Question: Please answer thoroughly and show all necessary work.... Thanks!! Question 2 (35 points) Use the Credit Suisse dataset posted on Brightspace to value a 6-month

Please answer thoroughly and show all necessary work.... Thanks!!

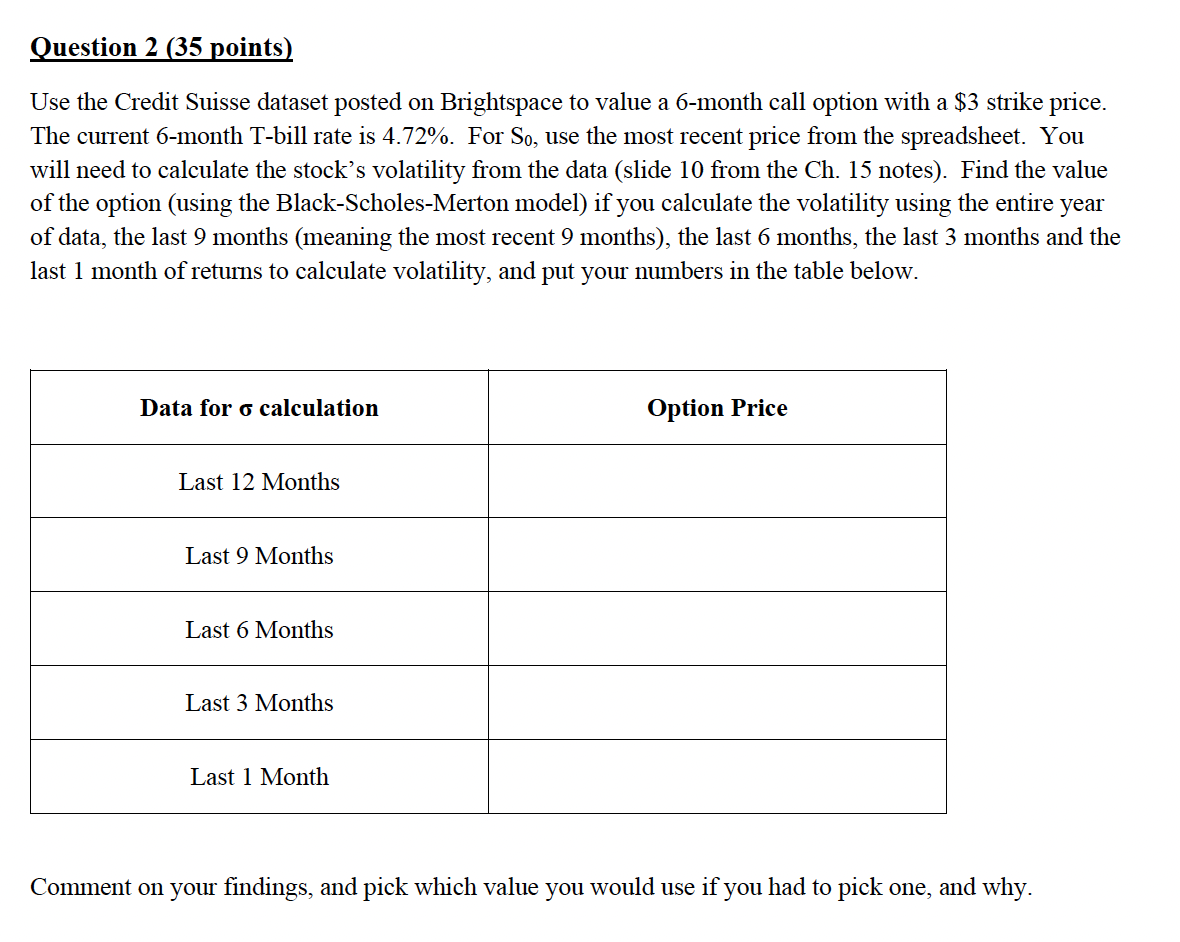

Question 2 (35 points) Use the Credit Suisse dataset posted on Brightspace to value a 6-month call option with a $3 strike price. The current 6-month T-bill rate is 4.72%. For S0, use the most recent price from the spreadsheet. You will need to calculate the stock's volatility from the data (slide 10 from the Ch. 15 notes). Find the value of the option (using the Black-Scholes-Merton model) if you calculate the volatility using the entire year of data, the last 9 months (meaning the most recent 9 months), the last 6 months, the last 3 months and the last 1 month of returns to calculate volatility, and put your numbers in the table below. Comment on your findings, and pick which value you would use if you had to pick one, and why. Question 2 (35 points) Use the Credit Suisse dataset posted on Brightspace to value a 6-month call option with a $3 strike price. The current 6-month T-bill rate is 4.72%. For S0, use the most recent price from the spreadsheet. You will need to calculate the stock's volatility from the data (slide 10 from the Ch. 15 notes). Find the value of the option (using the Black-Scholes-Merton model) if you calculate the volatility using the entire year of data, the last 9 months (meaning the most recent 9 months), the last 6 months, the last 3 months and the last 1 month of returns to calculate volatility, and put your numbers in the table below. Comment on your findings, and pick which value you would use if you had to pick one, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts