Question: please answer with the solving solution. Mr. Pawan Garg, a wealthy businessman, has approached you for profeesional advice on investment. He has a surplus of

please answer with the solving solution.

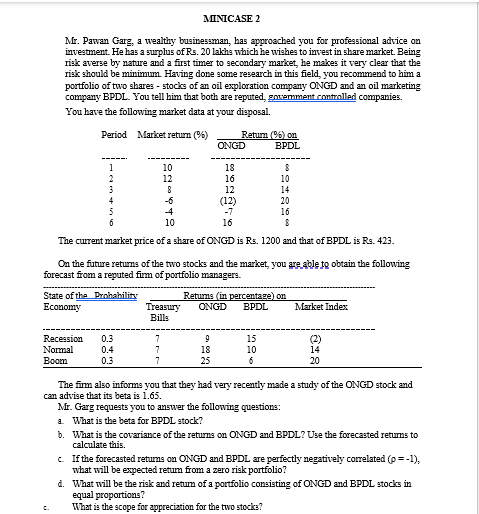

Mr. Pawan Garg, a wealthy businessman, has approached you for profeesional advice on investment. He has a surplus of R. 20 lakhs which he wighes to invest in share market. Being risk averse by nature and a first timer to gecondary market, he makes it very clear that the risk should be minimum. Having done some research in this field, you recommend to him a portfolio of two shares - stocks of an oil exploration company ONGD and an oil marketing company BPDL. You tell him that both are reputed, gnximment rontrolled companies. You have the following market data at your disposal. The current market price of a share of ONGD is Rs. 1200 and that of BPDL is Ra. 423. On the future returns of the two stocks and the market, you are. a ble tg obtain the following forecast from a reputed firm of portfolio managers. The firm also informs you that they had very recently made a study of the ONGD atock and can advige that its beta is 1.65. Mr. Garg requests you to answer the following questions: a. What is the beta for BPDL atock? b. What is the covariance of the returns on ONGD and BPDL? Use the forecasted returns to calculate this. c. If the forecasted retums on ONGD and BPDL are perfectly negatively correlated ( =1), what will be expected retum from a zero risk portfolio? d. What will be the riak and retum of a portfolio consisting of ONGD and BPDL stocks in equal proportions? c. What is the scope for appreciztion for the two stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts