Question: Please answer with reason why the option is correct and why remaining options are incorrect Which of the following is an election or calculation made

Please answer with reason why the option is correct and why remaining options are incorrect

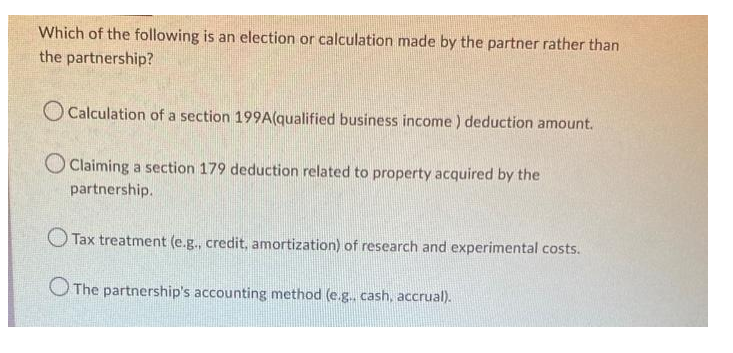

Which of the following is an election or calculation made by the partner rather than the partnership? Calculation of a section 199A(qualified business income ) deduction amount. Claiming a section 179 deduction related to property acquired by the partnership. ()Tax treatment (e.g., credit, amortization) of research and experimental costs. The partnership's accounting method (e.g., cash, accrual)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts