Question: Please answer these questions. 1. Kent Physical Therapy provides services worth $1,000 to a customer on account at a 25% trade discount. What journal entry

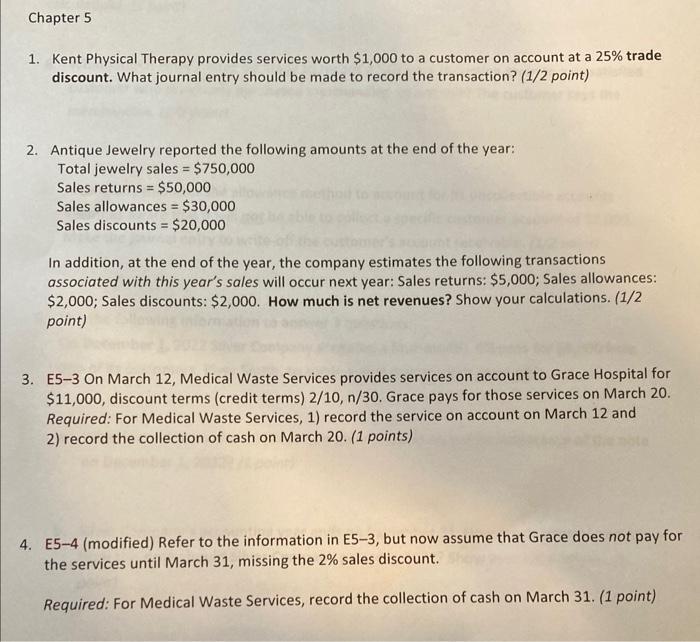

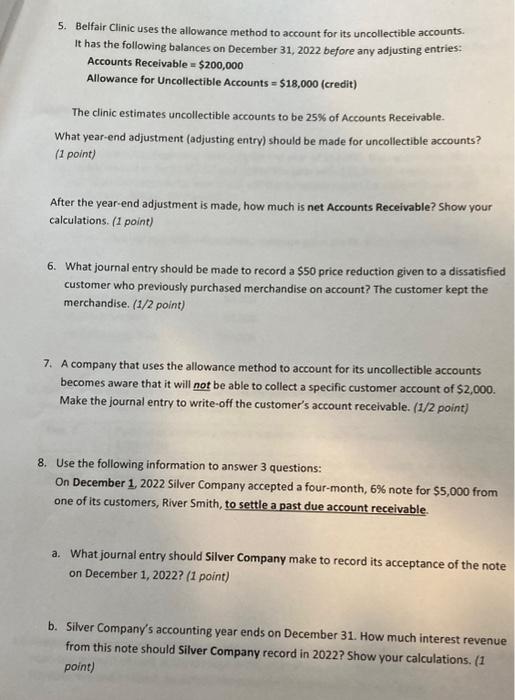

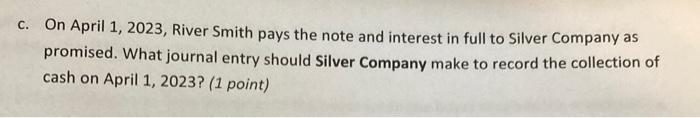

1. Kent Physical Therapy provides services worth $1,000 to a customer on account at a 25% trade discount. What journal entry should be made to record the transaction? ( 1/2 point) 2. Antique Jewelry reported the following amounts at the end of the year: Total jewelry sales =$750,000 Sales returns =$50,000 Sales allowances =$30,000 Sales discounts =$20,000 In addition, at the end of the year, the company estimates the following transactions associated with this year's sales will occur next year: Sales returns: $5,000; Sales allowances: $2,000; Sales discounts: $2,000. How much is net revenues? Show your calculations. (1/2 point) 3. E5-3 On March 12, Medical Waste Services provides services on account to Grace Hospital for $11,000, discount terms (credit terms) 2/10,n/30. Grace pays for those services on March 20. Required: For Medical Waste Services, 1) record the service on account on March 12 and 2) record the collection of cash on March 20. (1 points) 4. E5-4 (modified) Refer to the information in E5-3, but now assume that Grace does not pay for the services until March 31 , missing the 2% sales discount. Required: For Medical Waste Services, record the collection of cash on March 31 . ( 1 point) 6. What journal entry should be made to record a $50 price reduction given to a dissatisfied customer who previously purchased merchandise on account? The customer kept the merchandise. (1/2 point) 7. A company that uses the allowance method to account for its uncollectible accounts becomes aware that it will not be able to collect a specific customer account of $2,000. Make the journal entry to write-off the customer's account receivable. (1/2 point) 8. Use the following information to answer 3 questions: On December 1,2022 Silver Company accepted a four-month, 6% note for $5,000 from one of its customers, River Smith, to settle a past due account receivable. a. What journal entry should Silver Company make to record its acceptance of the note on December 1,2022? ( 1 point ) b. Silver Company's accounting year ends on December 31 . How much interest revenue from this note should Silver Company record in 2022? Show your calculations. ( 1 ) point) On April 1, 2023, River Smith pays the note and interest in full to Silver Company as promised. What journal entry should Silver Company make to record the collection of cash on April 1,2023? ( 1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts