Question: Please answer this question step by step. Thank you in advance! 2) (30 points) Texas Instruments is considering the launch of a new calculator, the

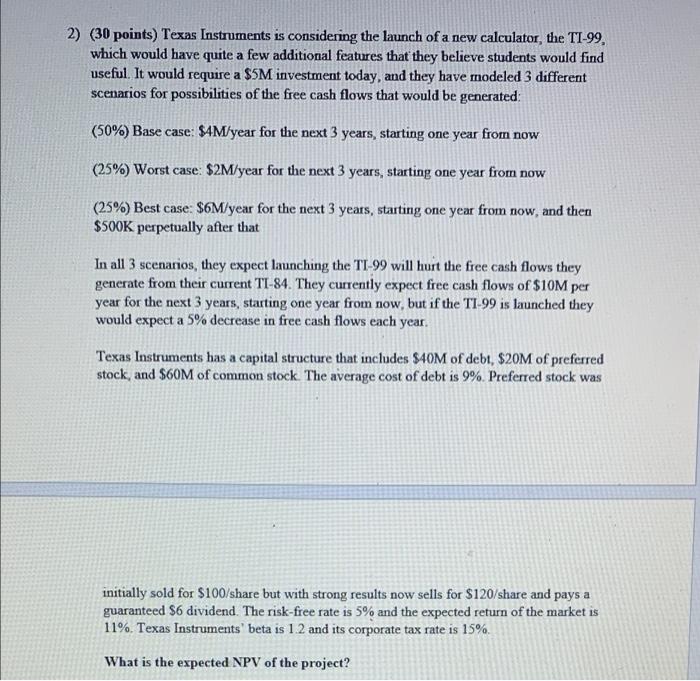

2) (30 points) Texas Instruments is considering the launch of a new calculator, the TI-99, which would have quite a few additional features that they believe students would find useful. It would require a $5M investment today, and they have modeled 3 different scenarios for possibilities of the free cash flows that would be generated: (50%) Base case: $4M/year for the next 3 years, starting one year from now (25%) Worst case: $2M/year for the next 3 years, starting one year from now (25%) Best case: $6M/year for the next 3 years, starting one year from now, and then $500K perpetually after that In all 3 scenarios, they expect launching the TT-99 will hurt the free cash flows they generate from their current TI-84. They currently expect free cash flows of $10M per year for the next 3 years, starting one year from now, but if the TI 99 is launched they would expect a 5% decrease in free cash flows each year. Texas Instruments has a capital structure that includes $40M of debt, $20M of preferred stock, and $60M of common stock. The average cost of debt is 9% Preferred stock was initially sold for $100/share but with strong results now sells for $120/share and pays a guaranteed $6 dividend. The risk-free rate is 5% and the expected return of the market is 11%. Texas Instruments' beta is 1.2 and its corporate tax rate is 15%. What is the expected NPV of the project? 2) (30 points) Texas Instruments is considering the launch of a new calculator, the TI-99, which would have quite a few additional features that they believe students would find useful. It would require a $5M investment today, and they have modeled 3 different scenarios for possibilities of the free cash flows that would be generated: (50%) Base case: $4M/year for the next 3 years, starting one year from now (25%) Worst case: $2M/year for the next 3 years, starting one year from now (25%) Best case: $6M/year for the next 3 years, starting one year from now, and then $500K perpetually after that In all 3 scenarios, they expect launching the TT-99 will hurt the free cash flows they generate from their current TI-84. They currently expect free cash flows of $10M per year for the next 3 years, starting one year from now, but if the TI 99 is launched they would expect a 5% decrease in free cash flows each year. Texas Instruments has a capital structure that includes $40M of debt, $20M of preferred stock, and $60M of common stock. The average cost of debt is 9% Preferred stock was initially sold for $100/share but with strong results now sells for $120/share and pays a guaranteed $6 dividend. The risk-free rate is 5% and the expected return of the market is 11%. Texas Instruments' beta is 1.2 and its corporate tax rate is 15%. What is the expected NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts