Question: Please answer these questions 1 & 2 with solution and explanation. Thank you. 1. in each of the following scenarios, explain whether or not WEnterprises

Please answer these questions 1 & 2 with solution and explanation. Thank you.

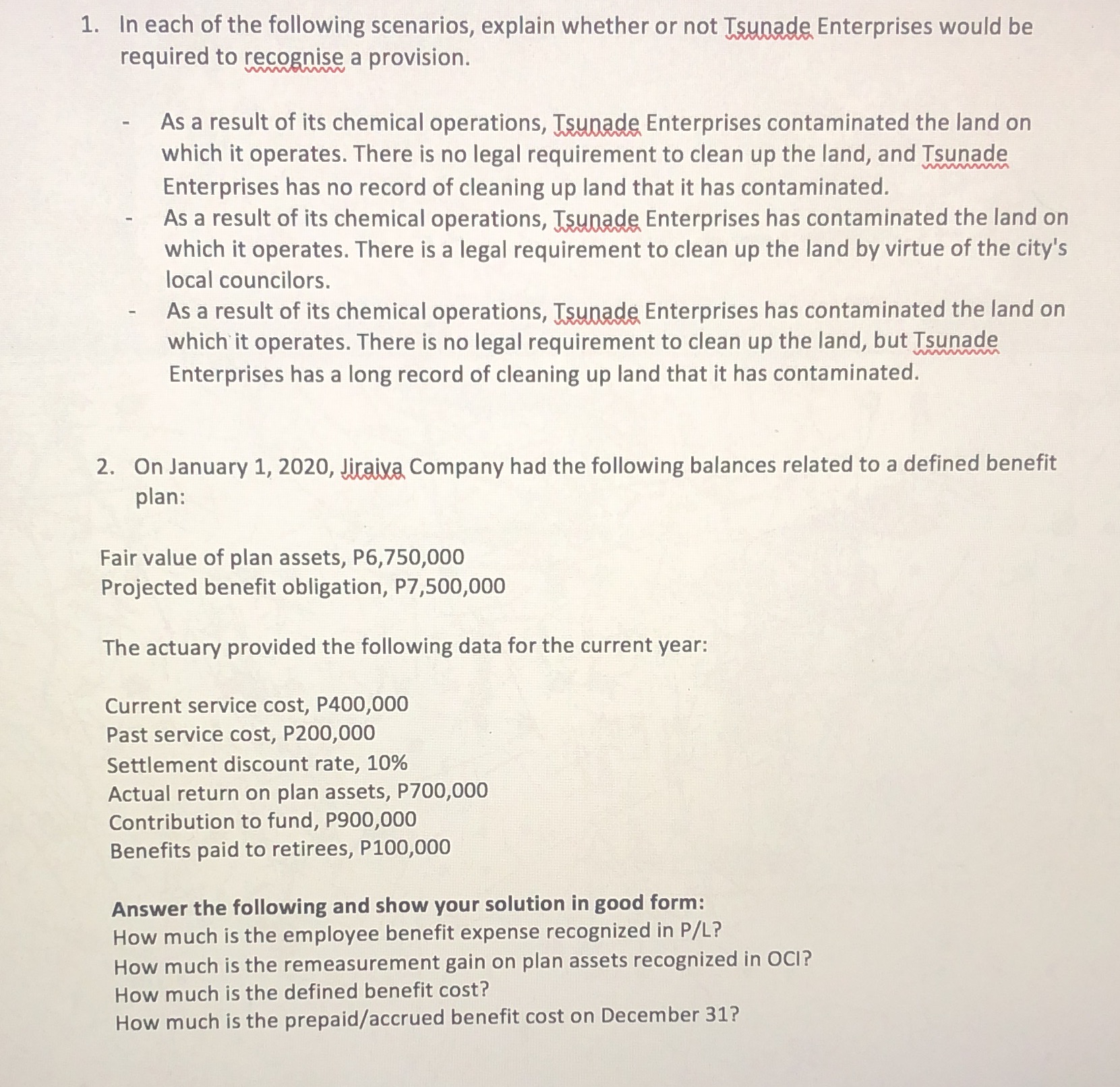

1. in each of the following scenarios, explain whether or not WEnterprises would be required to recognise a provision. As a result of its chemical operations, 1% Enterprises contaminated the land on which it operates. There is no legal requirement to clean up the land, and Tsunade Enterprises has no record of cleaning up land that it has contaminated. As a result of its chemical operations, W Enterprises has contaminated the land on which it operates. There is a legal requirement to clean up the land by virtue of the city's local councilors. As a result of its chemical operations, W Enterprises has contaminated the land on which' it operates. There is no legal requirement to clean up the land, but Tsunade Enterprises has a long record of cleaning up land that it has contaminated. 2. On January 1, 2020, WCompany had the following balances related to a defined benet plan: Fair value of plan assets, P6,?50,000 Projected benefit obligation, P7,500,000 The actuary provided the following data for the current year: Current service cost, P400,000 Past service cost, P200,000 Settlement discount rate, 10% Actual return on plan assets, P700,000 Contribution to fund, P900,000 Benefits paid to retirees, P100,000 Answer the following and show your solution in good form: How much is the employee benefit expense recognized in P/L? How much is the remeasurement gain on plan assets recognized In 00? How much is the defined benefit cost? How much Is the prepaid/accrued benefit cost on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts