Question: Please answer these questions with details. QUESTION 6 (20 marks) (a) Explain what efficient-market hypothesis (EMH) say about (a) securities prices, (b) their reaction to

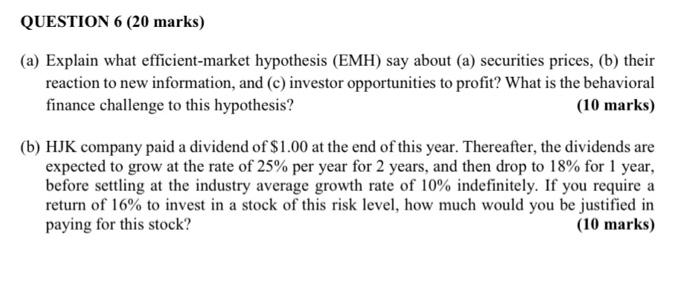

QUESTION 6 (20 marks) (a) Explain what efficient-market hypothesis (EMH) say about (a) securities prices, (b) their reaction to new information, and (c) investor opportunities to profit? What is the behavioral finance challenge to this hypothesis? (10 marks) (b) HJK company paid a dividend of $1.00 at the end of this year. Thereafter, the dividends are expected to grow at the rate of 25% per year for 2 years, and then drop to 18% for 1 year, before settling at the industry average growth rate of 10% indefinitely. If you require a return of 16% to invest in a stock of this risk level, how much would you be justified in paying for this stock? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts