Question: please answer them all! The firm estimates that it needs to initially invest $90 in new project, with the following cash flows: year 1 $30,

please answer them all!

please answer them all!

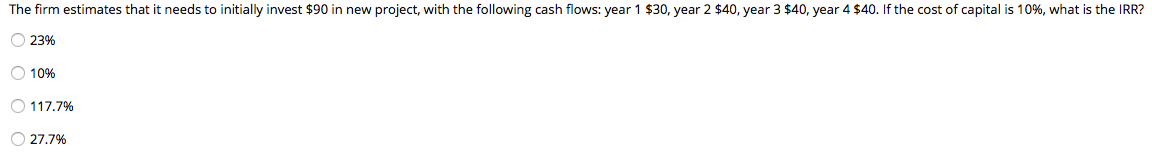

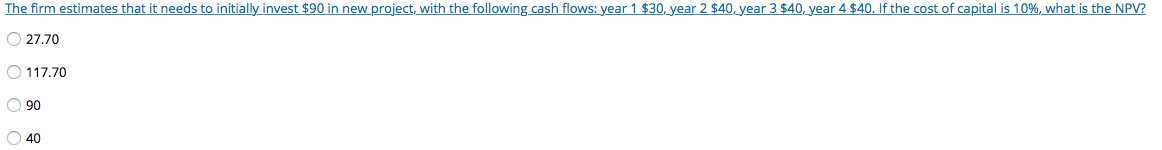

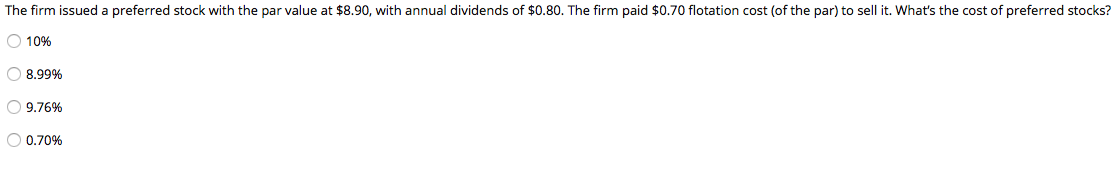

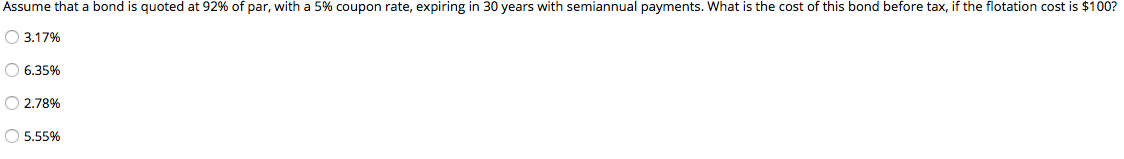

The firm estimates that it needs to initially invest $90 in new project, with the following cash flows: year 1 $30, year 2 $40, year 3 $40, year 4 $40. If the cost of capital is 10%, what is the IRR? - 23% 10% 117.7% 27.7% The firm estimates that it needs to initially invest $90 in new project, with the following cash flows: year 1 $30, year 2 $40 year 3 $40, year 4 $40. If the cost of capital is 10%, what is the NPV? 27.70 117.70 90 40 The firm issued a preferred stock with the par value at $8.90, with annual dividends of $0.80. The firm paid $0.70 flotation cost of the par) to sell it. What's the cost of preferred stocks? 10% 8.99% 09.76% O 0.70% Assume that a bond is quoted at 92% of par, with a 5% coupon rate, expiring in 30 years with semiannual payments. What is the cost of this bond before tax, if the flotation cost is $100? 3.17% 6.35% 2.78% 5.55%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts