Question: please answer with reason why the option is correct and why the other options are incorrect please answer if you really have knowledge A fire

please answer with reason why the option is correct and why the other options are incorrect please answer if you really have knowledge

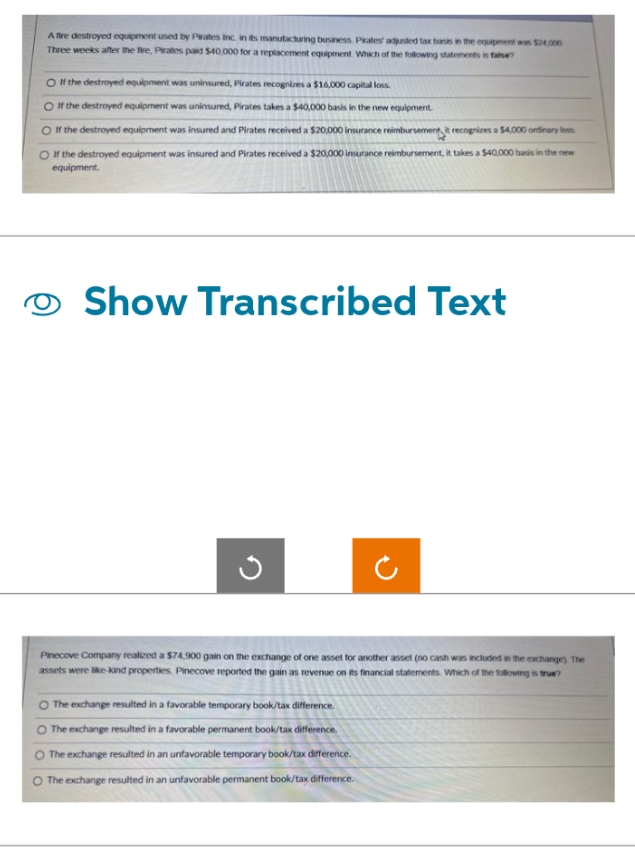

A fire destroyed equipment used by Prates Inc. in its manufacturing business. Prates' adpaded tox base in the equipment was $210on Three weeks after the fire, Pirates paid $40,000 for a replacement equipment. Which of the following walements is false? O If the destroyed equipment was uninsured, Pirates recognizes a $16,000 capital loss. O If the destroyed equipment was uninsured, Pirates takes a $40,000 bash in the new equipment. O If the destroyed equipment was insured and Pirates received a $20,000 insurance reimbursement it recognizes a $4,000 ordinary loss. If the destroyed equipment was insured and Pirates received a $20,000 insurance reimbursement, it takes a $40.000 basis in the new equipment. Show Transcribed Text Pinecove Company realized a $74,900 gain on the exchange of one asset for another asset (no cash was included in the exchange). The assets were like-kind properties. Pinecove reported the gain as revenue on its financial statements, Which of the following is true? The exchange resulted in a favorable temporary book/tax difference. O The exchange resulted in a favorable permanent book/tax difference. O The exchange resulted in an unfavorable temporary book/tax difference. O The exchange resulted in an unfavorable permanent book/tax difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts