Question: please answer with correct calculations and explanations. Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as follows: July 1 Inventory

please answer with correct calculations and explanations.

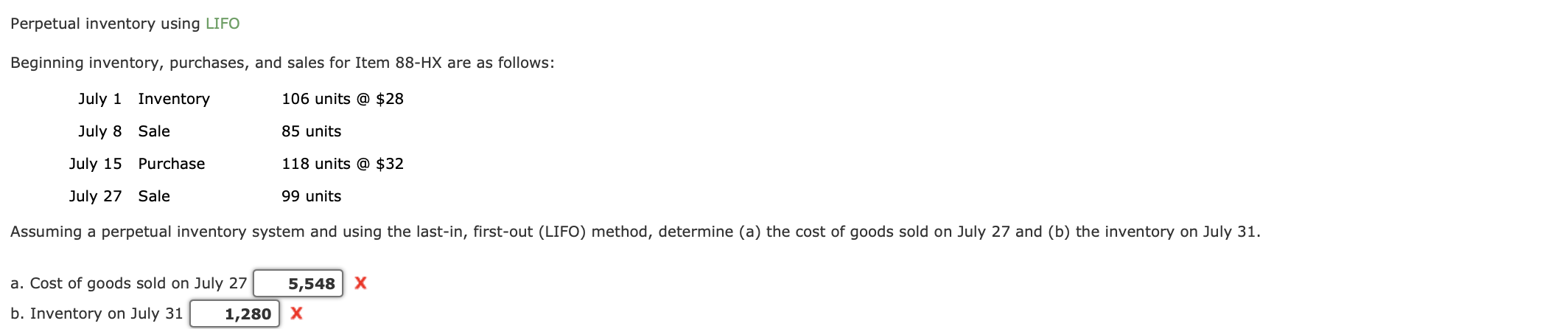

Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as follows: July 1 Inventory 106 units @ $28 July 8 Sale 85 units July 15 Purchase 118 units @ $32 July 27 Sale 99 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on July 27 and (b) the inventory on July 31. a. Cost of goods sold on July 27 5,548 X b. Inventory on July 31 1,280 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts