Question: *****PLEASE ANSWER WITH THE FORMULAS FOR EACH CELL, NOT JUST THE NUMBER!!***** A B C D E | 1 Perfect Parties, Inc. has several divisions.

*****PLEASE ANSWER WITH THE FORMULAS FOR EACH CELL, NOT JUST THE NUMBER!!*****

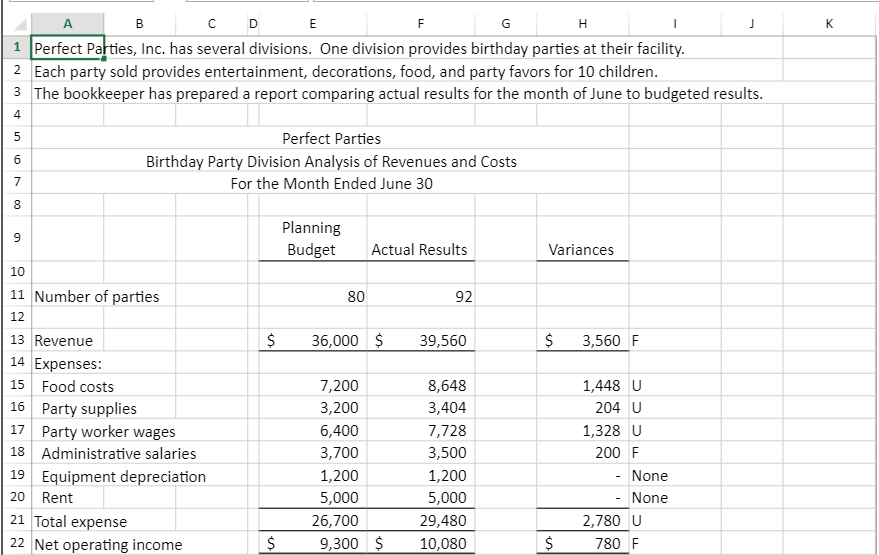

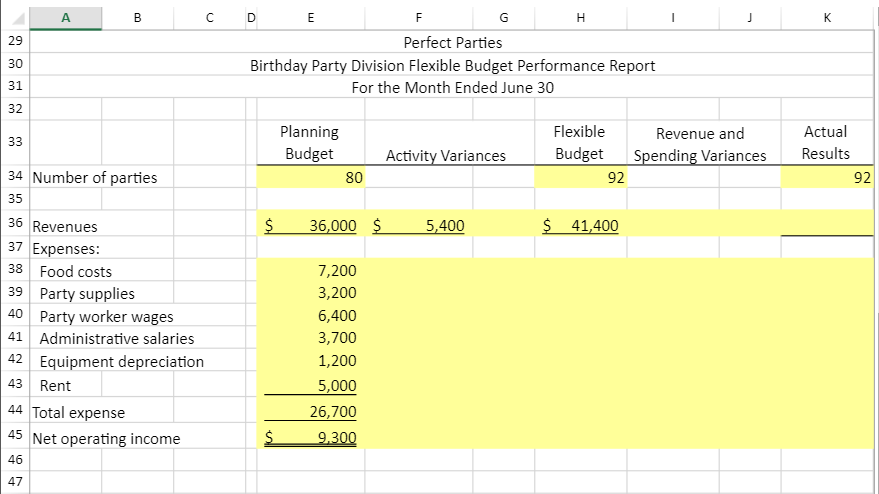

A B C D E | 1 Perfect Parties, Inc. has several divisions. One division provides birthday parties at their facility. | 2 Each party sold provides entertainment, decorations, food, and party favors for 10 children. The bookkeeper has prepared a report comparing actual results for the month of June to budgeted results. Perfect Parties Birthday Party Division Analysis of Revenues and Costs For the Month Ended June 30 Planning Budget Actual Results Variances | 11 Number of parties 80 92 12 36,000 $ 39,560 $ 3,560 F 13 Revenue 14 Expenses: 15 Food costs 16 Party supplies 17 Party worker wages 18 Administrative salaries 19 Equipment depreciation 20 Rent 21 Total expense 22 Net operating income 7,200 3,200 6,400 3,700 1,200 5,000 26,700 9,300 8,648 3,404 7,728 3,500 1,200 5,000 29,480 10,080 1,448 U 204 U 1,328 U 200 F - None - None 2,780 U 780 F $ $ $ Food costs, party supplies and party worker wages are variable costs. Administrative salaries, equipment depreciation and rent are fixed costs. Prepare a new report for June using the flexible budget approach. Enter all variances as positive amounts. If there is a variance, write an IF statements to indicate if it is For U (using capital letters). If there is no variance, enter the word None. A B C D E I F G H Perfect Parties Birthday Party Division Flexible Budget Performance Report For the Month Ended June 30 Planning Budget Flexible Budget Revenue and Spending Variances Actual Results Activity Variances 34 Number of parties 80 92 35 $ 36,000 $ 5,400 $ 41,400 36 Revenues 37 Expenses: 38 Food costs 39 Party supplies 40 Party worker wages 41 Administrative salaries 42 Equipment depreciation Rent 44 Total expense 45 Net operating income 7,200 3,200 6,400 3,700 1,200 5,000 26,700 9.300 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts