Question: Please show ALL work. Thank you. Problem C Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales

Please show ALL work. Thank you.

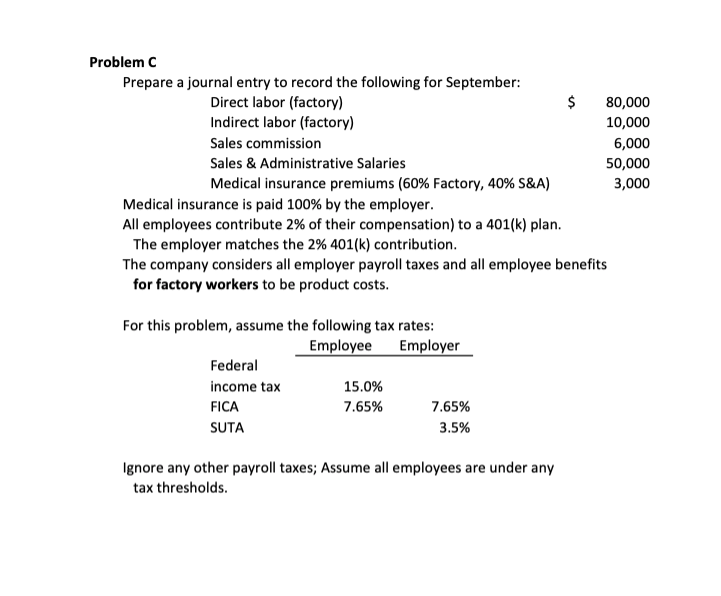

Problem C Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales commission Sales & Administrative Salaries Medical insurance premiums (60% Factory, 40% S&A) $80,000 10,000 6,000 50,000 3,000 Medical insurance is paid 100% by the employer All employees contribute 2% of their compensation) to a 401(k) plan The employer matches the 2% 401(k) contribution The company considers all employer payroll taxes and all employee benefits for factory workers to be product costs For this problem, assume the following tax rates Employee Employer Federal income tax FICA SUTA 15.0% 7.65% 7.65% 3.5% Ignore any other payroll taxes; Assume all employees are under any tax thresholds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts