Question: Please answer using the below answer key. ProblemC Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales

Please answer using the below answer key.

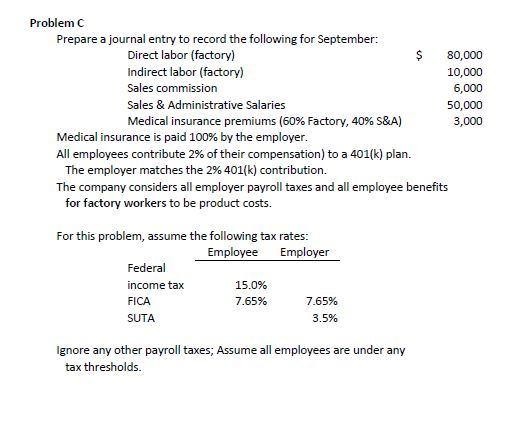

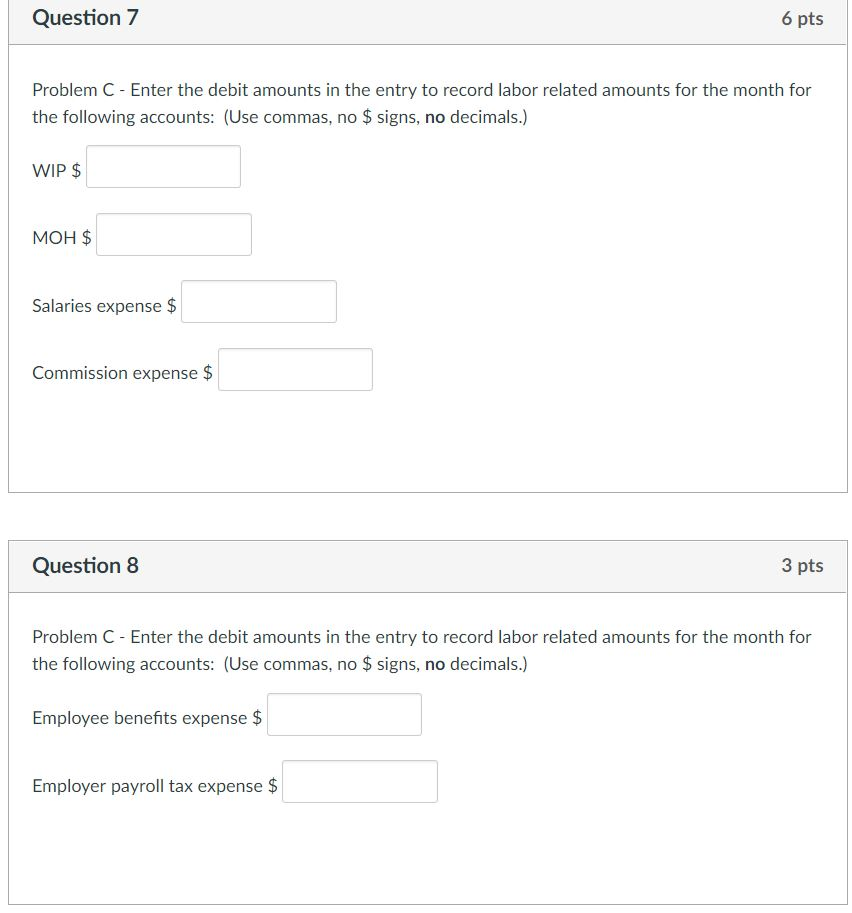

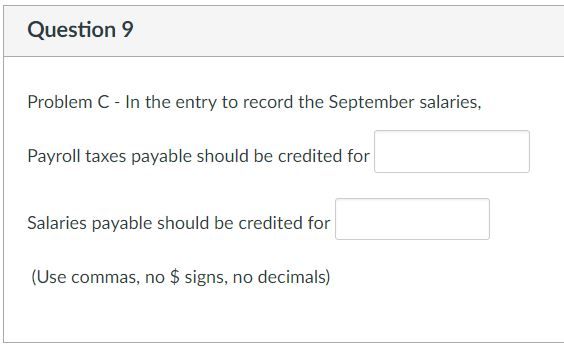

ProblemC Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales commission Sales & Administrative Salaries Medical insurance premiums (60% Factory, 40% S&A) $ 80,000 10,000 6,000 50,000 3,000 Medical insurance is paid 100% by the employer All employees contribute 2% of their compensation) to a 401(k) plan. The employer matches the 2% 401(k) contribution. The company considers all employer payroll taxes and all employee benefits for factory workers to be product costs. For this problem, assume the following tax rates: Employee Employer Federal income tax FICA SUTA 15.0% 7.65% 3.5% lgnore any other payroll taxes, Assume all employees are under any tax thresholds. Question7 6 pts Problem C - Enter the debit amounts in the entry to record labor related amounts for the month for the following accounts: (Use commas, no $ signs, no decimals.) WIP $ MOH $ Salaries expense$ Commission expense $ Question8 3 pts Problem C - Enter the debit amounts in the entry to record labor related amounts for the month for the following accounts: (Use commas, no $signs, no decimals.) Employee benefits expense $ Employer payroll tax expense $ Question 9 Problem C - In the entry to record the September salaries, Payroll taxes payable should be credited for Salaries payable should be credited for (Use commas, no $ signs, no decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts