Question: Please answer thoroughly. Do not use excel, only financial calculator. Using to study. Kebt Corporation's Class Semi bonds have a 14-year maturity and a 9.25%

Please answer thoroughly. Do not use excel, only financial calculator. Using to study.

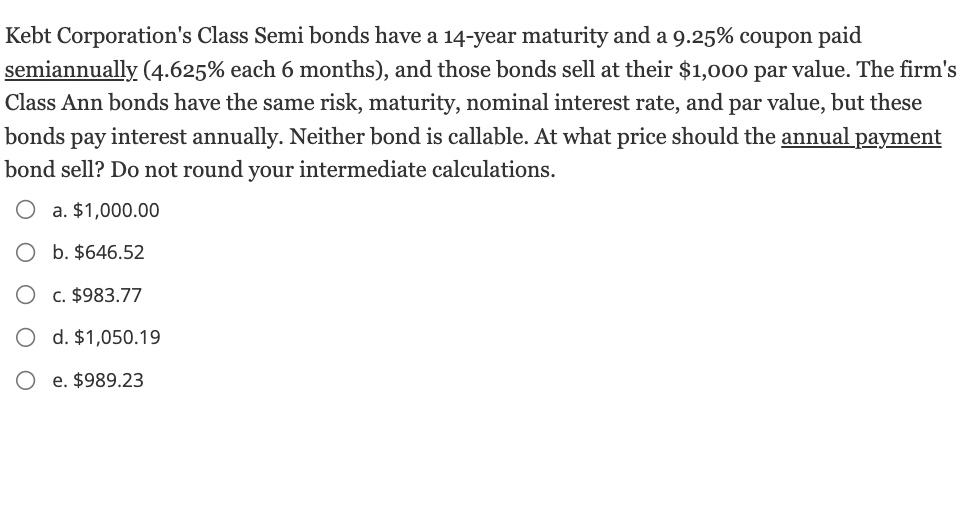

Kebt Corporation's Class Semi bonds have a 14-year maturity and a 9.25% coupon paid semiannually (4.625\% each 6 months), and those bonds sell at their $1,000 par value. The firm's Class Ann bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. At what price should the annual payment bond sell? Do not round your intermediate calculations. a. $1,000.00 b. $646.52 c. $983.77 d. $1,050.19 e. $989.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts