Question: please answer those three questions for me Click on the Loans PMT tab and enter your name in Cell C1. If Cell C1 is left

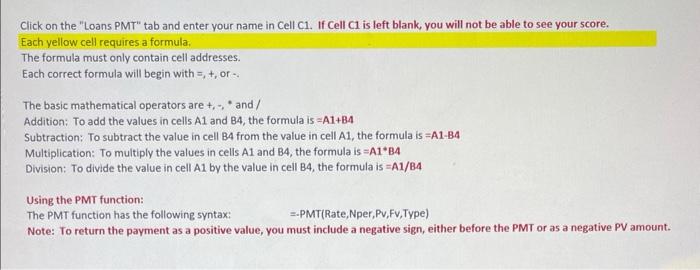

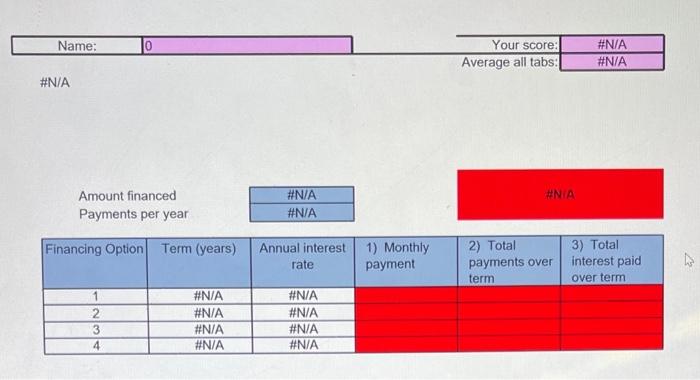

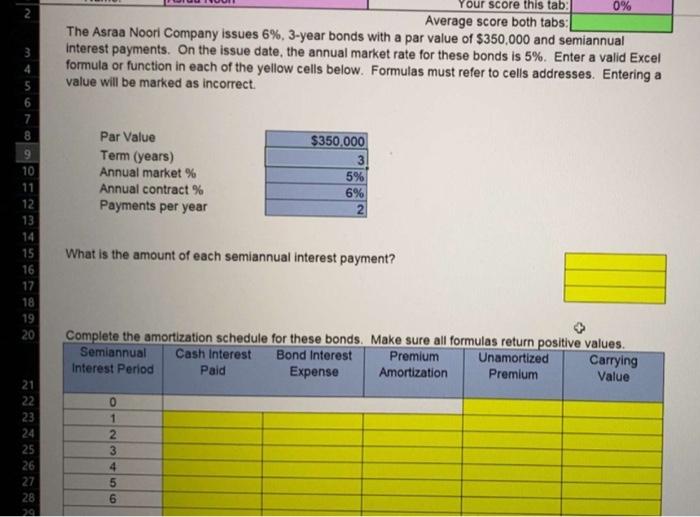

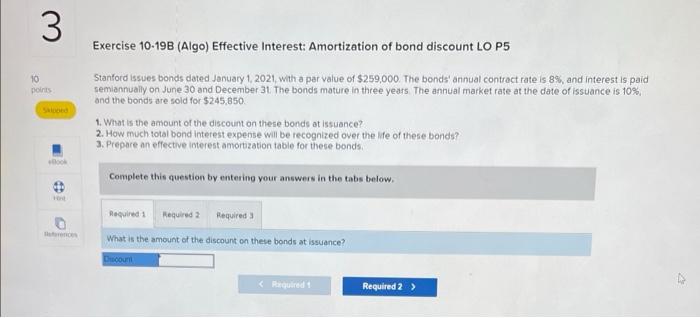

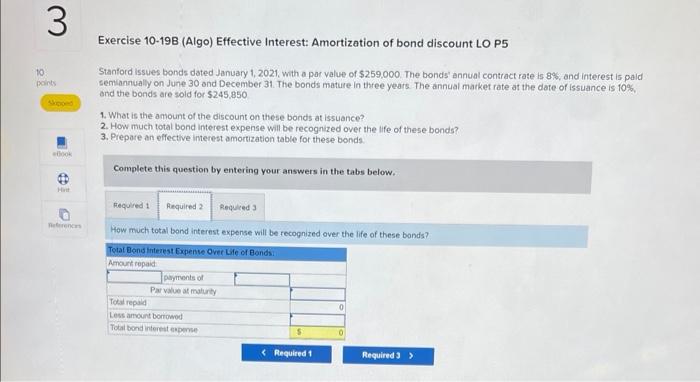

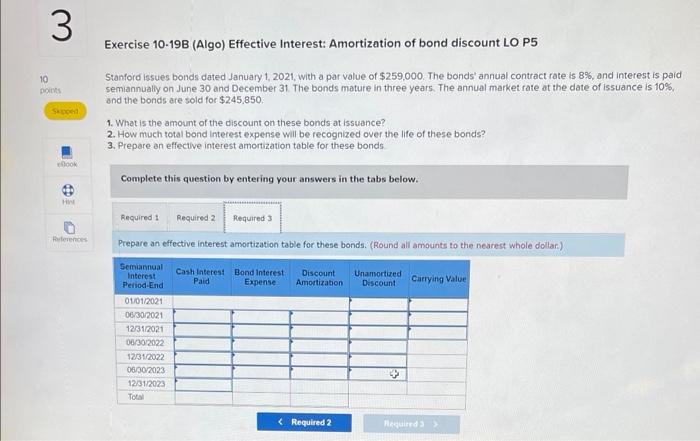

Click on the "Loans PMT" tab and enter your name in Cell C1. If Cell C1 is left blank, you will not be able to see your score. Each yellow cell requires a formula. The formula must only contain cell addresses. Each correct formula will begin with =,+, or The basic mathematical operators are t, " and / Addition: To add the values in cells A1 and B4, the formula is =A1+BA Subtraction: To subtract the value in cell BA from the value in cell A1, the formula is =A1-BA Multiplication: To multiply the values in cells A1 and B4, the formula is =A1+B4 Division: To divide the value in cell A1 by the value in cell B4, the formula is =A1/B4 Using the PMT function: The PMT function has the following syntax: =.PMT(Rate,Nper,Pv, Fv,Type) Note: To return the payment as a positive value, you must include a negative sign, either before the PMT or as a negative PV amount. Amount financed Payments per year Average score both tabs: The Asraa Noori Company issues 6%,3-year bonds with a par value of $350,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 5%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value will be marked as incorrect. What is the amount of each semiannual interest payment? The Asraa Noori Company issues 5%,3-year bonds with a par value of $400,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 6%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value will be marked as incorrect. What is the amount of each semiannual interest payment? Exercise 10.19B (Algo) Effective Interest: Amortization of bond discount LO P5 Stanford issues bonds dated January 1, 2021, with a par value of $259,000. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31 . The bonds mature in three years. The annual market rate at the date of isstance is 10%, and the bonds are sold for $245.850. 1. What is the amount of the discount on these bonds ot issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an effective interest amortzation table for these bonds. Complete this question by entering your answers in the tabs below. What is the amount of the discount on these bonds at issuance? Exercise 10-198 (Algo) Effective Interest: Amortization of bond discount LO P5 Stanford issues bonds dated January 1, 2021, with a par value of $259.000. The bonds' anncual contract rate is 8%, and interest is pald semiannually on June 30 and December 31 . The bonds mature in three years. The annual matket rate at the date of issuance is 10% and the bonds are sold for $245.850 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an effective interest amortization table for these bonds. Complete this question by entering your answers in the tabs below. How much total bond interest expense will be recognized over the life of these bands? Exercise 10-19B (Algo) Effective Interest: Amortization of bond discount LO P5 Stanford issues bonds dated January 1, 2021, with a par value of $259,000. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31 . The bonds mature in three years. The annual market rate ot the date of issuance is 10%. and the bonds are sold for $2,45,850 : 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an effective interest amortization table for these bonds Complete this question by entering your answers in the tabs below. Prepare an effective interest amortization table for these bonds. (Round all amounts to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts