Question: Please answer with workings and formulas. this is my revision for my upcoming exams. please help me QUESTION 2 (25 MARKS) The following financial data

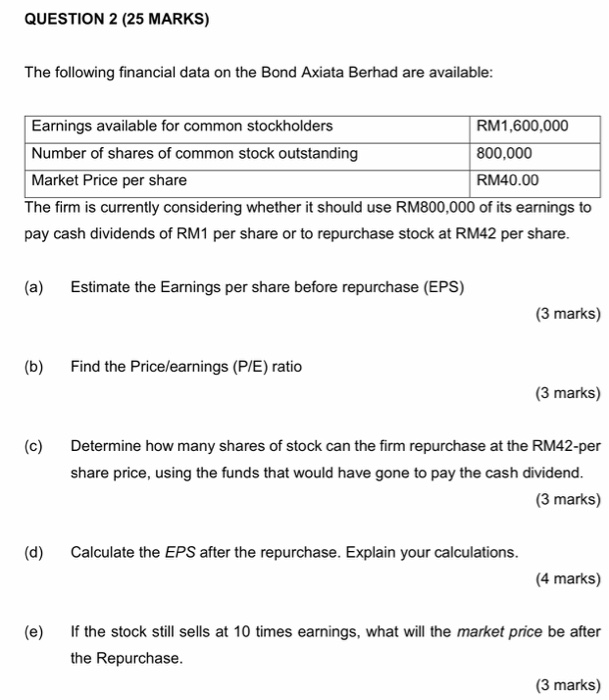

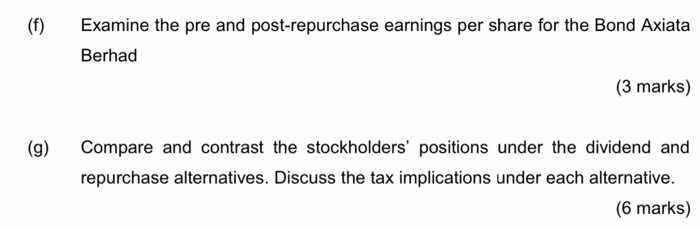

QUESTION 2 (25 MARKS) The following financial data on the Bond Axiata Berhad are available: Earnings available for common stockholders RM1,600,000 Number of shares of common stock outstanding 800,000 Market Price per share RM40.00 The firm is currently considering whether it should use RM800,000 of its earnings to pay cash dividends of RM1 per share or to repurchase stock at RM42 per share. (a) Estimate the Earnings per share before repurchase (EPS) (3 marks) (b) Find the Pricelearnings (P/E) ratio (3 marks) Determine how many shares of stock can the firm repurchase at the RM42-per share price, using the funds that would have gone to pay the cash dividend. (3 marks) (d) Calculate the EPS after the repurchase. Explain your calculations. (4 marks) (e) If the stock still sells at 10 times earnings, what will the market price be after the Repurchase. (3 marks) Examine the pre and post-repurchase earnings per share for the Bond Axiata Berhad (3 marks) (9) Compare and contrast the stockholders' positions under the dividend and repurchase alternatives. Discuss the tax implications under each alternative. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Lets break down the problem and address each part systematically with the appropriate formulas and calculations Given Data Earnings available for common stockholders RM 1600000 Number of shares outsta... View full answer

Get step-by-step solutions from verified subject matter experts