Question: please answer with handwritten formula work only, no spreadsheet/excel, thank you Problem 2. ABC must pay liabilities of 1000 due in 6 months and another

please answer with handwritten formula work only, no spreadsheet/excel, thank you

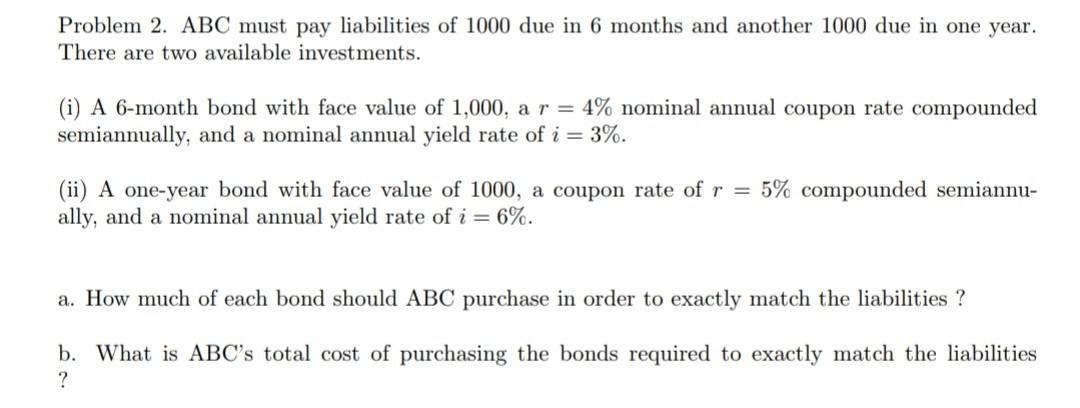

Problem 2. ABC must pay liabilities of 1000 due in 6 months and another 1000 due in one year. There are two available investments. (i) A 6-month bond with face value of 1,000, a r = 4% nominal annual coupon rate compounded semiannually, and a nominal annual yield rate of i = 3%. (ii) A one-year bond with face value of 1000, a coupon rate of r = 5% compounded semiannu- ally, and a nominal annual yield rate of i = 6%. a. How much of each bond should ABC purchase in order to exactly match the liabilities? b. What is ABC's total cost of purchasing the bonds required to exactly match the liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts