Question: please answer this question as soon as possible Metlock Company purchased land for $115200 with the intention of constructing a new operating facility. The land

please answer this question as soon as possible

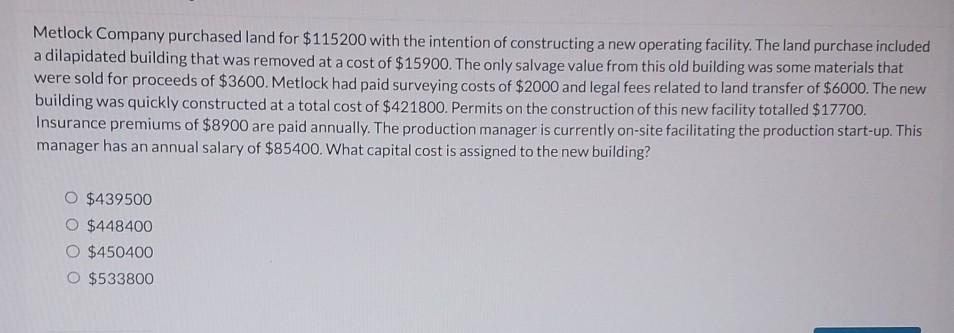

Metlock Company purchased land for $115200 with the intention of constructing a new operating facility. The land purchase included a dilapidated building that was removed at a cost of $15900. The only salvage value from this old building was some materials that were sold for proceeds of $3600. Metlock had paid surveying costs of $2000 and legal fees related to land transfer of $6000. The new building was quickly constructed at a total cost of $421800. Permits on the construction of this new facility totalled $17700. Insurance premiums of $8900 are paid annually. The production manager is currently on-site facilitating the production start-up. This manager has an annual salary of $85400. What capital cost is assigned to the new building? $439500 $448400 $450400 $533800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts