Question: please answer with written formulas, ty! Tippit-the-Strong Company is looking at a new sausage system with an installed cost of $280,000. This asset will be

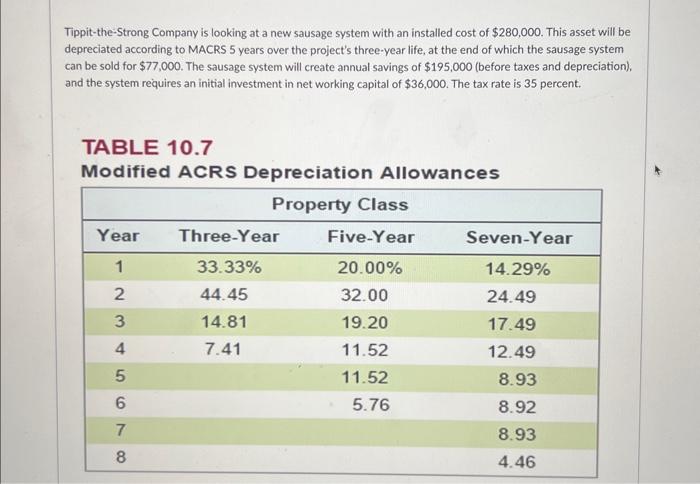

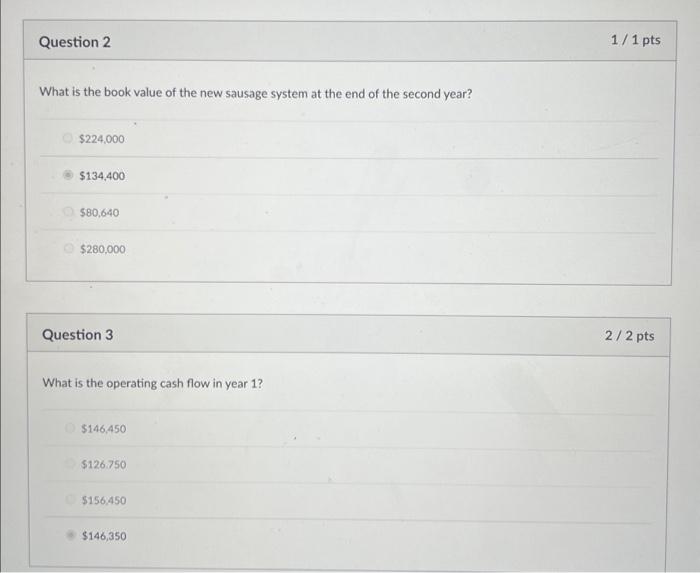

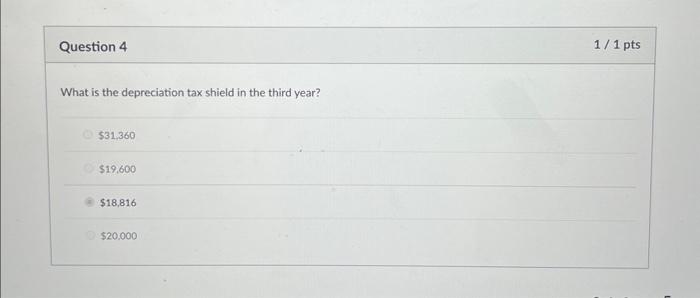

Tippit-the-Strong Company is looking at a new sausage system with an installed cost of $280,000. This asset will be depreciated according to MACRS 5 years over the project's three-year life, at the end of which the sausage system can be sold for $77,000. The sausage system will create annual savings of $195,000 (before taxes and depreciation), and the system requires an initial investment in net working capital of $36,000. The tax rate is 35 percent. TABLE 10.7 Modified ACRS Depreciation Allowances What is the book value of the new sausage system at the end of the second year? $224,000 $134,400 $80,640 $280,000 Question 3 What is the operating cash flow in year 1 ? $146,450 $126.750 $156,450 $146,350 What is the depreciation tax shield in the third year? $31,360 $19,600 $18,816 $20.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts