Question: please answer these two questions!!! and have details! Thank you! The risk-free rate is 5% and the expected market risk premium is 10%. A portfolio

please answer these two questions!!! and have details! Thank you!

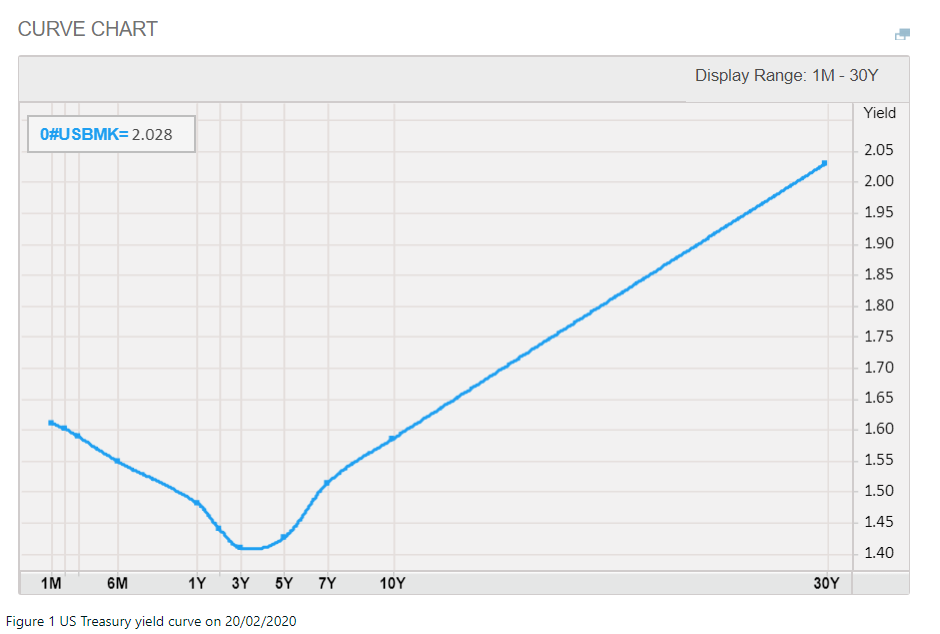

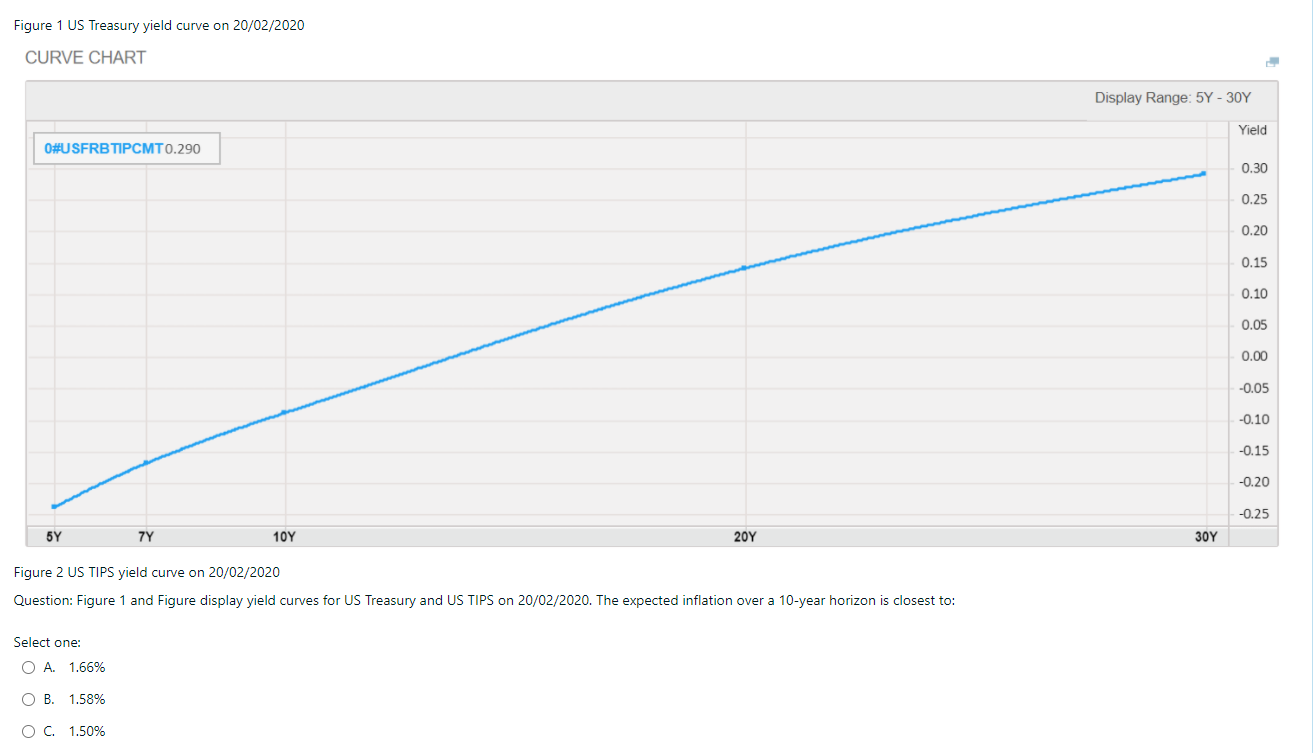

The risk-free rate is 5% and the expected market risk premium is 10%. A portfolio manager realized a return of 20% on a portfolio with an adjusted beta of 1.5. After considering its systematic risk, this portfolio: Select one: O A. underperformed the market expectation. O B. outperformed the market expectation. O C. equaled the market's expected performance. CURVE CHART Display Range: 1M - 30Y Yield O#USBMK= 2.028 2.05 2.00 1.95 1.90 1.85 1.80 1.75 1.70 1.65 1.60 1.55 1.50 1.45 1.40 1M 6M 1Y 3Y 5Y 7Y 10Y 30Y Figure 1 US Treasury yield curve on 20/02/2020 Figure 1 US Treasury yield curve on 20/02/2020 CURVE CHART Display Range: 5Y - 30Y Yield O#USFRBTIPCMT0.290 0.30 0.25 0.20 0.15 0.10 0.05 0.00 -0.05 -0.10 -0.15 -0.20 -0.25 5Y 7Y 10Y 20Y 30Y Figure 2 US TIPS yield curve on 20/02/2020 Question: Figure 1 and Figure display yield curves for US Treasury and US TIPS on 20/02/2020. The expected inflation over a 10-year horizon is closest to: Select one: O A. 1.66% OB. 1.58% O C. 1.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts