Question: Please answer this exercise in Excel attachment.Presentthese exercises and problems in Excel. Please calculate numbers in Excel formulas. Do not simply plug in the numbers,

Please answer this exercise in Excel attachment.Presentthese exercises and problems in Excel. Please calculate numbers in Excel formulas. Do not simply plug in the numbers, please use formulas to calculate all valuesin the spreadsheets.

Exercise 5,2,8

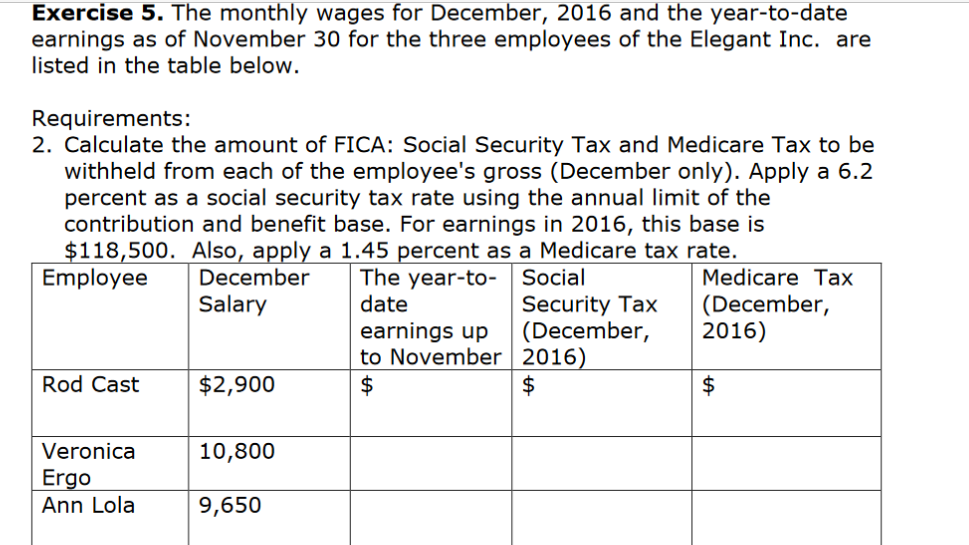

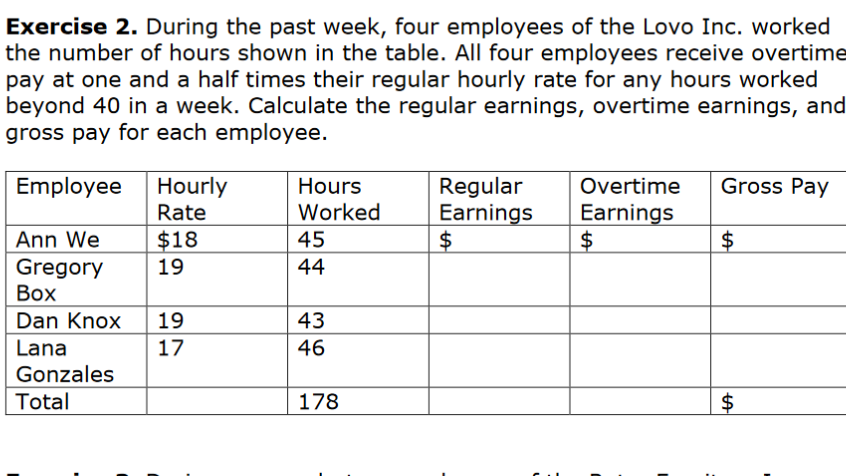

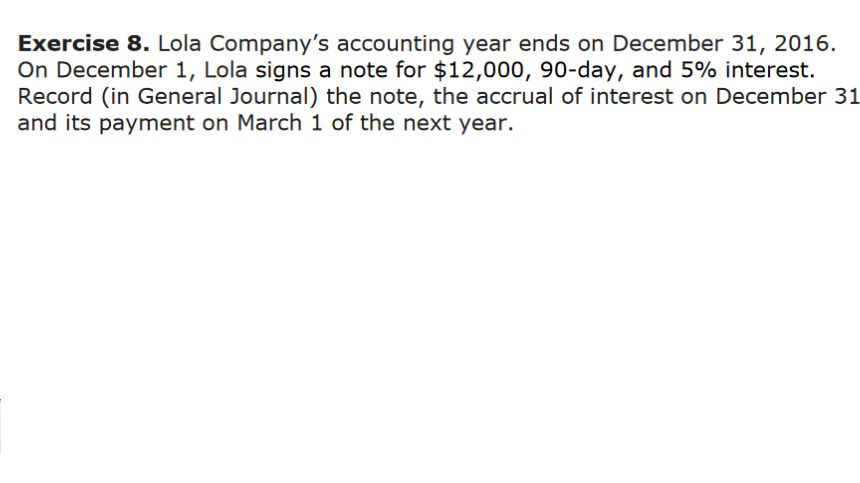

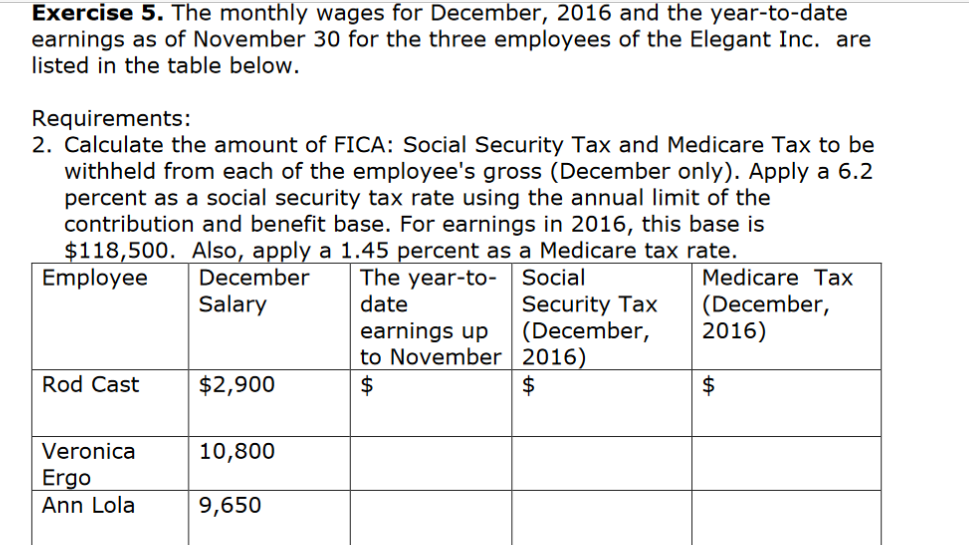

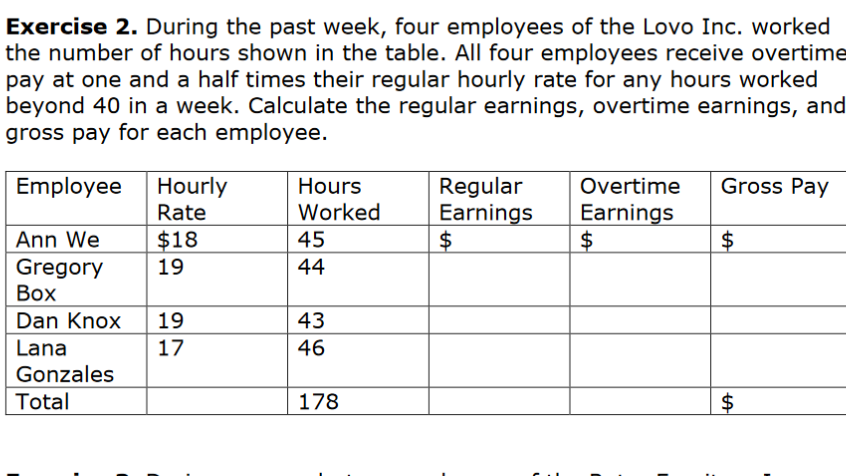

Exercise 8. Loia Company's accounting year ends on December 31, 2016. On December 1Ir Lola signs a note for $12,000, 90-day, and 5% interest. Record (in General Journal) the note, the accrual of interest on December 31 and its payment on March 1 of the next year. Exercise 5. The monthly wages For December, 2016 and the year-to-date earnings as of November 30 for the three employees of the Elegant Inc. are listed in the table below. Requirements: 2. Calculate the amount of FICA: Social Security Tax and Medicare Tax to be withheld from each of the employee's gross (December only). Apply a 6.2 percent as a social security tax rate using the annual limit of the contribution and benet base. For earnings in 2016, this base is '-118 500. Also a- -| a 1.45 -ercent as a Medicare tax rate. Employee December The year-to- Social Medicare Tax Salary date Security Tax (December, earnings up (December, 2016) to November Rod Cast $2,900 $ $ 3; Veronica 10,800 Ergo Ann Lola 9,650 Exercise 2. During the past week, four employees of the Love Inc. worked the number of hours shown in the table. All four employees receive overtime pay at one and a half times their regular hourly rate for any hours worked beyond 40 in a week. Calculate the regular earnings, overtime earnings, and gross pay for each employee. Employee Hourly Hours Regular Overtime Gross Pay Rate Worked Earnin- s Earnin a 5 Ann We Gregory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts