Question: Please answer this question and show calculations steps. Thank you 13). 1 You would like to estimate the weighted average cost of capital for a

Please answer this question and show calculations steps. Thank you

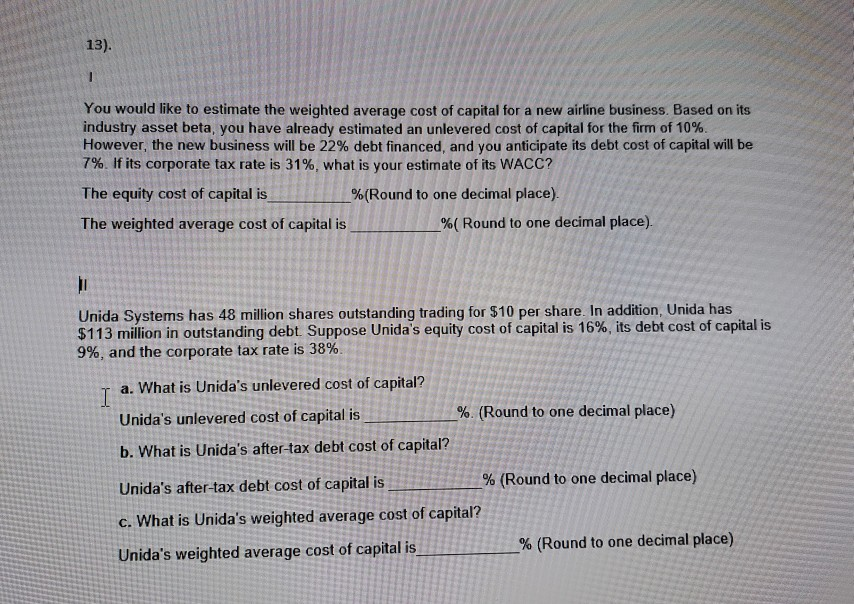

13). 1 You would like to estimate the weighted average cost of capital for a new airline business. Based on its industry asset beta, you have already estimated an unlevered cost of capital for the firm of 10%. However, the new business will be 22% debt financed, and you anticipate its debt cost of capital will be 7%. If its corporate tax rate is 31%, what is your estimate of its WACC? The equity cost of capital is %(Round to one decimal place). The weighted average cost of capital is %( Round to one decimal place). Unida Systems has 48 million shares outstanding trading for $10 per share. In addition, Unida has $113 million in outstanding debt. Suppose Unida's equity cost of capital is 16%, its debt cost of capital is 9%, and the corporate tax rate is 38% I a. What is Unida's unlevered cost of capital? Unida's unlevered cost of capital is %. (Round to one decimal place) b. What is Unida's after-tax debt cost of capital? Unida's after-tax debt cost of capital is % (Round to one decimal place) c. What is Unida's weighted average cost of capital? Unida's weighted average cost of capital is % (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts