Question: PLEASE ANSWER THIS QUESTION FOR ME, I HAVE A SIMILAR QUESTION WITH ANSWERS (JUST DIFF ANSWERS IF YOU NEED IT) Question 2 (15 points) Suppose

PLEASE ANSWER THIS QUESTION FOR ME, I HAVE A SIMILAR QUESTION WITH ANSWERS (JUST DIFF ANSWERS IF YOU NEED IT)

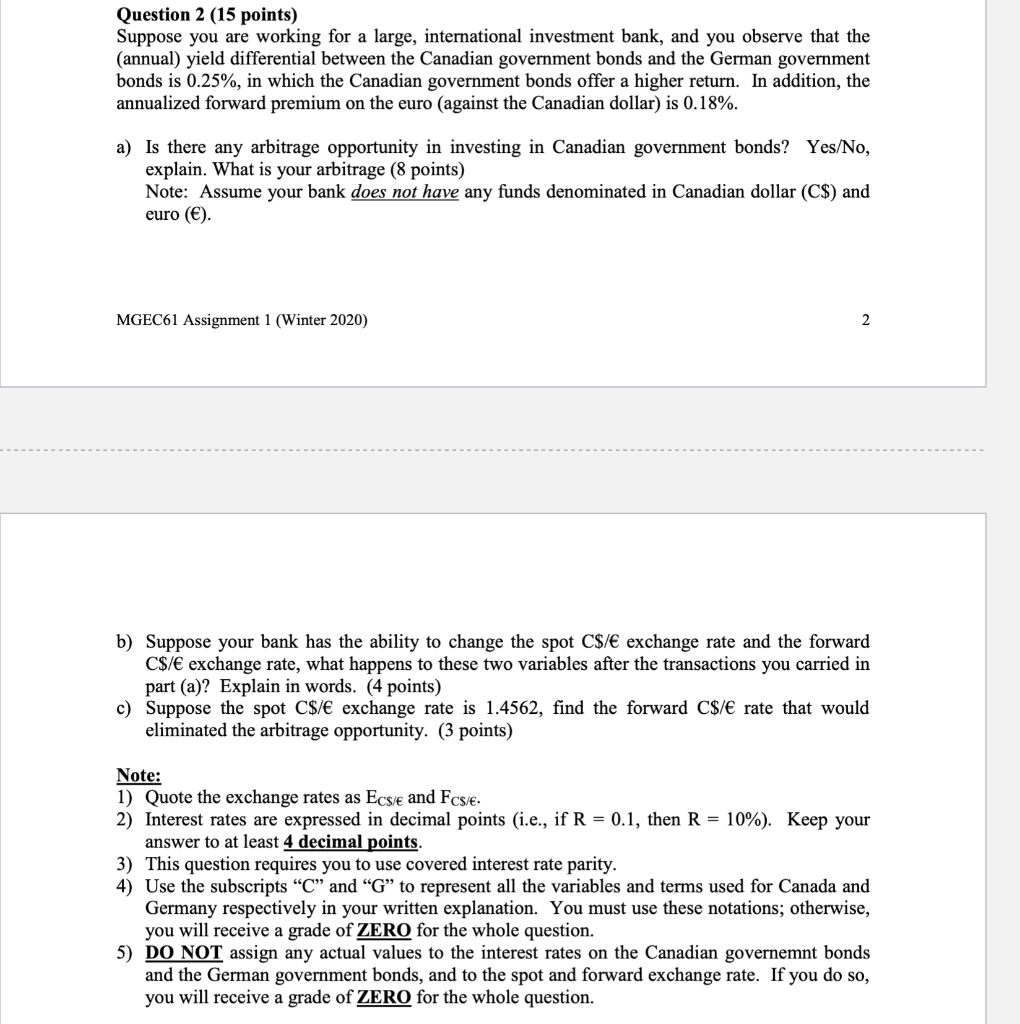

Question 2 (15 points) Suppose you are working for a large, international investment bank, and you observe that the (annual) yield differential between the Canadian government bonds and the German government bonds is 0.25%, in which the Canadian government bonds offer a higher return. In addition, the annualized forward premium on the euro (against the Canadian dollar) is 0.18%. a) Is there any arbitrage opportunity in investing in Canadian government bonds? Yes/No, explain. What is your arbitrage (8 points) Note: Assume your bank does not have any funds denominated in Canadian dollar (C$) and euro (). MGEC61 Assignment 1 (Winter 2020) b) Suppose your bank has the ability to change the spot C$/ exchange rate and the forward C$/ exchange rate, what happens to these two variables after the transactions you carried in part (a)? Explain in words. (4 points) Suppose the spot C$/ exchange rate is 1.4562, find the forward C$/ rate that would eliminated the arbitrage opportunity. (3 points) Note: 1) Quote the exchange rates as Ecs/ and Fc$/. 2) Interest rates are expressed in decimal points (i.e., if R = 0.1, then R = 10%). Keep your answer to at least 4 decimal points. 3) This question requires you to use covered interest rate parity. 4) Use the subscripts C and G to represent all the variables and terms used for Canada and Germany respectively in your written explanation. You must use these notations; otherwise, you will receive a grade of ZERO for the whole question. DO NOT assign any actual values to the interest rates on the Canadian governemnt bonds and the German government bonds, and to the spot and forward exchange rate. If you do so, you will receive a grade of ZERO for the whole question. Question 2 (15 points) Suppose you are working for a large, international investment bank, and you observe that the (annual) yield differential between the Canadian government bonds and the German government bonds is 0.25%, in which the Canadian government bonds offer a higher return. In addition, the annualized forward premium on the euro (against the Canadian dollar) is 0.18%. a) Is there any arbitrage opportunity in investing in Canadian government bonds? Yes/No, explain. What is your arbitrage (8 points) Note: Assume your bank does not have any funds denominated in Canadian dollar (C$) and euro (). MGEC61 Assignment 1 (Winter 2020) b) Suppose your bank has the ability to change the spot C$/ exchange rate and the forward C$/ exchange rate, what happens to these two variables after the transactions you carried in part (a)? Explain in words. (4 points) Suppose the spot C$/ exchange rate is 1.4562, find the forward C$/ rate that would eliminated the arbitrage opportunity. (3 points) Note: 1) Quote the exchange rates as Ecs/ and Fc$/. 2) Interest rates are expressed in decimal points (i.e., if R = 0.1, then R = 10%). Keep your answer to at least 4 decimal points. 3) This question requires you to use covered interest rate parity. 4) Use the subscripts C and G to represent all the variables and terms used for Canada and Germany respectively in your written explanation. You must use these notations; otherwise, you will receive a grade of ZERO for the whole question. DO NOT assign any actual values to the interest rates on the Canadian governemnt bonds and the German government bonds, and to the spot and forward exchange rate. If you do so, you will receive a grade of ZERO for the whole

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts