Question: Please answer this exercise in Excel attachment. Please calculate numbers in Excel formulas or please leave excel formulas so I can plug them in. Exercise

Please answer this exercise in Excel attachment. Please calculate numbers in Excel formulas or please leave excel formulas so I can plug them in.

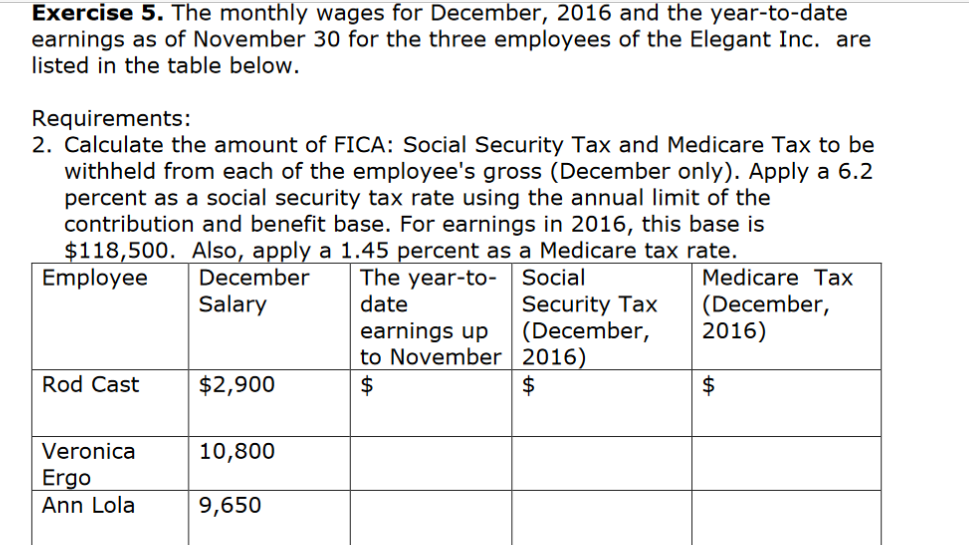

Exercise 5. The monthly wages for December, 2016 and the year-to-date earnings as of November 30 for the three employees of the Elegant Inc. are listed in the table below. Requirements: 2. Calculate the amount of FICA: Social Security Tax and Medicare Tax to be withheld from each of the employee's gross (December only). Apply a 6.2 percent as a social security tax rate using the annual limit of the contribution and benefit base. For earnings in 2016, this base is 118,500. Also, apply a 1.45 percent as a Medicare tax rate. Employee December The year-to- Social MedicareTax Salary date earnings up (December, 2016) to November 2016 Security Tax (December, Rod Cast $2,900 Veronica Ergo Ann Lola 10,800 9,650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts