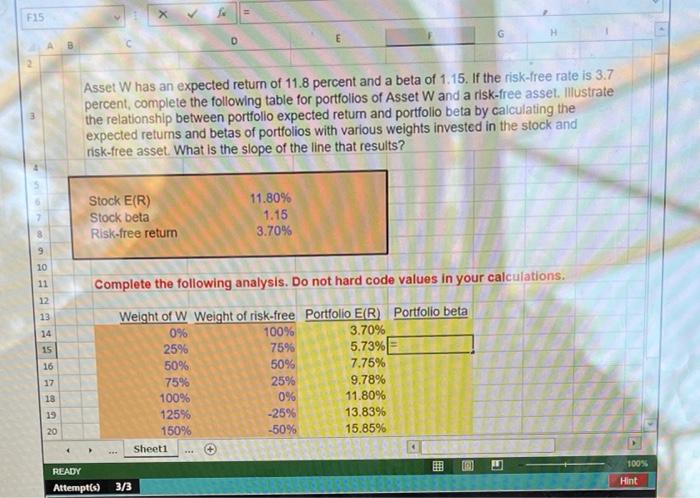

Question: please answer with excel formulas and exact cells! 725 G H A D Asset W has an expected return of 11.8 percent and a beta

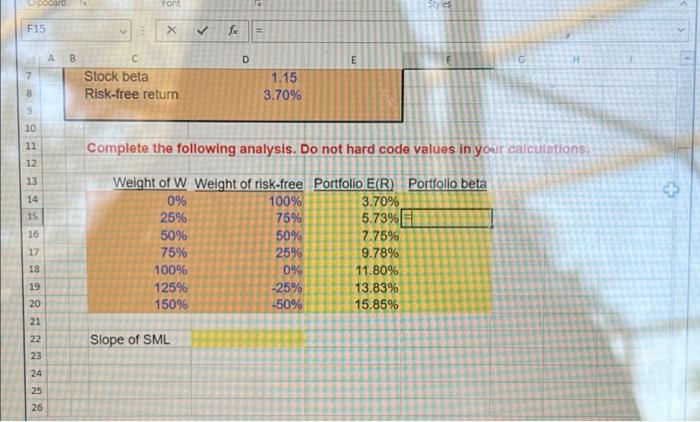

725 G H A D Asset W has an expected return of 11.8 percent and a beta of 1.15. If the risk-free rate is 3.7 percent, complete the following table for portfolios of Asset W and a risk-free asset. Mustrate the relationship between portfolio expected return and portfolio beta by calculating the expected returns and betas of portfolios with various weights invested in the stock and risk-free asset. What is the slope of the line that results? Stock E(R) Stock beta Risk-free return 11.80% 1.15 3.70% 8 9 10 11 Complete the following analysis. Do not hard code values in your calculations. 12 13 14 15 16 17 18 Weight of W Weight of risk-free Portfolio E(R) Portfolio beta 0% 100% 3.70% 25% 75% 5.73% 50% 50% 7.75% 75% 25% 9.78% 100% 0% 11.80% 125% -25% 13.83% 150% -50% 15.85% Sheet1 19 20 LU 100% READY Attempt(s) 3/3 Hint poor Font Styles F15 = D E G AB Stock beta Risk-free return 1.15 3.70% 8 9 10 11 12 Complete the following analysis. Do not hard code values in your calculations 13 FAM99 SNS98 14 15 16 17 18 19 20 21 22 23 Weight of W Weight of risk-free Portfolio E(R) Portfolio beta 0% 100% 3.70% 25% 75% 5.73% 50% 50% 7.75% 75% 25% 9.78% 100% 09% 11.80% 125% -25% 13.83% 150% -50% 15.85% Slope of SML 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts