Question: Please answer those Two Questions by showing how you got all the conclusions (Brief explanation please for thumbs-up) Prepare an absorption costing income statement for

Please answer those Two Questions by showing how you got all the conclusions (Brief explanation please for thumbs-up)

- Prepare an absorption costing income statement for the quarter ended June 30.

- Prepare a balance sheet as of June 30. Please classify your balance sheet by separating out current assets from your non-current assets

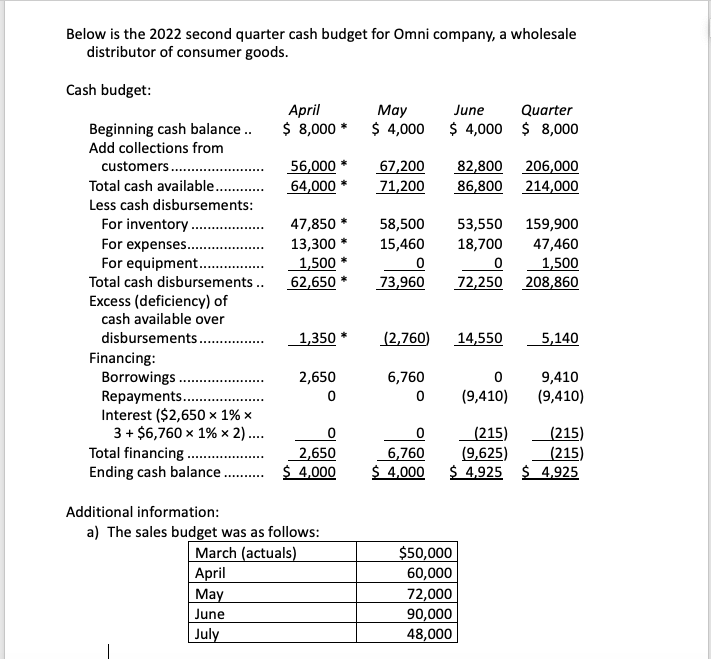

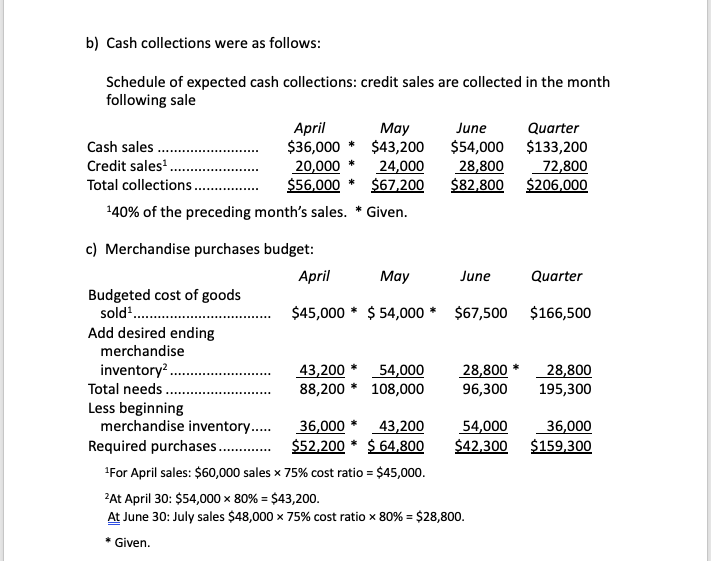

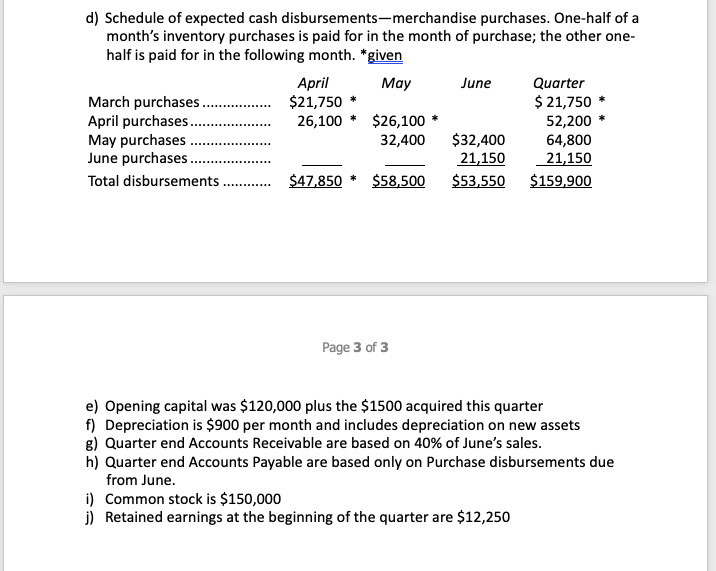

Below is the 2022 second quarter cash budget for Omni company, a wholesale distributor of consumer goods. ( Additional information: a) The sales budget was as follows: b) Cash collections were as follows: Schedule of expected cash collections: credit sales are collected in the month following sale 140% of the preceding month's sales. * Given. c) Merchandise purchases budget: d) Schedule of expected cash disbursements-merchandise purchases. One-half of a month's inventory purchases is paid for in the month of purchase; the other onehalf is paid for in the following month. *given Page 3 of 3 e) Opening capital was $120,000 plus the $1500 acquired this quarter f) Depreciation is $900 per month and includes depreciation on new assets g) Quarter end Accounts Receivable are based on 40% of June's sales. h) Quarter end Accounts Payable are based only on Purchase disbursements due from June. i) Common stock is $150,000 j) Retained earnings at the beginning of the quarter are $12,250 Below is the 2022 second quarter cash budget for Omni company, a wholesale distributor of consumer goods. ( Additional information: a) The sales budget was as follows: b) Cash collections were as follows: Schedule of expected cash collections: credit sales are collected in the month following sale 140% of the preceding month's sales. * Given. c) Merchandise purchases budget: d) Schedule of expected cash disbursements-merchandise purchases. One-half of a month's inventory purchases is paid for in the month of purchase; the other onehalf is paid for in the following month. *given Page 3 of 3 e) Opening capital was $120,000 plus the $1500 acquired this quarter f) Depreciation is $900 per month and includes depreciation on new assets g) Quarter end Accounts Receivable are based on 40% of June's sales. h) Quarter end Accounts Payable are based only on Purchase disbursements due from June. i) Common stock is $150,000 j) Retained earnings at the beginning of the quarter are $12,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts