Question: Please answer with calculations using a financial calculator Question 29 14 years ago the Singleton Company issued 30-year bonds with a 12.5% annual coupon rate

Please answer with calculations using a financial calculator

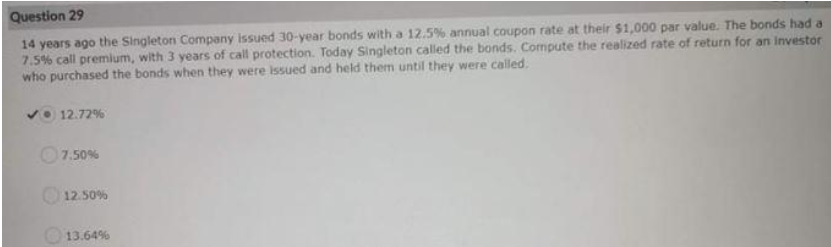

Question 29 14 years ago the Singleton Company issued 30-year bonds with a 12.5% annual coupon rate at their $1,000 par value. The bonds had a 7.5% call premium, with 3 years of call protection. Today Singleton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called 12.72% 7.50% 12.50% 13.64%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts