Question: please answer these! 5 a) Intercept = Suppose in the current market, the risk free rate is 4%, and the expected return on the entire

please answer these!

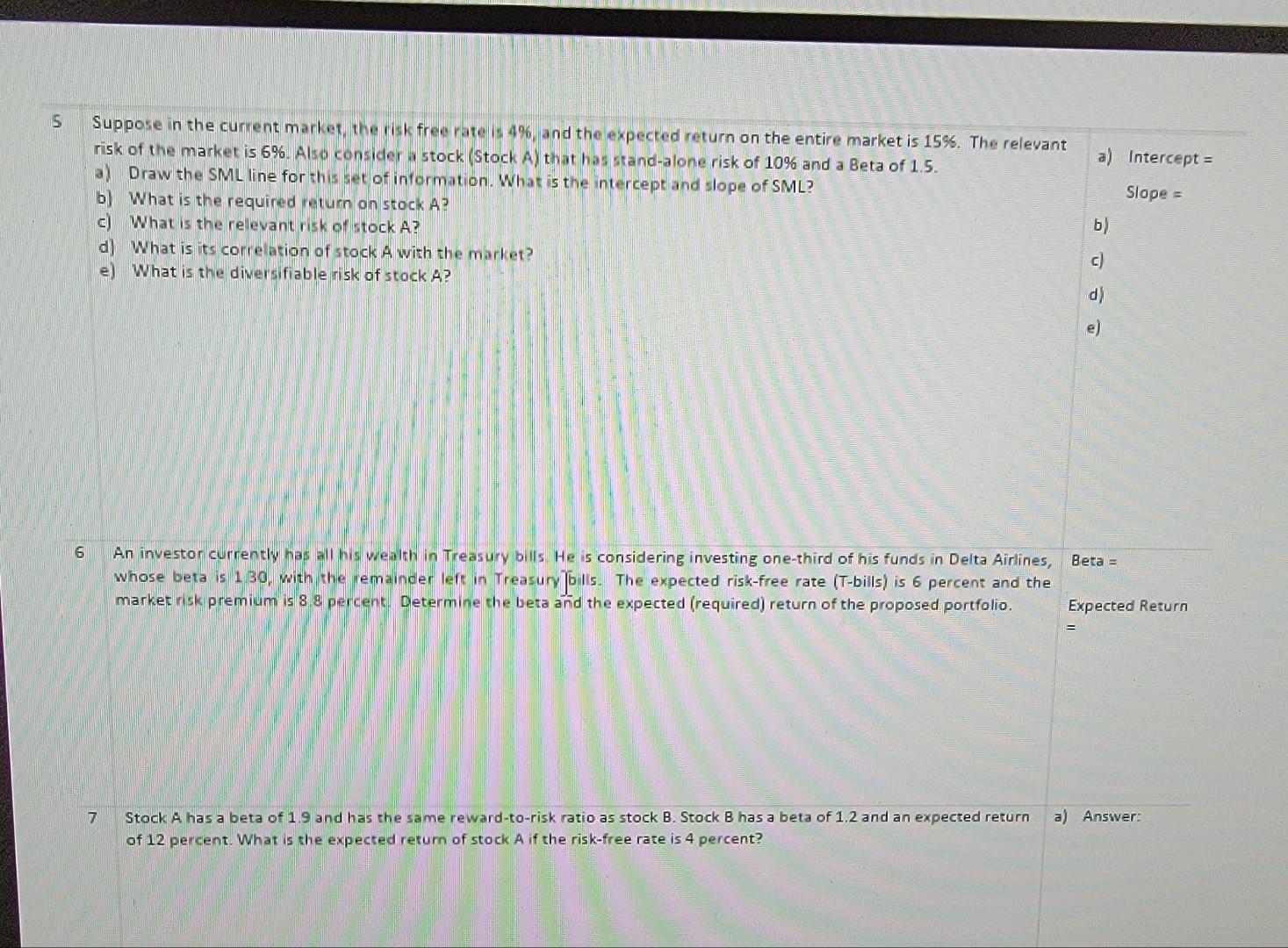

5 a) Intercept = Suppose in the current market, the risk free rate is 4%, and the expected return on the entire market is 15%. The relevant risk of the market is 6%. Also consider a stock (Stock Ay that has stand-alone risk of 10% and a Beta of 1.5. a) Draw the SML line for this set of information. What is the intercept and slope of SML? b) What is the required return on stock A? c) What is the relevant risk of stock A? d) What is its correlation of stock A with the market? e) What is the diversifiable risk of stock A? Slape = b) c) d) e] 6 Beta = An investor currently has all his wealth in Treasury bills. He is considering investing one-third of his funds in Delta Airlines, whose beta is 130, with the remainder lert in Treasury bills. The expected risk-free rate (T-bills) is 6 percent and the market risk premium is 8 8 percent. Determine the beta and the expected (required) return of the proposed portfolio. Expected Return 7 a) Answer: Stock A has a beta of 1.9 and has the same reward-to-risk ratio as stock B. Stock B has a beta of 1.2 and an expected return of 12 percent. What is the expected return of stock A if the risk-free rate is 4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts