Question: please answer with four decimals EXERCISE #4: A 5-year 4% A-rated corporate bond's yield to maturity is 6%. [Assume annual or semiannual.] Quoted Price =

please answer with four decimals

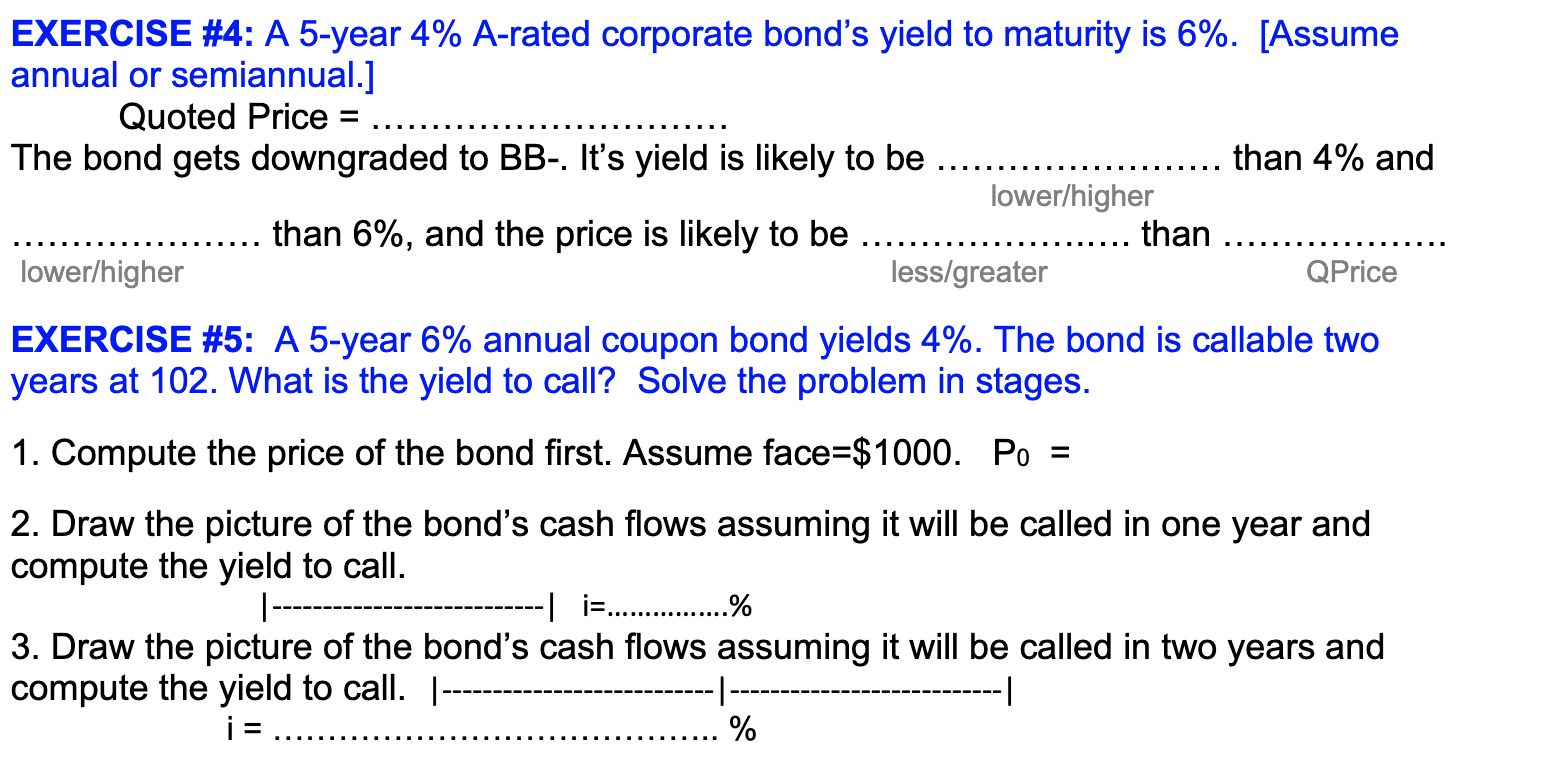

EXERCISE \#4: A 5-year 4\% A-rated corporate bond's yield to maturity is 6\%. [Assume annual or semiannual.] Quoted Price = The bond gets downgraded to BB-. It's yield is likely to be than 4% and than 6%, lower/hiaher lower/higher less/greater than QPrice EXERCISE \#5: A 5-year 6\% annual coupon bond yields 4\%. The bond is callable two years at 102. What is the yield to call? Solve the problem in stages. 1. Compute the price of the bond first. Assume face =$1000. P0= 2. Draw the picture of the bond's cash flows assuming it will be called in one year and compute the yield to call. i=....% 3. Draw the picture of the bond's cash flows assuming it will be called in two years and compute the yield to call. i= %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts