Question: Please answer with explanation if possible . Thank you! Do Homework - Michael Page + px?homeworkld-5159493258 questionld-18flushed-falseicld-53550458back Apps .com : ers research D esearch 2-

Please answer with explanation if possible . Thank you!

Please answer with explanation if possible . Thank you!

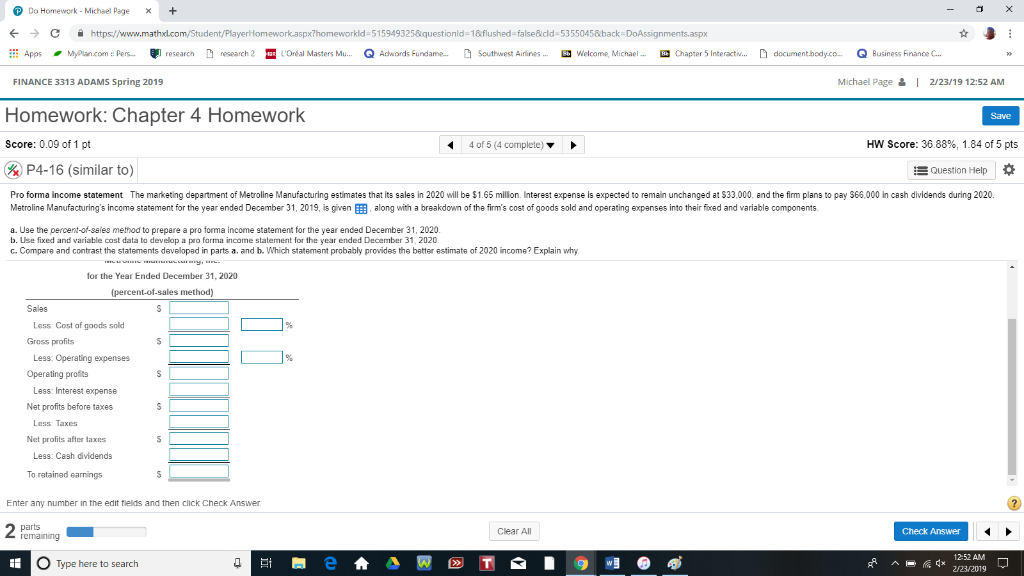

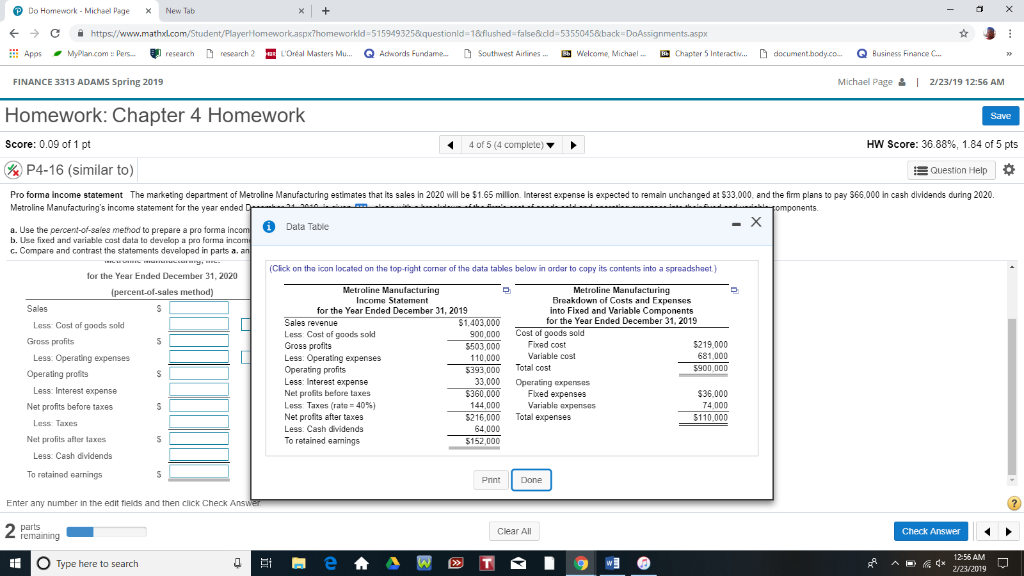

Do Homework - Michael Page + px?homeworkld-5159493258 questionld-18flushed-falseicld-53550458back Apps .com : ers research D esearch 2- Oral Masters Mu Q Achsor s Fundam Southwest Airi r es -welcome Michael -Chapter 5 Interactiv D docume thodyca Q Business f na cec. FINANCE 3313 ADAMS Spring 2019 Michael Page2/23/19 12:52 AM Homework: Chapter 4 Homework Save Score: 0.09 of 1 pt 44 of 5 (4 complete) HW Score: 36.88%, 1.84 of 5 pts P4-16 (similar to) Question Help Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.65 million. Interest expense is expected to remain unchanged at 33,000, and the firm plans to pay S66,000 in cash dividands during 2020. Matroline Manufacturing's income statement for the year ended December 31, 2019, is given along with a breakdown of the firm's cost of goods sold and operating expanses into their fixed and variable components a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020 b. Use fixed and variable cost data to develop a pro farma income statement for the year ended December 31, 2020 c. Compare and contrast the statements developad in parts a. and b. Which statement probably provides the better estimate of 2020 income?Explain why for the Year Ended December 31, 2020 (percent-ot-sales method) Sales Less Cost af goods sold Gross profits Less Operating expenses Operating profits Less: Interest expense Net profits before taxes Less Taxes Net profits after taxes Less: Cash dividends To retained earnings Enter any number in the edit tields and then click Check Answer Clear All Check Answer O Type here to search 12:52 AMM A2232019 @ Do Homework-Michael p.age Ne. Tab px?homeworkld-5159493258 questionld-18flushed-falseicld-53550458back Apps .com : ers research D esearch 2- Oral Masters Mu Q Achsor s Fundam Southwest Airi r es -welcome Michael -Chapter 5 Interactiv D docume thodyca Q Business f na cec. FINANCE 3313 ADAMS Spring 2019 Michael Page 2/23/19 12:56 AM Homework: Chapter 4 Homework Save Score: 0.09 of 1 pt 4015(4 complete ) HW Score: 36.88%, 1.84 of 5 pts P4-16 (similar to) E Question Help Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.65 million. Interest expense is expected to remain unchanged at 33,000, and the firm plans to pay S66,000 in cash dividands during 2020. Matroline Manufacturing's income statement for the year ended Data Table a. Use the percent-of-sales method to prepare a pro forma i b. Use fixed and variable cost data to develop a pro farma in c. Compare and contrast the statements developad in parts a (Click on tha icon located on the top-right corner of the data tables below in ordar to copy its contents into a spreadshaet) for the Year Ended December 31, 2020 Metroline Manufacturing Income Statement for the Year Ended December 31, 2019 Metroline Manufacturing Breakdown of Costs and Expenses into Fixed and Variable Components for the Year Ended December 31, 2019 (percent-ot-sales method) Sales $1,403,0 Less Cost af goods sold Gross profits of goods sold Forad cost Variable cost Less Cost of gaods sol Gross profits Less. Operating expenses Operating profits Less: Interest expanse Net profits before taxes Less Taxes (rate: 40%) Net profits after taxes Less: Cash dividends To retained earmings 900,000 $503.000 110,000 $219,000 681,000 5900,000 Less: Operating expenses Operating profits 393,000 Total cost 3,000 Operating expenses Less: Interest expense Net profits before taxes $360,000 144,000 Fbed expenses Variable expenses $36,000 74,000 $110,000 $216,000 Total expenses Less Taxes 64,000 $152,000 Net profits after taxes Less: Cash dividends To retained earnings Prnint Done Enter any number in the edit tields and then click Check Ans parts Clear All Check Answer 12:56 AMM Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts