Question: Please answer this 2 part question. Thanks! Required information [The following information applies to the questions displayed below.) Oak Mart, a producer of solid oak

Please answer this 2 part question. Thanks!

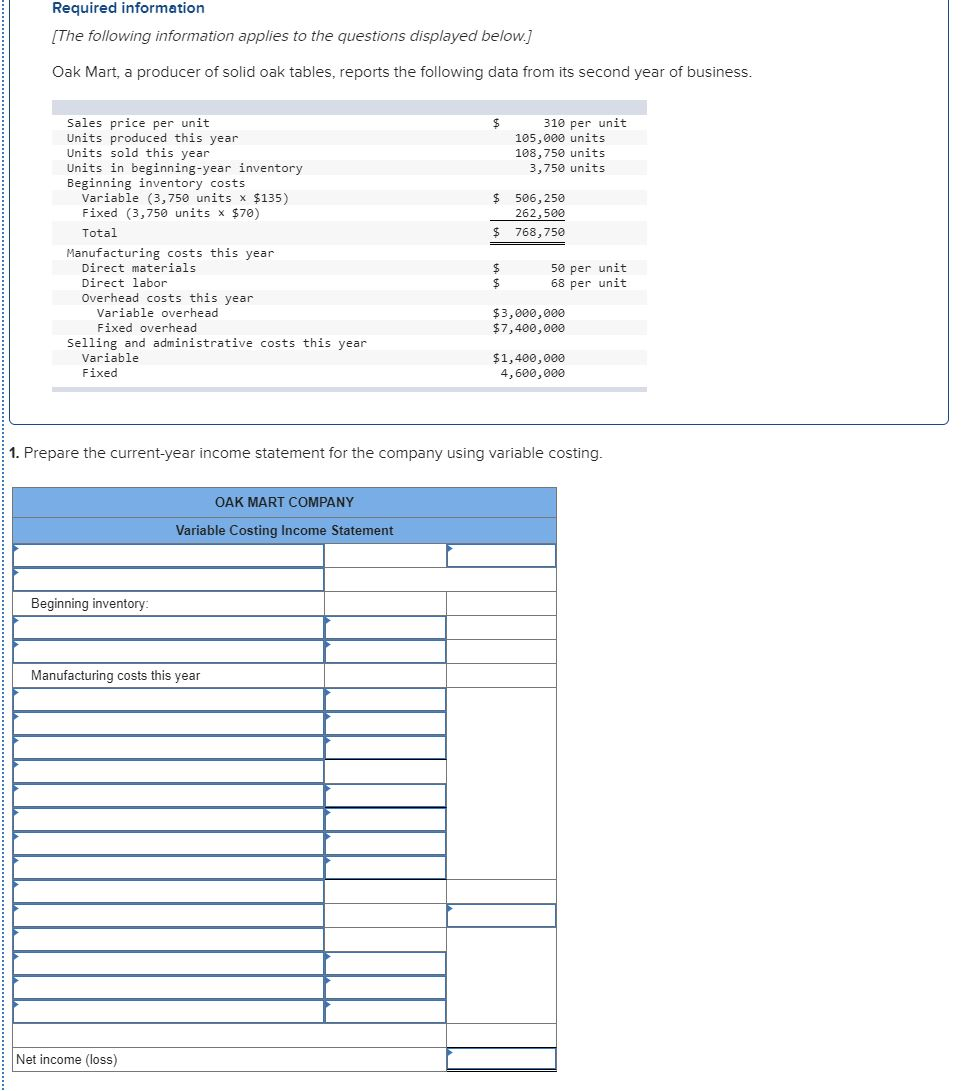

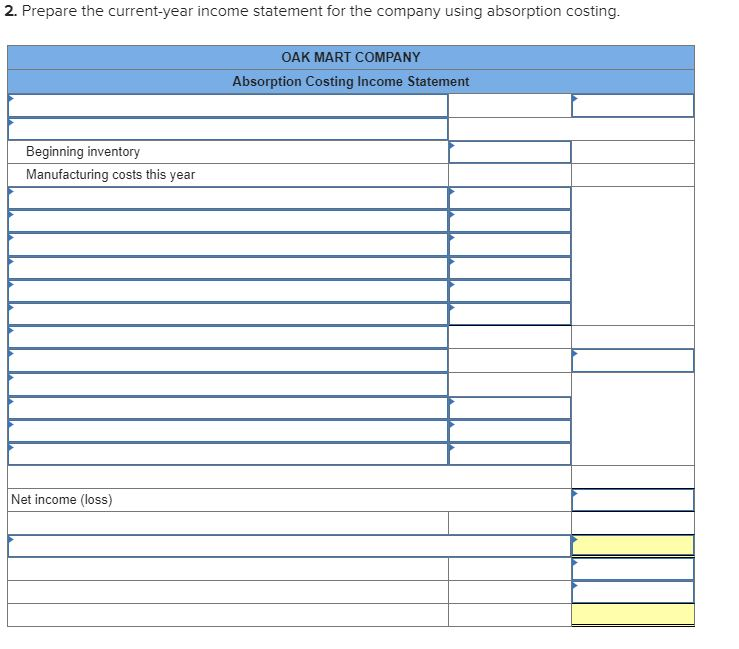

Required information [The following information applies to the questions displayed below.) Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. $ 310 per unit 105,000 units 108,750 units 3,750 units $ 506,250 262,500 768,750 $ Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs Variable (3,750 units x $135) Fixed (3,750 units x $70) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed $ 50 per unit 68 per unit $3,000,000 $7,400,000 $1,400,000 4,600,000 1. Prepare the current-year income statement for the company using variable costing. OAK MART COMPANY Variable Costing Income Statement Beginning inventory Manufacturing costs this year Net income (loss) 2. Prepare the current-year income statement for the company using absorption costing. OAK MART COMPANY Absorption Costing Income Statement Beginning inventory Manufacturing costs this year Net income (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts