Question: Please answer these questions with explanations , do not copy from other answers from chegg! much appreciated. 3. Consider again the non-dividend paying stock in

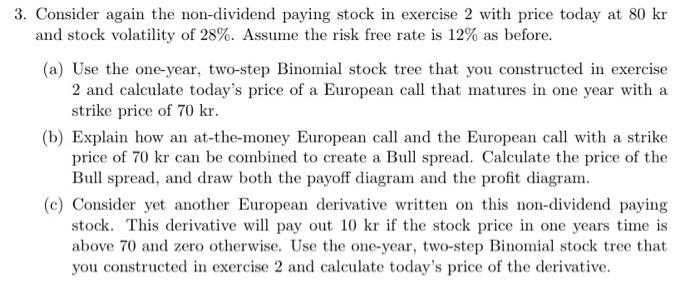

3. Consider again the non-dividend paying stock in exercise 2 with price today at 80 kr and stock volatility of 28%. Assume the risk free rate is 12% as before. (a) Use the one-year, two-step Binomial stock tree that you constructed in exercise 2 and calculate today's price of a European call that matures in one year with a strike price of 70 kr. (b) Explain how an at-the-money European call and the European call with a strike price of 70 kr can be combined to create a Bull spread. Calculate the price of the Bull spread, and draw both the payoff diagram and the profit diagram. (c) Consider yet another European derivative written on this non-dividend paying stock. This derivative will pay out 10 kr if the stock price in one years time is above 70 and zero otherwise. Use the one-year, two-step Binomial stock tree that you constructed in exercise 2 and calculate today's price of the derivative. 3. Consider again the non-dividend paying stock in exercise 2 with price today at 80 kr and stock volatility of 28%. Assume the risk free rate is 12% as before. (a) Use the one-year, two-step Binomial stock tree that you constructed in exercise 2 and calculate today's price of a European call that matures in one year with a strike price of 70 kr. (b) Explain how an at-the-money European call and the European call with a strike price of 70 kr can be combined to create a Bull spread. Calculate the price of the Bull spread, and draw both the payoff diagram and the profit diagram. (c) Consider yet another European derivative written on this non-dividend paying stock. This derivative will pay out 10 kr if the stock price in one years time is above 70 and zero otherwise. Use the one-year, two-step Binomial stock tree that you constructed in exercise 2 and calculate today's price of the derivative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts