Question: please answer with calculations PROBLEM 3 (20 POINTS) For the 2020 tax year, Flack Corporation had a deficit in Current E&P of $24,059, and a

please answer with calculations

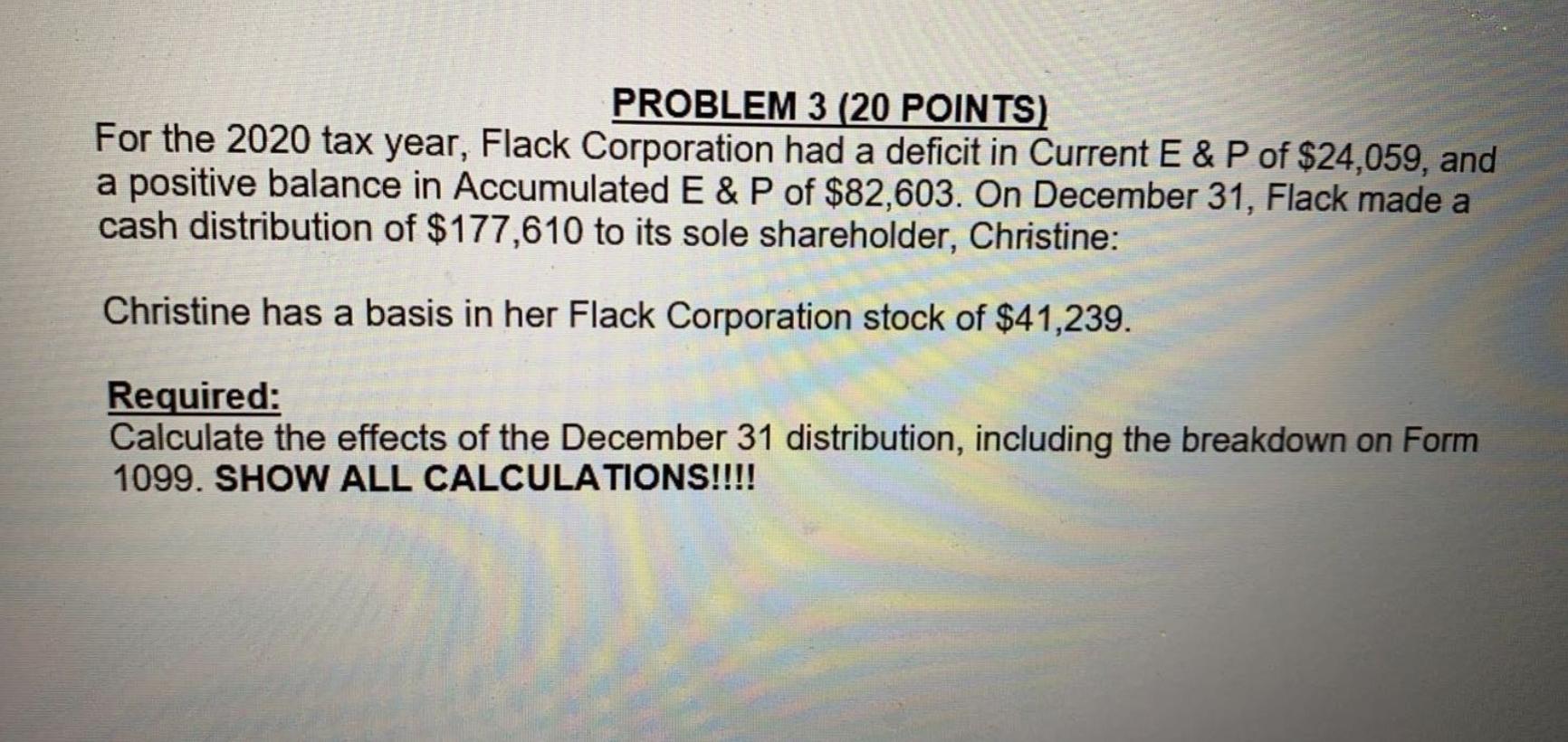

PROBLEM 3 (20 POINTS) For the 2020 tax year, Flack Corporation had a deficit in Current E&P of $24,059, and a positive balance in Accumulated E&P of $82,603. On December 31, Flack made a cash distribution of $177,610 to its sole shareholder, Christine: Christine has a basis in her Flack Corporation stock of $41,239. Required: Calculate the effects of the December 31 distribution, including the breakdown on Form 1099. SHOW ALL CALCULATIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts