Question: Please answer those problem ASAP Question 26 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $100,000 plus it

Please answer those problem ASAP

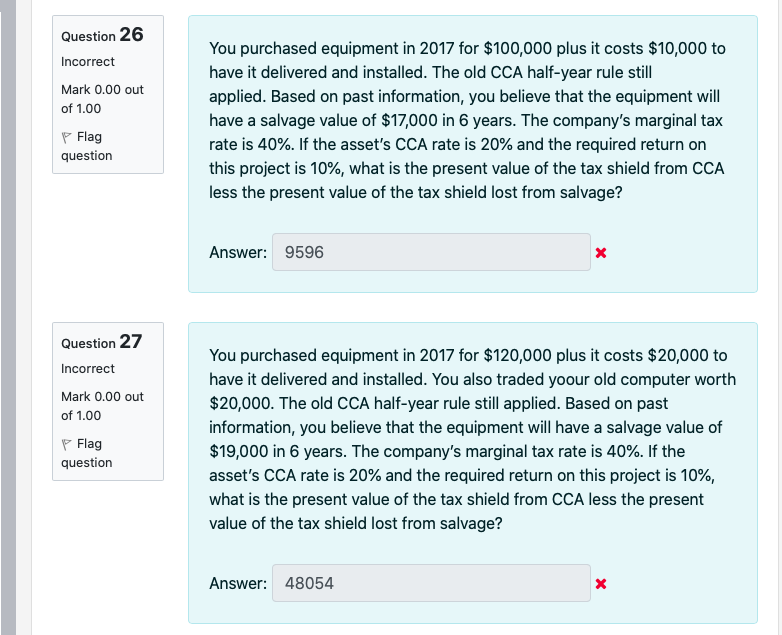

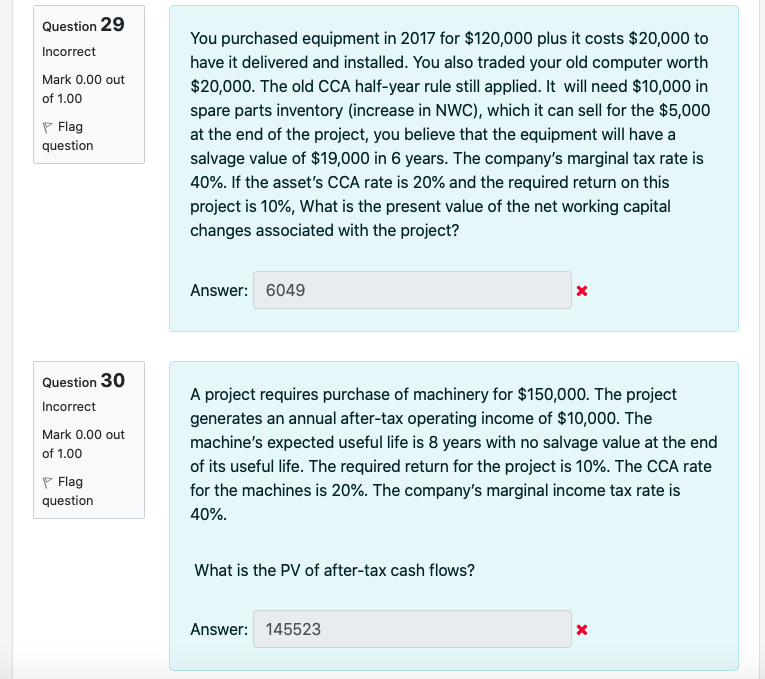

Question 26 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $100,000 plus it costs $10,000 to have it delivered and installed. The old CCA half-year rule still applied. Based on past information, you believe that the equipment will have a salvage value of $17,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, what is the present value of the tax shield from CCA less the present value of the tax shield lost from salvage? Answer: 9596 x Question 27 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $120,000 plus it costs $20,000 to have it delivered and installed. You also traded yoour old computer worth $20,000. The old CCA half-year rule still applied. Based on past information, you believe that the equipment will have a salvage value of $19,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, what is the present value of the tax shield from CCA less the present value of the tax shield lost from salvage? Answer: 48054 Question 29 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $120,000 plus it costs $20,000 to have it delivered and installed. You also traded your old computer worth $20,000. The old CCA half-year rule still applied. It will need $10,000 in spare parts inventory (increase in NWC), which it can sell for the $5,000 at the end of the project, you believe that the equipment will have a salvage value of $19,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, What is the present value of the net working capital changes associated with the project? Answer: 6049 x Question 30 Incorrect Mark 0.00 out of 1.00 A project requires purchase of machinery for $150,000. The project generates an annual after-tax operating income of $10,000. The machine's expected useful life is 8 years with no salvage value at the end of its useful life. The required return for the project is 10%. The CCA rate for the machines is 20%. The company's marginal income tax rate is 40% P Flag question What is the PV of after-tax cash flows? Answer: 145523 x Question 26 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $100,000 plus it costs $10,000 to have it delivered and installed. The old CCA half-year rule still applied. Based on past information, you believe that the equipment will have a salvage value of $17,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, what is the present value of the tax shield from CCA less the present value of the tax shield lost from salvage? Answer: 9596 x Question 27 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $120,000 plus it costs $20,000 to have it delivered and installed. You also traded yoour old computer worth $20,000. The old CCA half-year rule still applied. Based on past information, you believe that the equipment will have a salvage value of $19,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, what is the present value of the tax shield from CCA less the present value of the tax shield lost from salvage? Answer: 48054 Question 29 Incorrect Mark 0.00 out of 1.00 P Flag question You purchased equipment in 2017 for $120,000 plus it costs $20,000 to have it delivered and installed. You also traded your old computer worth $20,000. The old CCA half-year rule still applied. It will need $10,000 in spare parts inventory (increase in NWC), which it can sell for the $5,000 at the end of the project, you believe that the equipment will have a salvage value of $19,000 in 6 years. The company's marginal tax rate is 40%. If the asset's CCA rate is 20% and the required return on this project is 10%, What is the present value of the net working capital changes associated with the project? Answer: 6049 x Question 30 Incorrect Mark 0.00 out of 1.00 A project requires purchase of machinery for $150,000. The project generates an annual after-tax operating income of $10,000. The machine's expected useful life is 8 years with no salvage value at the end of its useful life. The required return for the project is 10%. The CCA rate for the machines is 20%. The company's marginal income tax rate is 40% P Flag question What is the PV of after-tax cash flows? Answer: 145523 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts