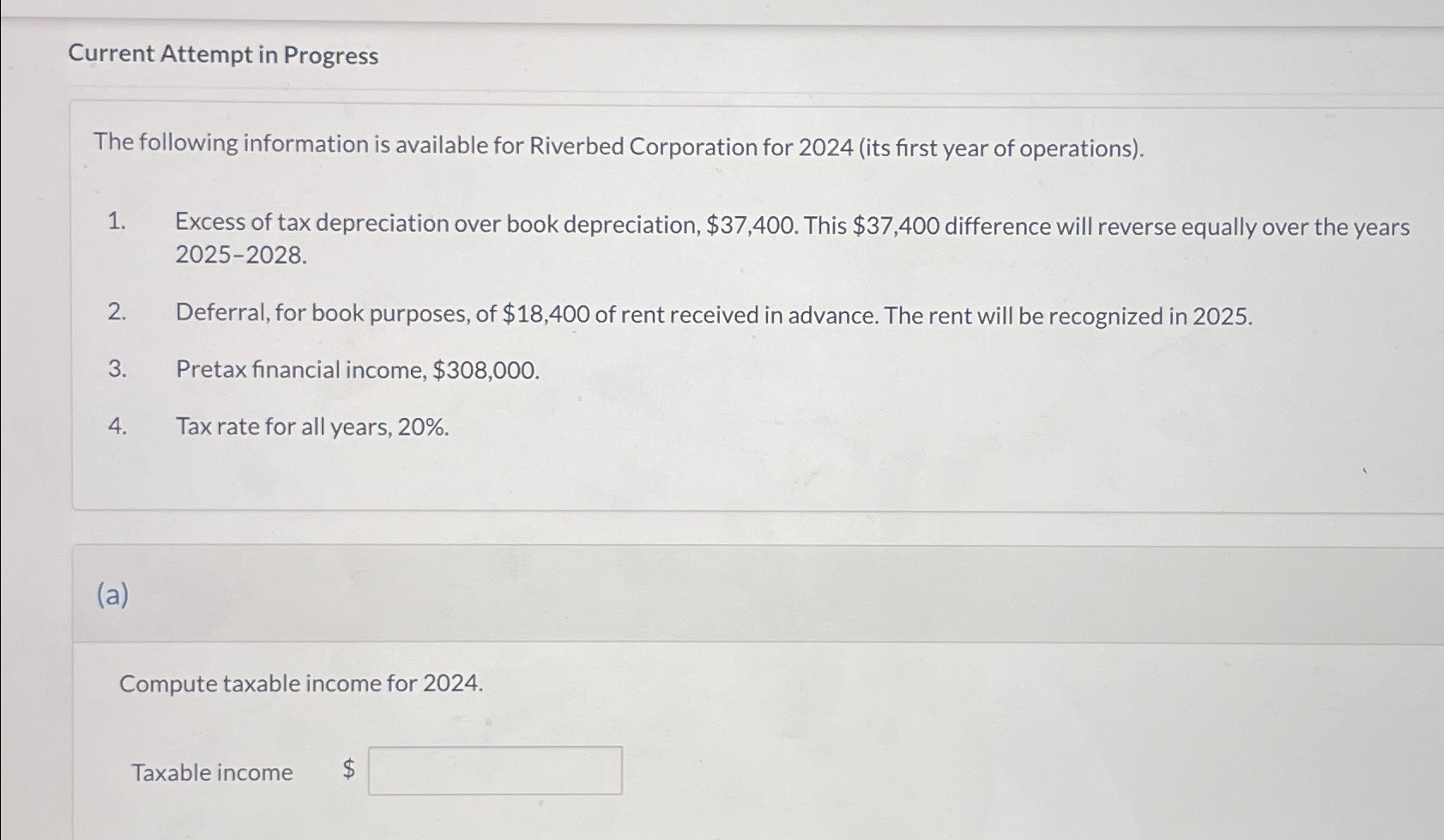

Question: please answer with correct and detailed calculations and explanations. make sure supporting statements are also provided for each step and calculation. Current Attempt in Progress

please answer with correct and detailed calculations and explanations. make sure supporting statements are also provided for each step and calculation.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts