Question: Please answer them using Mathematica if possible. Handwritten answer is fine too. Thanks! 2. In this exercise, we analyze a simplified q model. Suppose that

Please answer them using Mathematica if possible. Handwritten answer is fine too. Thanks!

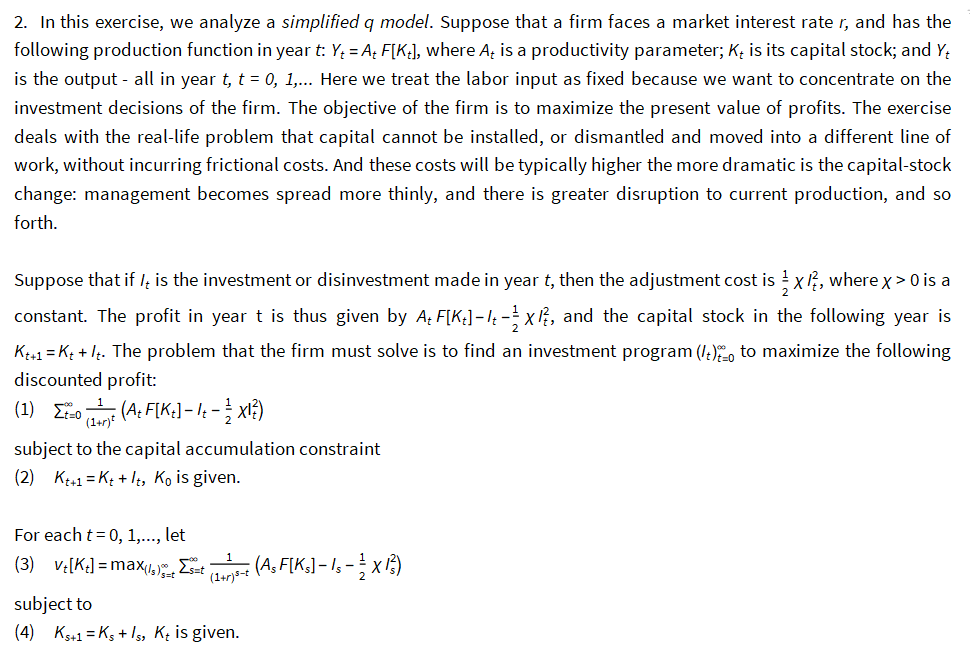

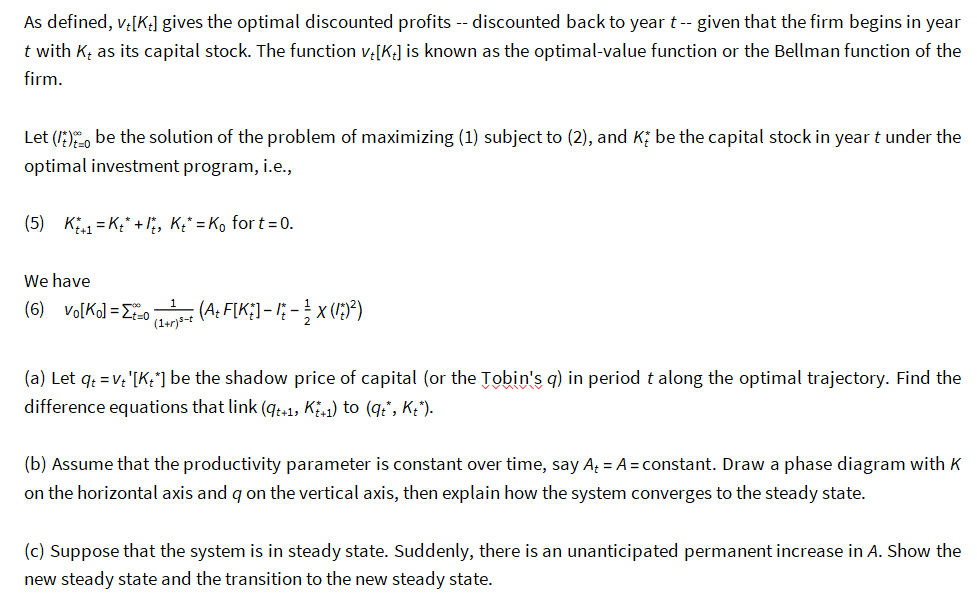

2. In this exercise, we analyze a simplified q model. Suppose that a firm faces a market interest rate r, and has the following production function in year t: Y = A+ F[Kt], where A is a productivity parameter; K+ is its capital stock; and Y4 is the output - all in year t, t = 0, 1,... Here we treat the labor input as fixed because we want to concentrate on the investment decisions of the firm. The objective of the firm is to maximize the present value of profits. The exercise deals with the real-life problem that capital cannot be installed, or dismantled and moved into a different line of work, without incurring frictional costs. And these costs will be typically higher the more dramatic is the capital-stock change management becomes spread more thinly, and there is greater disruption to current production, and so forth. Suppose that if le is the investment or disinvestment made in year t, then the adjustment cost is 0 is a constant. The profit in year t is thus given by A4 F[K:] 14 x1, and the capital stock in the following year is Kt+1 = K+ + 1t. The problem that the firm must solve is to find an investment program (I+)-o to maximize the following discounted profit: (1) Eo ame (A F[K:] x??) subject to the capital accumulation constraint (2) Kt+1 = K+ + It, ko is given. For each t = 0, 1,..., let (3) v[K:] = maxlove Esat (Dunjot (A$F[K] - Is - x 13) subject to (4) Ks+1 = Ks + Is, Kt is given. As defined, vt[K] gives the optimal discounted profits -- discounted back to year t -- given that the firm begins in year t with K as its capital stock. The function v[kt] is known as the optimal-value function or the Bellman function of the firm. Let (17)-o be the solution of the problem of maximizing (1) subject to (2), and Kibe the capital stock in year t under the optimal investment program, i.e., (5) Kia1 = K* +, Ke* = K, fort=0. We have (6) Vo[K] = Ef=0 dume (A? F[K) 17 * x(17)?) (a) Let qt = v'[K**] be the shadow price of capital (or the Tobin's q) in period t along the optimal trajectory. Find the difference equations that link (97+1, Ki-1) to (9t*, Ky"). (b) Assume that the productivity parameter is constant over time, say A4 = A=constant. Draw a phase diagram with K on the horizontal axis and q on the vertical axis, then explain how the system converges to the steady state. (c) Suppose that the system is in steady state. Suddenly, there is an unanticipated permanent increase in A. Show the new steady state and the transition to the new steady state. 2. In this exercise, we analyze a simplified q model. Suppose that a firm faces a market interest rate r, and has the following production function in year t: Y = A+ F[Kt], where A is a productivity parameter; K+ is its capital stock; and Y4 is the output - all in year t, t = 0, 1,... Here we treat the labor input as fixed because we want to concentrate on the investment decisions of the firm. The objective of the firm is to maximize the present value of profits. The exercise deals with the real-life problem that capital cannot be installed, or dismantled and moved into a different line of work, without incurring frictional costs. And these costs will be typically higher the more dramatic is the capital-stock change management becomes spread more thinly, and there is greater disruption to current production, and so forth. Suppose that if le is the investment or disinvestment made in year t, then the adjustment cost is 0 is a constant. The profit in year t is thus given by A4 F[K:] 14 x1, and the capital stock in the following year is Kt+1 = K+ + 1t. The problem that the firm must solve is to find an investment program (I+)-o to maximize the following discounted profit: (1) Eo ame (A F[K:] x??) subject to the capital accumulation constraint (2) Kt+1 = K+ + It, ko is given. For each t = 0, 1,..., let (3) v[K:] = maxlove Esat (Dunjot (A$F[K] - Is - x 13) subject to (4) Ks+1 = Ks + Is, Kt is given. As defined, vt[K] gives the optimal discounted profits -- discounted back to year t -- given that the firm begins in year t with K as its capital stock. The function v[kt] is known as the optimal-value function or the Bellman function of the firm. Let (17)-o be the solution of the problem of maximizing (1) subject to (2), and Kibe the capital stock in year t under the optimal investment program, i.e., (5) Kia1 = K* +, Ke* = K, fort=0. We have (6) Vo[K] = Ef=0 dume (A? F[K) 17 * x(17)?) (a) Let qt = v'[K**] be the shadow price of capital (or the Tobin's q) in period t along the optimal trajectory. Find the difference equations that link (97+1, Ki-1) to (9t*, Ky"). (b) Assume that the productivity parameter is constant over time, say A4 = A=constant. Draw a phase diagram with K on the horizontal axis and q on the vertical axis, then explain how the system converges to the steady state. (c) Suppose that the system is in steady state. Suddenly, there is an unanticipated permanent increase in A. Show the new steady state and the transition to the new steady state

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts