Question: please answer vith parts if yoh know correct answer Suppose that you hold a piece of land in the City of London that you may

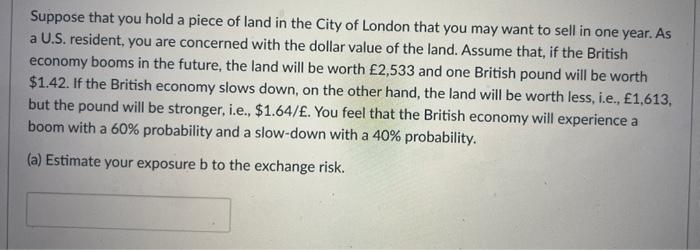

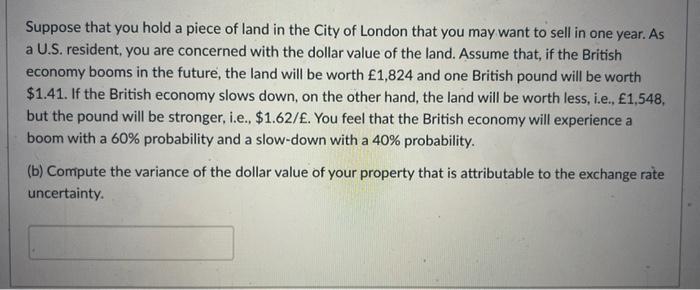

Suppose that you hold a piece of land in the City of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that, if the British economy booms in the future, the land will be worth 2,533 and one British pound will be worth $1.42. If the British economy slows down on the other hand, the land will be worth less, i.e., 1,613, but the pound will be stronger, i.e., $1.64/. You feel that the British economy will experience a boom with a 60% probability and a slow-down with a 40% probability. (a) Estimate your exposure b to the exchange risk. Suppose that you hold a piece of land in the City of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that, if the British economy booms in the future, the land will be worth 1,824 and one British pound will be worth $1.41. If the British economy slows down, on the other hand, the land will be worth less, i.e., 1,548, but the pound will be stronger, i.e., $1.62/. You feel that the British economy will experience a boom with a 60% probability and a slow-down with a 40% probability. (b) Compute the variance of the dollar value of your property that is attributable to the exchange rate uncertainty

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts