Question: Please answer with the correct solution. Q2. The capital structure of XYZ Ltd is given as under as on 31/03/2021: 12% Debentures 15% Preference shares

Please answer with the correct solution.

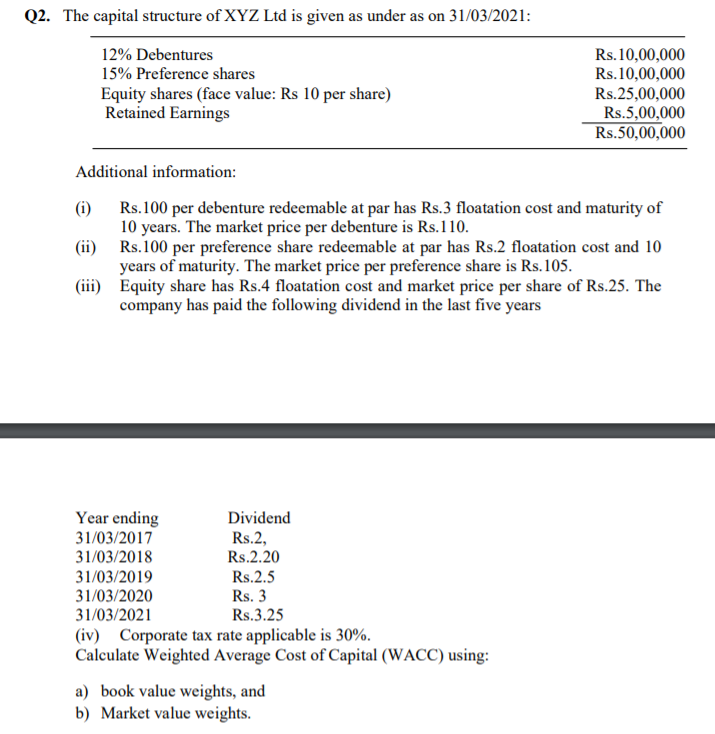

Q2. The capital structure of XYZ Ltd is given as under as on 31/03/2021: 12% Debentures 15% Preference shares Equity shares (face value: Rs 10 per share) Retained Earnings Rs.10,00,000 Rs.10,00,000 Rs.25,00,000 Rs. 5,00,000 Rs.50,00,000 Additional information: (i) Rs.100 per debenture redeemable at par has Rs.3 floatation cost and maturity of 10 years. The market price per debenture is Rs.110. (ii) Rs.100 per preference share redeemable at par has Rs.2 floatation cost and 10 years of maturity. The market price per preference share is Rs. 105. (iii) Equity share has Rs.4 floatation cost and market price per share of Rs.25. The company has paid the following dividend in the last five years Year ending Dividend 31/03/2017 Rs.2, 31/03/2018 Rs.2.20 31/03/2019 Rs.2.5 31/03/2020 Rs. 3 31/03/2021 Rs.3.25 (iv) Corporate tax rate applicable is 30%. Calculate Weighted Average Cost of Capital (WACC) using: a) book value weights, and b) Market value weights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts