Question: please answer this questions as soon as possible, no need for explanation, i will upvote 7. Which account listed below is classified as a contra-

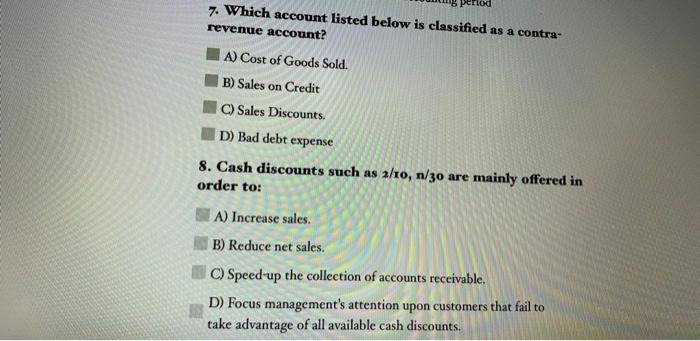

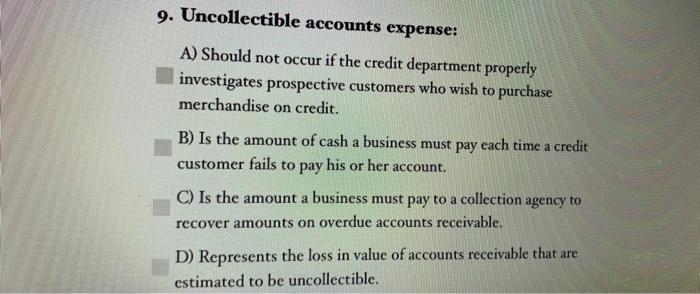

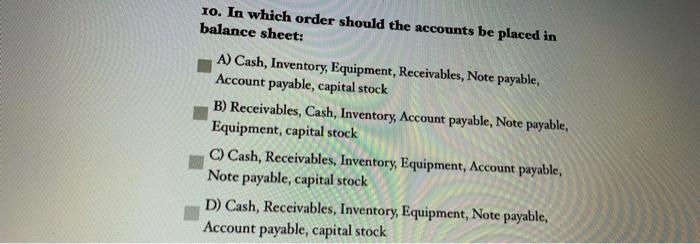

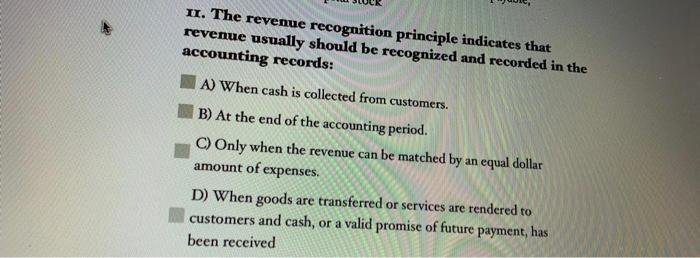

7. Which account listed below is classified as a contra- revenue account? A) Cost of Goods Sold. B) Sales on Credit C) Sales Discounts. D) Bad debt expense 8. Cash discounts such as a/io, n/30 are mainly offered in order to: A) Increase sales. B) Reduce net sales. C) Speed-up the collection of accounts receivable. D) Focus management's attention upon customers that fail to take advantage of all available cash discounts. 9. Uncollectible accounts expense: A) Should not occur if the credit department properly investigates prospective customers who wish to purchase merchandise on credit. B) Is the amount of cash a business must pay each time a credit customer fails to pay his or her account. C) Is the amount a business must pay to a collection agency to recover amounts on overdue accounts receivable. D) Represents the loss in value of accounts receivable that are estimated to be uncollectible. 10. In which order should the accounts be placed in balance sheet: A) Cash, Inventory, Equipment, Receivables, Note payable, Account payable, capital stock B) Receivables, Cash, Inventory, Account payable, Note payable, Equipment, capital stock Cash, Receivables, Inventory, Equipment, Account payable, Note payable, capital stock D) Cash, Receivables, Inventory, Equipment, Note payable, Account payable, capital stock II. The revenue recognition principle indicates that revenue usually should be recognized and recorded in the accounting records: A) When cash is collected from customers. B) At the end of the accounting period. C) Only when the revenue can be matched by an equal dollar amount of expenses. D) When goods are transferred or services are rendered to customers and cash, or a valid promise of future payment, has been received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts