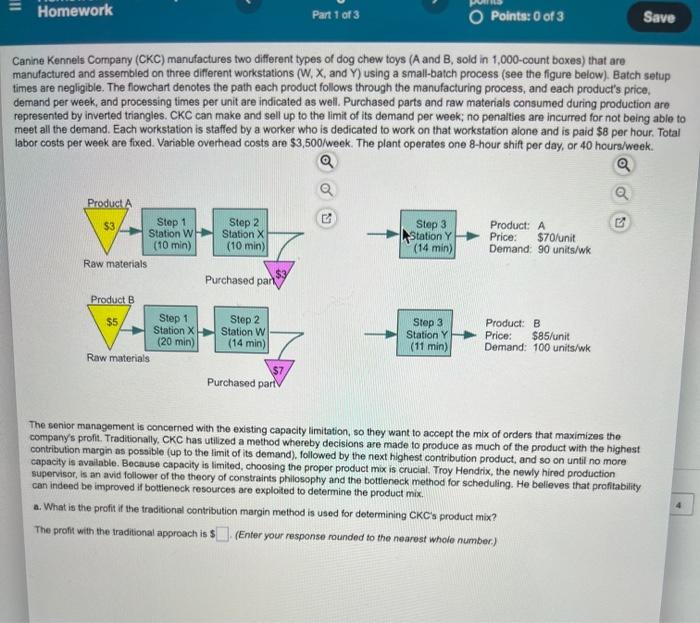

Homework: Make-Up Homework Question 5, Problem 11 HW Score: 30%, 3 of 10 points O Points: 0 of 2 Save Community Federal Bank in Dothan, Alabama, recently increased its fees to customers who use employees as tellers. Management is interested in whether its new fee policy has increased the number of customers now using its automatic teller machines to that point that more machines are required. The following table provides the number of automatic teller transactions by week. Use trend projection with regression to forecast usage for weeks 13-16. D 7 9 10 11 Period Transactions 1 2 3 721 722 828 4 5 638 687 6 738 775 8 706 720 834 827 Obtain the trend projection with regression forecast. (Enter your responses rounded to the nearest whole number.) Period Forecast, F 13 14 15 16 12 665 II Homework Part 1 of 3 O Points: 0 of 3 Save Canine Kennels Company (CKC) manufactures two different types of dog chew toys (A and B, sold in 1,000-count boxes) that are manufactured and assembled on three different workstations (W, X, and Y) using a small-batch process (see the figure below). Batch setup times are negligible. The flowchart denotes the path each product follows through the manufacturing process, and each product's price, demand per week, and processing times per unit are indicated as well. Purchased parts and raw materials consumed during production are represented by inverted triangles. CKC can make and sell up to the limit of its demand per week; no penalties are incurred for not being able to meet all the demand. Each workstation is staffed by a worker who is dedicated to work on that workstation alone and is paid $8 per hour. Total labor costs per week are fixed. Variable overhead costs are $3,500/week. The plant operates one 8-hour shift per day, or 40 hours/week. Q Product A G 5 $3 Step 1 Station W Step 2 Station X (10 min) Step 3 Station Y (14 min) Product: A Price: $70/unit Demand: 90 units/wk (10 min) Raw materials Purchased park Product B $5 Step 2 Product: B Station W Step 3 Station Y (11 min) Price: $85/unit Demand: 100 units/wk (14 min) Raw materials Purchased part The senior management is concerned with the existing capacity limitation, so they want to accept the mix of orders that maximizes the company's profit. Traditionally, CKC has utilized a method whereby decisions are made to produce as much of the product with the highest contribution margin as possible (up to the limit of its demand), followed by the next highest contribution product, and so on until no more capacity is available. Because capacity is limited, choosing the proper product mix is crucial. Troy Hendrix, the newly hired production supervisor, is an avid follower of the theory of constraints philosophy and the bottleneck method for scheduling. He believes that profitability can indeed be improved if bottleneck resources are exploited to determine the product mix. a. What is the profit if the traditional contribution margin method is used for determining CKC's product mix? The profit with the traditional approach is $. (Enter your response rounded to the nearest whole number.) Step 1 Station X (20 min) $3 $7

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock