Question: Please answer this question and its entirety clearly so I can understand, thank you. I will be sure to leave a like and comment. Options

Please answer this question and its entirety clearly so I can understand, thank you. I will be sure to leave a like and comment.

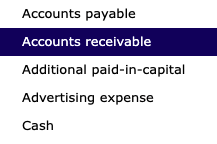

Options for blanks:

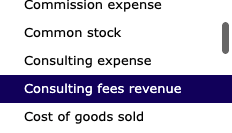

Options for blanks:

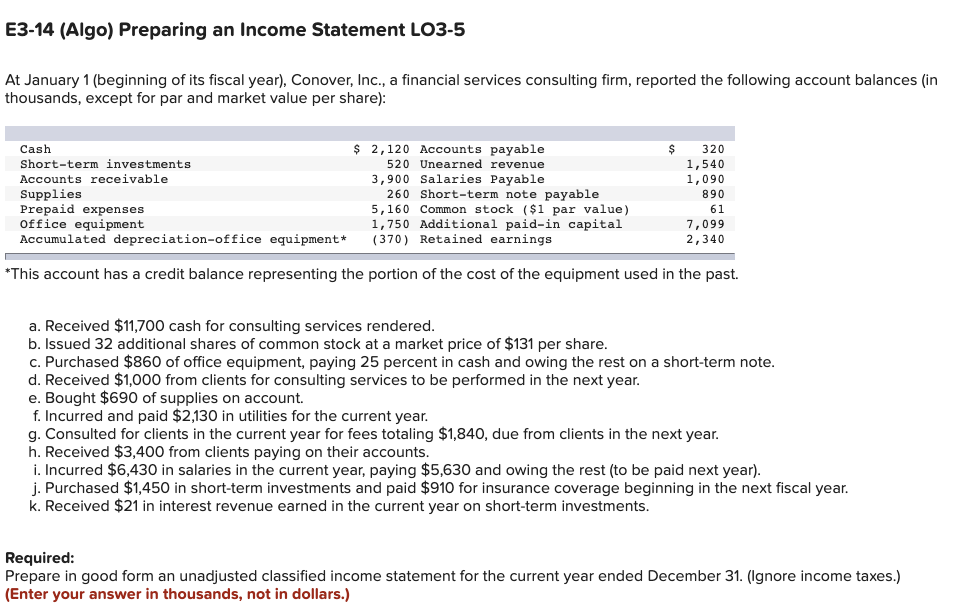

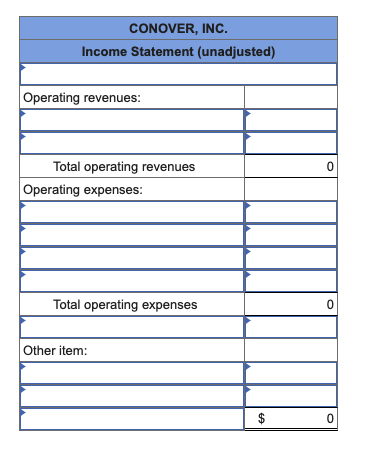

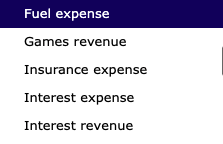

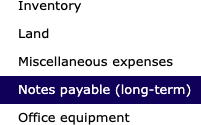

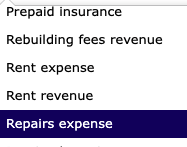

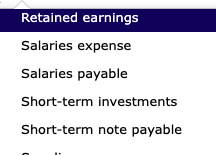

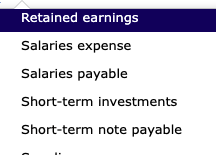

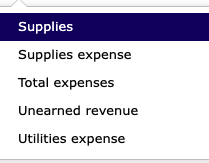

E3-14 (Algo) Preparing an Income Statement LO3-5 At January 1 (beginning of its fiscal year), Conover, Inc., a financial services consulting firm, reported the following account balances (in thousands, except for par and market value per share): $ Cash $ 2,120 Accounts payable Short-term investments 520 Unearned revenue Accounts receivable 3,900 Salaries Payable Supplies 260 Short-term note payable Prepaid expenses 5,160 Common stock ($1 par value) Office equipment 1,750 Additional paid-in capital Accumulated depreciation-office equipment* (370) Retained earnings 320 1,540 1,090 890 61 7,099 2,340 *This account has credit balance representing the portion of the cost of the equipment used in the past. a. Received $11,700 cash for consulting services rendered. b. Issued 32 additional shares of common stock at a market price of $131 per share. c. Purchased $860 of office equipment, paying 25 percent in cash and owing the rest on a short-term note. d. Received $1,000 from clients for consulting services to be performed in the next year. e. Bought $690 of supplies on account. f. Incurred and paid $2,130 in utilities for the current year. g. Consulted for clients in the current year for fees totaling $1,840, due from clients in the next year. h. Received $3,400 from clients paying on their accounts. i. Incurred $6,430 in salaries in the current year, paying $5,630 and owing the rest (to be paid next year). j. Purchased $1,450 in short-term investments and paid $910 for insurance coverage beginning in the next fiscal year. k. Received $21 in interest revenue earned in the current year on short-term investments. Required: Prepare in good form an unadjusted classified income statement for the current year ended December 31. (Ignore income taxes.) (Enter your answer in thousands, not in dollars.) CONOVER, INC. Income Statement (unadjusted) Operating revenues: 0 Total operating revenues Operating expenses: Total operating expenses 0 Other item: $ 0 Accounts payable Accounts receivable Additional paid-in-capital Advertising expense Cash Commission expense Common stock Consulting expense Consulting fees revenue Cost of goods sold Fuel expense Games revenue Insurance expense Interest expense Interest revenue Inventory Land Miscellaneous expenses Notes payable (long-term) Office equipment Prepaid insurance Rebuilding fees revenue Rent expense Rent revenue Repairs expense Retained earnings Salaries expense Salaries payable Short-term investments Short-term note payable Retained earnings Salaries expense Salaries payable Short-term investments Short-term note payable Supplies Supplies expense Total expenses Unearned revenue Utilities expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts