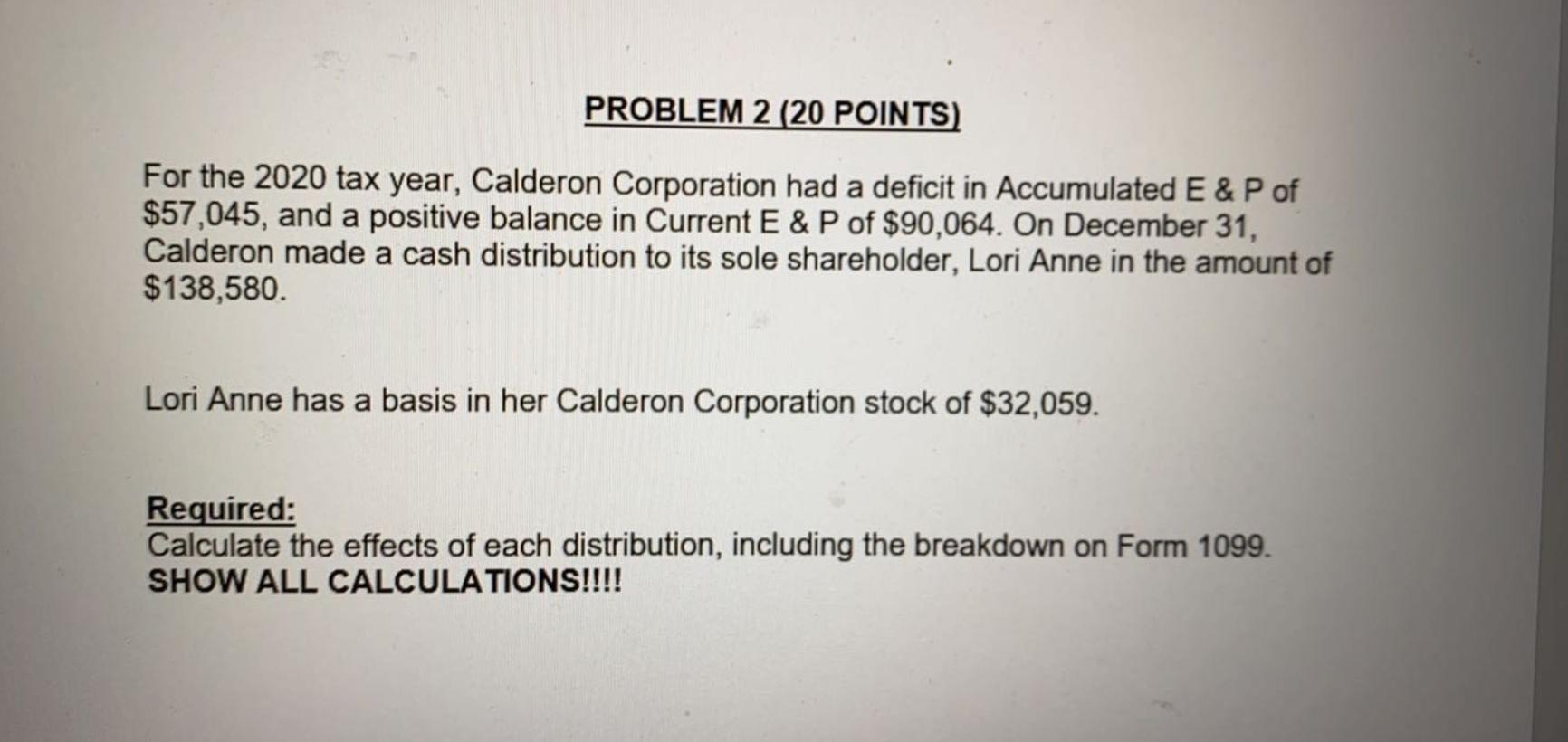

Question: please answer with calculations PROBLEM 2 (20 POINTS) For the 2020 tax year, Calderon Corporation had a deficit in Accumulated E&P of $57,045, and a

please answer with calculations

PROBLEM 2 (20 POINTS) For the 2020 tax year, Calderon Corporation had a deficit in Accumulated E&P of $57,045, and a positive balance in Current E&P of $90,064. On December 31, Calderon made a cash distribution to its sole shareholder, Lori Anne in the amount of $138,580. Lori Anne has a basis in her Calderon Corporation stock of $32,059. Required: Calculate the effects of each distribution, including the breakdown on Form 1099. SHOW ALL CALCULATIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts