Question: Please answer this question and its entirety clearly so that I can understand, thank you so much. I will be sure to leave a like

Please answer this question and its entirety clearly so that I can understand, thank you so much. I will be sure to leave a like and comment.

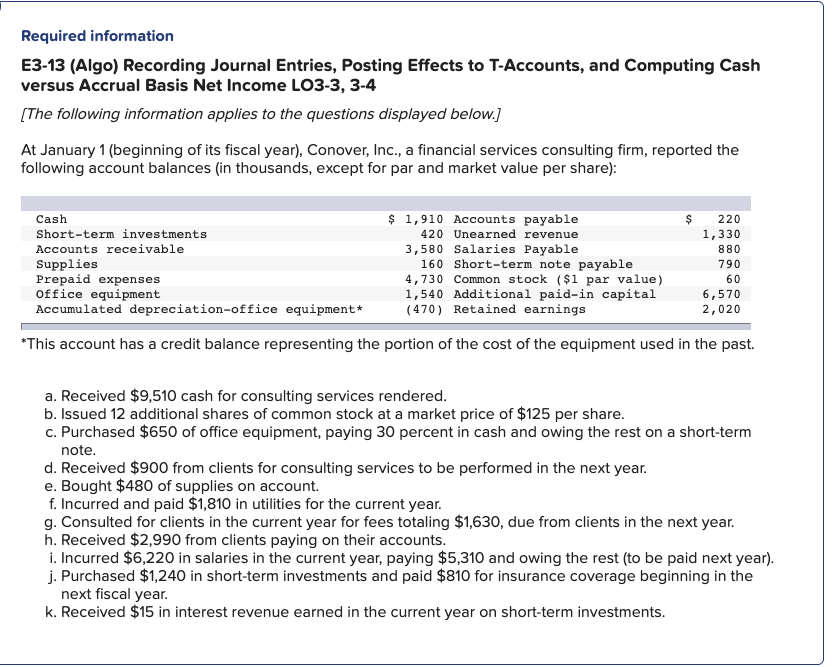

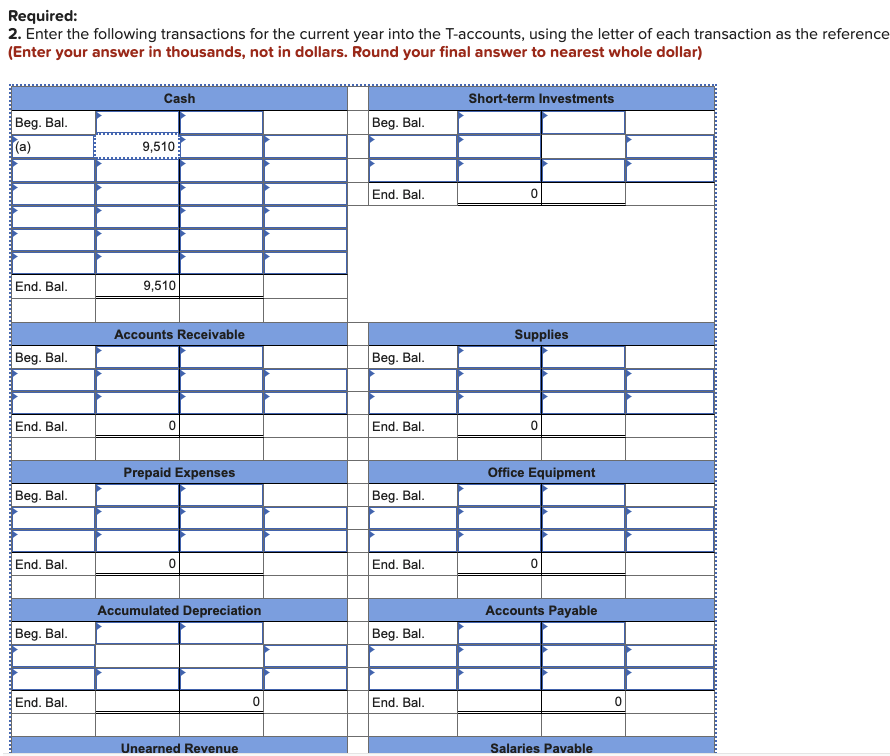

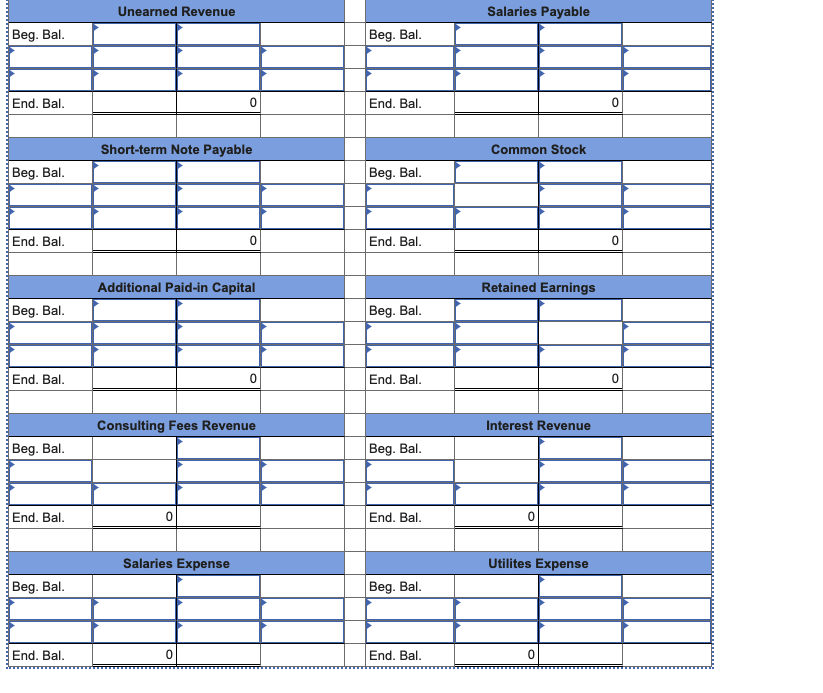

Required information E3-13 (Algo) Recording Journal Entries, Posting Effects to T-Accounts, and Computing Cash versus Accrual Basis Net Income LO3-3, 3-4 (The following information applies to the questions displayed below.) At January 1 (beginning of its fiscal year), Conover, Inc., a financial services consulting firm, reported the following account balances (in thousands, except for par and market value per share): $ Cash Short-term investments Accounts receivable Supplies Prepaid expenses Office equipment Accumulated depreciation-office equipment* $ 1,910 Accounts payable 420 Unearned revenue 3,580 Salaries Payable 160 Short-term note payable 4,730 Common stock ($1 par value) 1,540 Additional paid-in capital (470) Retained earnings 220 1,330 880 790 60 6,570 2,020 *This account has a credit balance representing the portion of the cost of the equipment used in the past. a. Received $9,510 cash for consulting services rendered. b. Issued 12 additional shares of common stock at a market price of $125 per share. c. Purchased $650 of office equipment, paying 30 percent in cash and owing the rest on a short-term note. d. Received $900 from clients for consulting services to be performed in the next year. e. Bought $480 of supplies on account. f. Incurred and paid $1,810 in utilities for the current year. g. Consulted for clients in the current year for fees totaling $1,630, due from clients in the next year. h. Received $2,990 from clients paying on their accounts. i. Incurred $6,220 in salaries in the current year, paying $5,310 and owing the rest (to be paid next year). j. Purchased $1,240 in short-term investments and paid $810 for insurance coverage beginning in the next fiscal year. k. Received $15 in interest revenue earned in the current year on short-term investments. Required: 2. Enter the following transactions for the current year into the T-accounts, using the letter of each transaction as the reference (Enter your answer in thousands, not in dollars. Round your final answer to nearest whole dollar) Cash Short-term Investments Beg. Bal. Beg. Bal. (a) 9,510 End. Bal. 0 End. Bal. 9,510 Accounts Receivable Supplies Beg. Bal. Beg. Bal. End. Bal. End. Bal. 0 Prepaid Expenses Office Equipment Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. 0 Accumulated Depreciation Accounts Payable Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. Unearned Revenue Salaries Pavable Unearned Revenue Salaries Payable Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. 0 Short-term Note Payable Common Stock Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. 0 Additional Paid-in Capital Retained Earnings Beg. Bal. Beg. Bal. End. Bal. End. Bal. Consulting Fees Revenue Interest Revenue Beg. Bal. Beg. Bal. End. Bal. 0 End. Bal. Salaries Expense Utilites Expense Beg. Bal. Beg. Bal. End. Bal. O End. Bal. 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts