Question: please answer using the excel, thank you. Mattel is a US-based company whose sales are roughly two thirds in dollars (Asia and the Americas) and

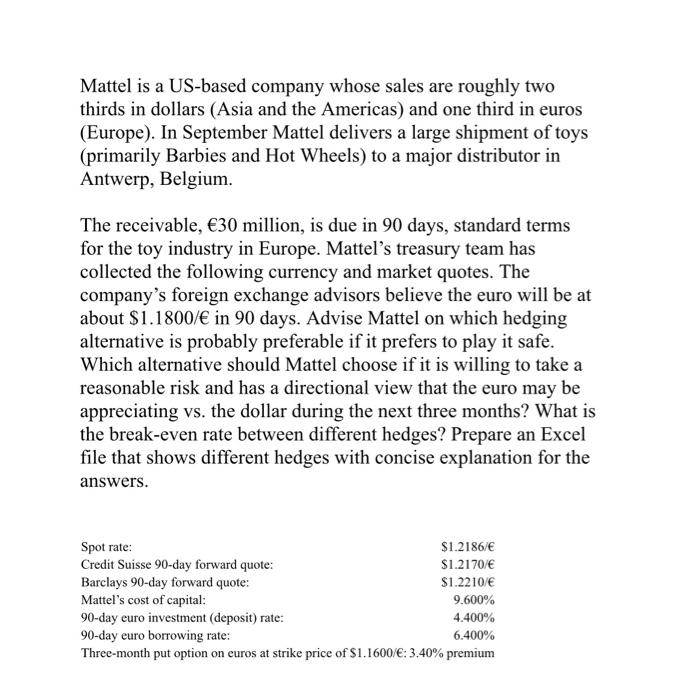

Mattel is a US-based company whose sales are roughly two thirds in dollars (Asia and the Americas) and one third in euros (Europe). In September Mattel delivers a large shipment of toys (primarily Barbies and Hot Wheels) to a major distributor in Antwerp, Belgium. The receivable, 30 million, is due in 90 days, standard terms for the toy industry in Europe. Mattel's treasury team has collected the following currency and market quotes. The company's foreign exchange advisors believe the euro will be at about $1.1800/ in 90 days. Advise Mattel on which hedging alternative is probably preferable if it prefers to play it safe Which alternative should Mattel choose if it is willing to take a reasonable risk and has a directional view that the euro may be appreciating vs. the dollar during the next three months? What is the break-even rate between different hedges? Prepare an Excel file that shows different hedges with concise explanation for the answers Spot rate: Credit Suisse 90-day forward quote: Barclays 90-day forward quote: Mattel's cost of capital: 90-day euro investment (deposit) rate: 90-day euro borrowing rate Three-month put option on $1.2186/E $1.2170/ $1.2210/E 9.600% 4.400% 6.400% strike price of $1.1600/: 3.40% premium euros at Mattel is a US-based company whose sales are roughly two thirds in dollars (Asia and the Americas) and one third in euros (Europe). In September Mattel delivers a large shipment of toys (primarily Barbies and Hot Wheels) to a major distributor in Antwerp, Belgium. The receivable, 30 million, is due in 90 days, standard terms for the toy industry in Europe. Mattel's treasury team has collected the following currency and market quotes. The company's foreign exchange advisors believe the euro will be at about $1.1800/ in 90 days. Advise Mattel on which hedging alternative is probably preferable if it prefers to play it safe Which alternative should Mattel choose if it is willing to take a reasonable risk and has a directional view that the euro may be appreciating vs. the dollar during the next three months? What is the break-even rate between different hedges? Prepare an Excel file that shows different hedges with concise explanation for the answers Spot rate: Credit Suisse 90-day forward quote: Barclays 90-day forward quote: Mattel's cost of capital: 90-day euro investment (deposit) rate: 90-day euro borrowing rate Three-month put option on $1.2186/E $1.2170/ $1.2210/E 9.600% 4.400% 6.400% strike price of $1.1600/: 3.40% premium euros at

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts