Question: Please answer True or False for the following: 16. A negative alpha implies that the stock is overvalued. 17. If a stock has an expected

Please answer True or False for the following:

16. A negative alpha implies that the stock is overvalued.

17. If a stock has an expected return of 10% when the RFR is 2% and the market return is 10%, beta must be 1.0.

18. The market risk premium in the previous question is 10%.

19. In an efficient market, all assets would plot on the SML.

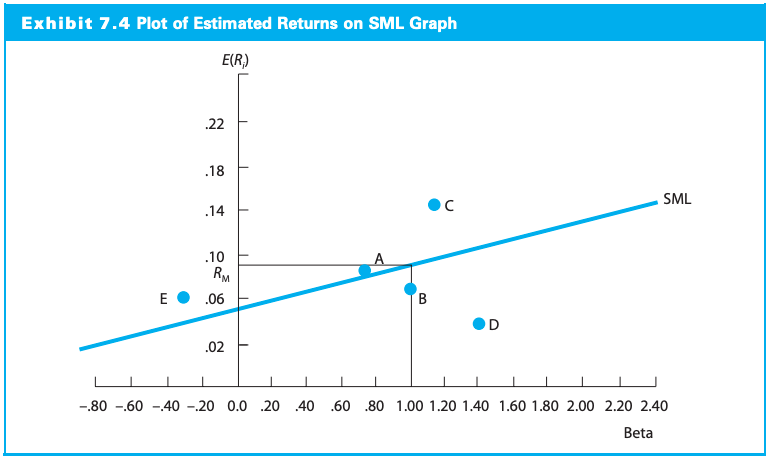

20. In the books Exhibit 7.4, the RFR is less than 6%.

Exhibit 7.4 Plot of Estimated Returns on SML Graph E(R) .22 .18 .14 SML .10 RM E .06 B D .02 - 80 -60 -40 -20 0.0 20 40 60 80 1.00 1.20 1.40 1.60 1.80 2.00 2.20 2.40 Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts