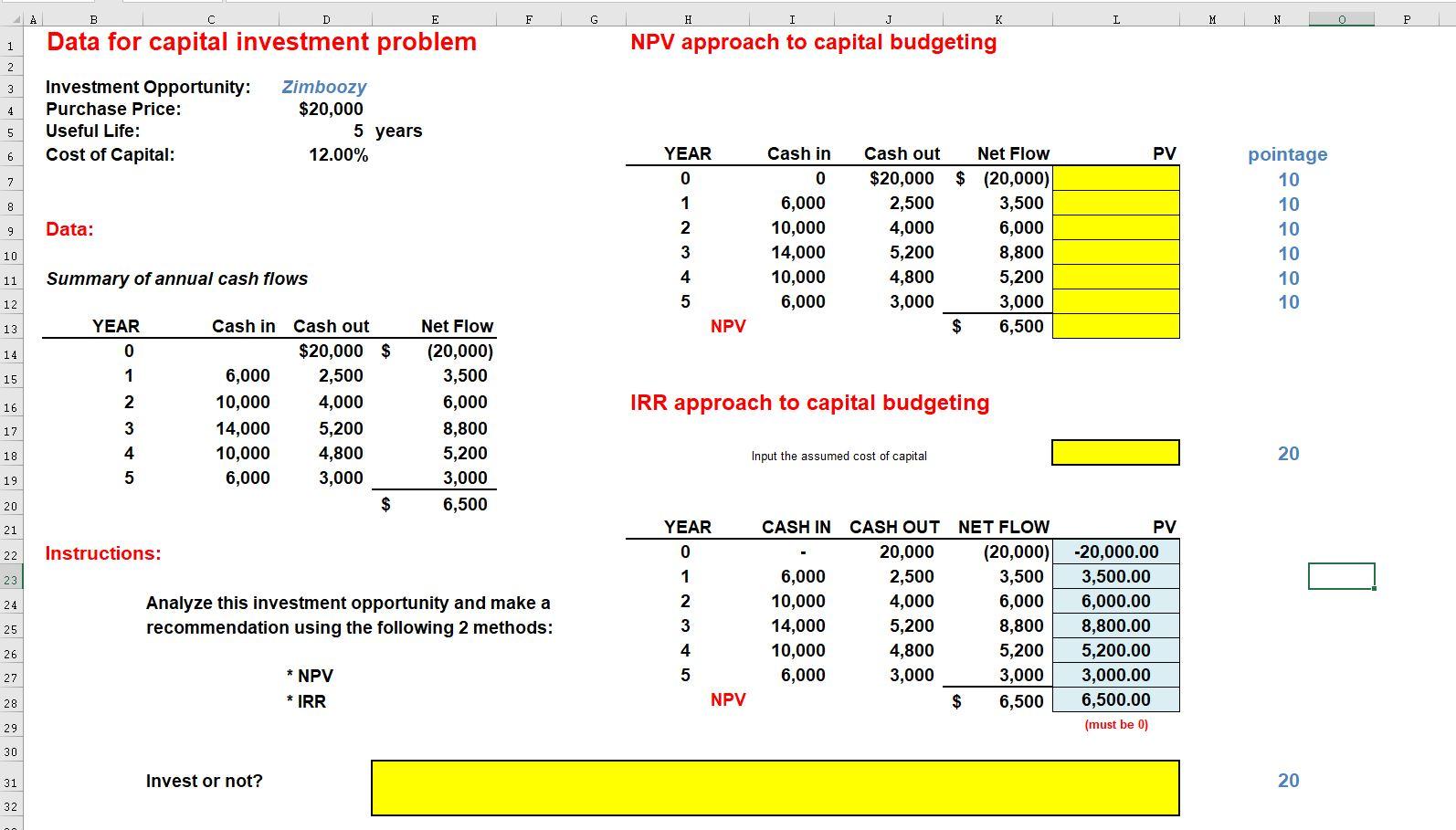

Question: Please answer with the excel formulas required in detail. (Example, in L7 exactly what is the formula to use) There are several versions of this

Please answer with the excel formulas required in detail. (Example, in L7 exactly what is the formula to use) There are several versions of this question but does not include these details. Thanks!

A B D F G H I J K L M N 0 P 1 Data for capital investment problem NPV approach to capital budgeting 2 3 Zimboozy $20,000 4 Investment Opportunity: Purchase Price: Useful Life: Cost of Capital: 5 5 years 6 12.00% PV 7 8 9 Data: YEAR 0 1 2 3 4 5 NPV Cash in 0 6,000 10,000 14,000 10,000 6,000 4,000 Cash out Net Flow $20,000 $ (20,000) 2,500 3,500 6,000 5,200 8,800 4,800 5,200 3,000 3,000 $ 6,500 pointage 10 10 10 10 10 10 10 11 Summary of annual cash flows 12 13 YEAR 0 14 15 1 16 Cash in Cash out $20,000 $ 6,000 2,500 10,000 4,000 14,000 5,200 10,000 4,800 6,000 3,000 $ IRR approach to capital budgeting 2 3 4 Net Flow (20,000) 3,500 6,000 8,800 5,200 3,000 6,500 17 18 Input the assumed cost of capital 20 19 5 20 21 YEAR 0 22 Instructions: 23 1 24 Analyze this investment opportunity and make a recommendation using the following 2 methods: CASH IN CASH OUT NET FLOW 20,000 (20,000) 6,000 2,500 3,500 10,000 4,000 6,000 14,000 5,200 8,800 10,000 4,800 5,200 6,000 3,000 3,000 $ 6,500 2 3 4 25 PV -20,000.00 3,500.00 6,000.00 8,800.00 5,200.00 3,000.00 6,500.00 (must be 0) 26 27 * NPV 5 28 * IRR NPV 29 30 31 Invest or not? 20 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts