Question: Please answer within the given format with all supporting calculation seperately Please answer correct otherwise skip it Use same format as given Account Debit Credit

Please answer within the given format with all supporting calculation seperately

Please answer correct otherwise skip it

Use same format as given

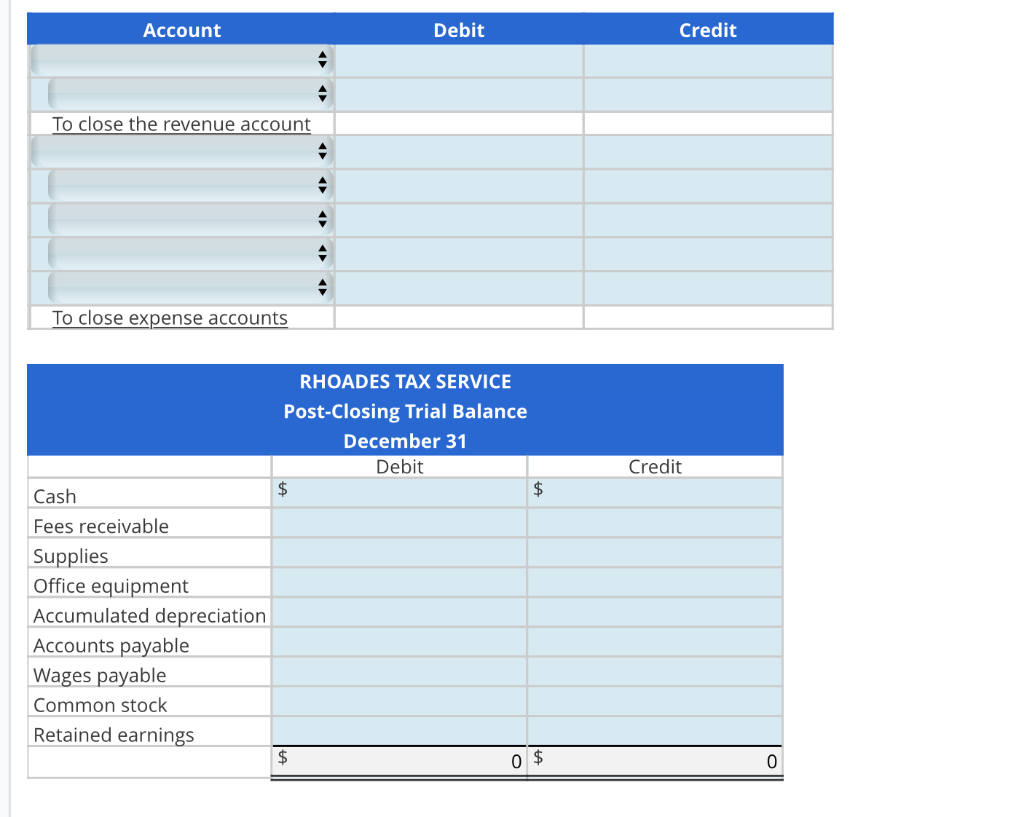

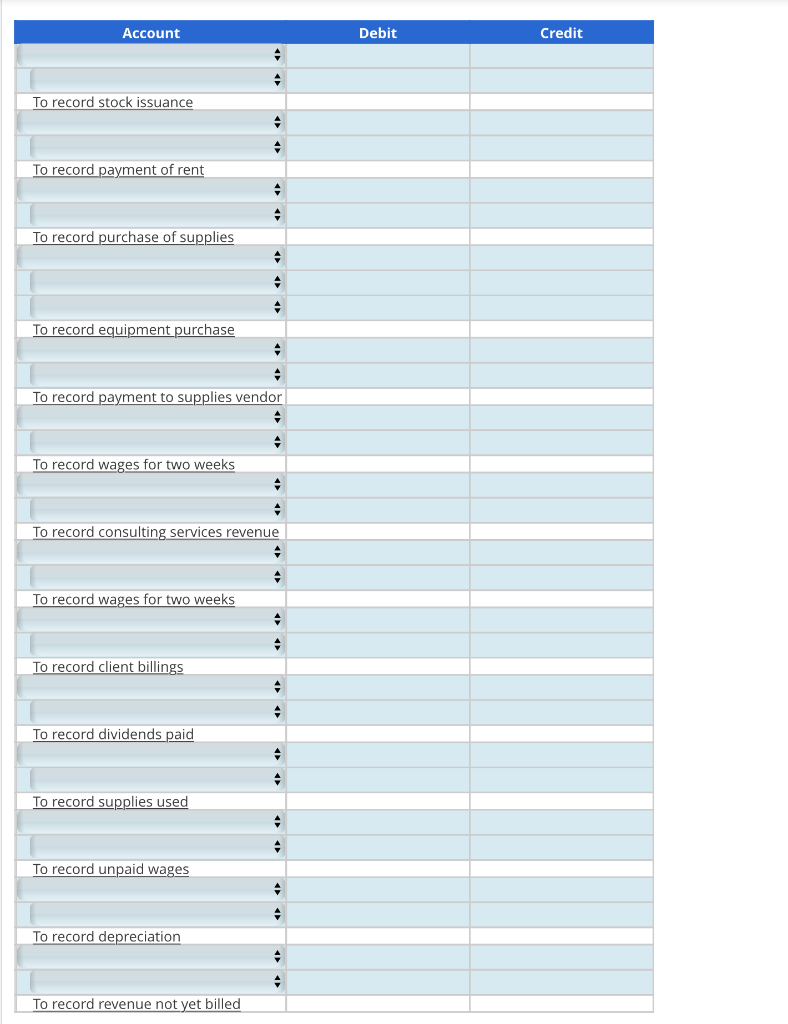

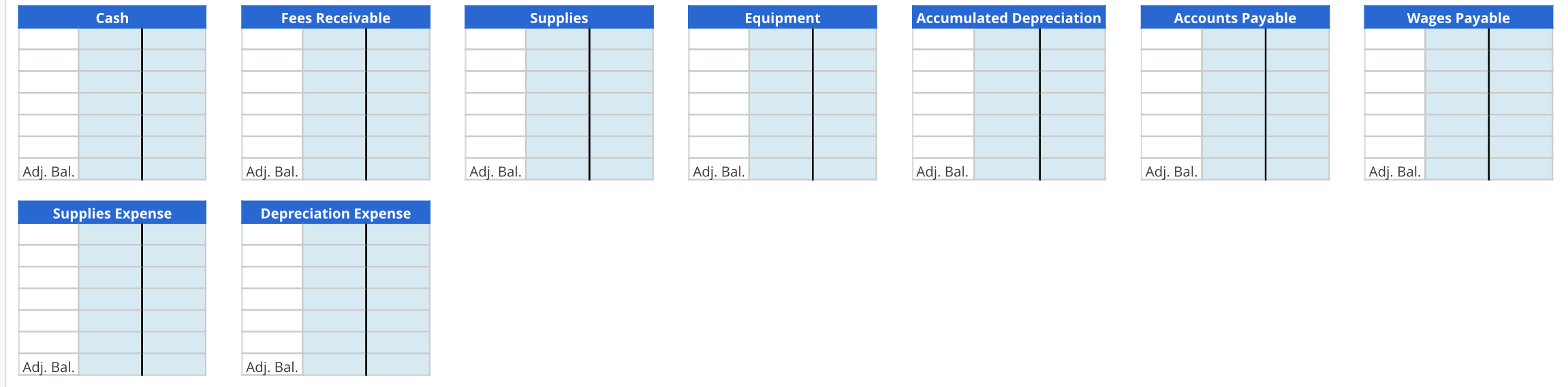

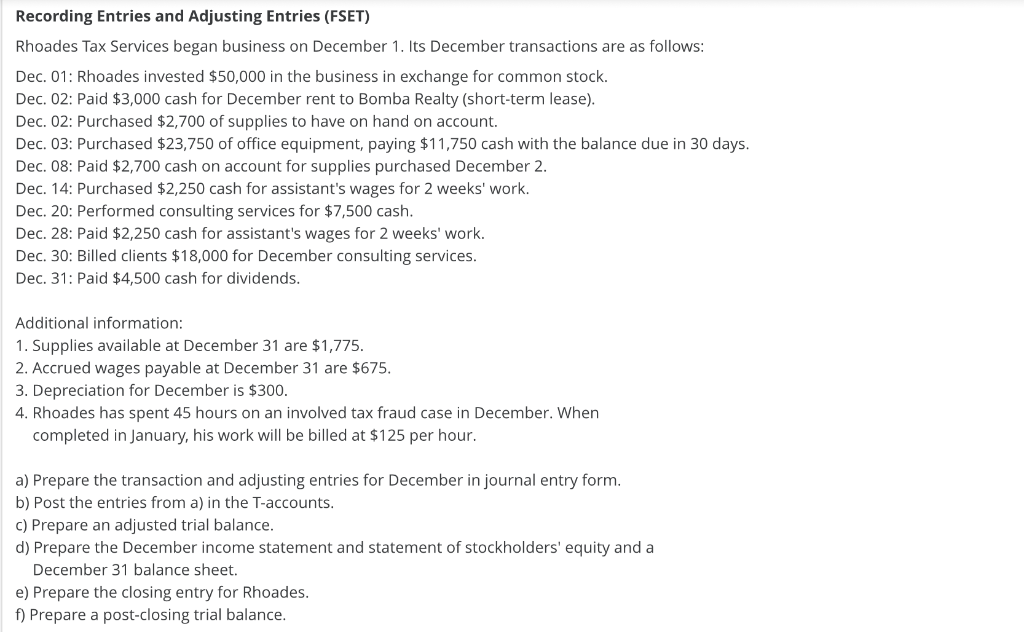

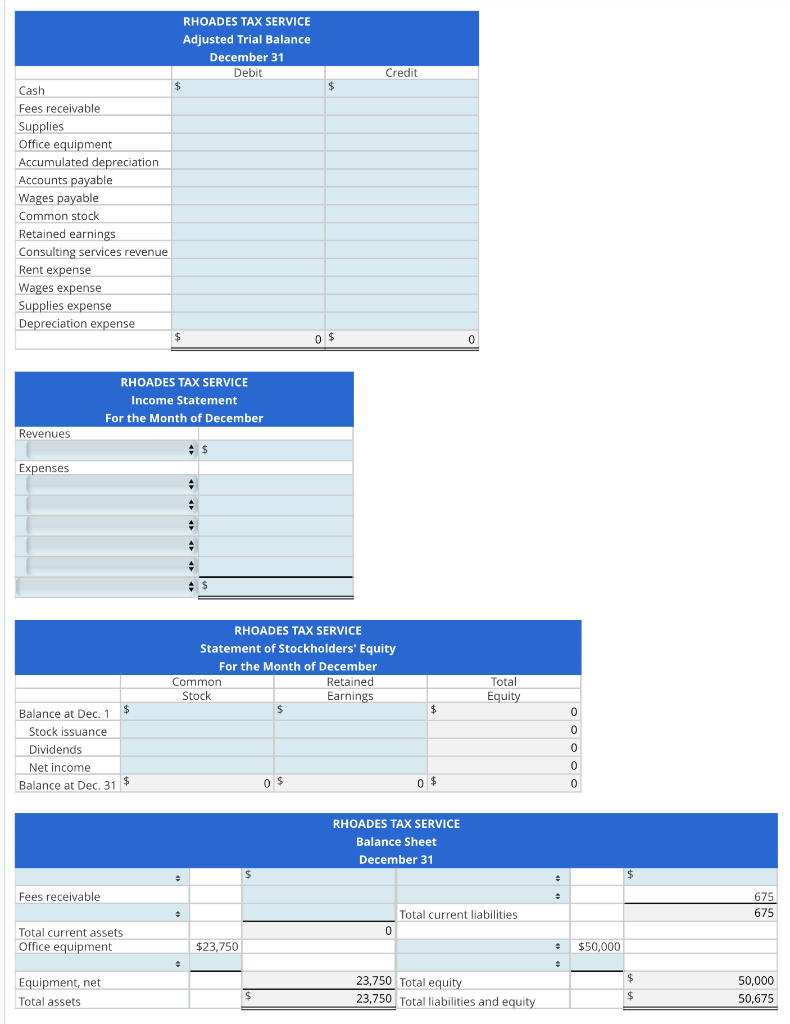

Account Debit Credit To close the revenue account To close expense accounts RHOADES TAX SERVICE Post-Closing Trial Balance December 31 Debit Credit Cash $ $ Fees receivable Supplies Office equipment Accumulated depreciation Accounts payable Wages payable Common stock Retained earnings $ 0 $ 0Account Debit Credit To record stock issuance To record payment of rent To record purchase of supplies To record equipment purchase To record payment to supplies vendor To record wages for two weeks To record consulting services revenue To record wages for two weeks To record client billings To record dividends paid To record supplies used To record unpaid wages To record depreciation To record revenue not yet billedCash Fees Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Adj. Bal. Adj. Bal. Adj. Bal. Adj. Bal. Adj. Bal. Adj. Bal. Adj. Bal. Supplies Expense Depreciation Expense Adj. Bal. Adj. Bal.Recording Entries and Adjusting Entries (FSET) Rhoades Tax Services began business on December 1. Its December transactions are as follows: Dec. 01: Rhoades invested $50,000 in the business in exchange for common stock. Dec. 02: Paid $3,000 cash for December rent to Bomba Realty (short-term lease). Dec. 02: Purchased $2,700 of supplies to have on hand on account. Dec. 03: Purchased $23,750 of office equipment, paying $11,750 cash with the balance due in 30 days. Dec. 08: Paid $2,700 cash on account for supplies purchased December 2. Dec. 14: Purchased $2,250 cash for assistant's wages for 2 weeks' work. Dec. 20: Performed consulting services for $7,500 cash. Dec. 28: Paid $2,250 cash for assistant's wages for 2 weeks' work. Dec. 30: Billed clients $18,000 for December consulting services. Dec. 31: Paid $4,500 cash for dividends. Additional information: 1. Supplies available at December 31 are $1,775. 2. Accrued wages payable at December 31 are $675. 3. Depreciation for December is $300. 4. Rhoades has spent 45 hours on an involved tax fraud case in December. When completed in January, his work will be billed at $125 per hour. a) Prepare the transaction and adjusting entries for December in journal entry form. b) Post the entries from a) in the T-accounts. () Prepare an adjusted trial balance. d) Prepare the December income statement and statement of stockholders' equity and a December 31 balance sheet. e) Prepare the closing entry for Rhoades. f) Prepare a post-closing trial balance.RHOADES TAX SERVICE Adjusted Trial Balance December 31 Debit Credit Cash $ $ Fees receivable Supplies Office equipment Accumulated depreciation Accounts payable Wages payable Common stock Retained earnings Consulting services revenue Rent expense Wages expense Supplies expense Depreciation expense 0 $ 0 RHOADES TAX SERVICE Income Statement For the Month of December Revenues Expenses RHOADES TAX SERVICE Statement of Stockholders' Equity For the Month of December Common Retained Total Stock Earnings Equity Balance at Dec. 1 $ $ $ Stock issuance Dividends Net income Balance at Dec. 31 $ 0 $ RHOADES TAX SERVICE Balance Sheet December 31 5 $ Fees receivable 675 Total current liabilities 675 Total current assets 0 Office equipment $23,750 $50,000 Equipment, net 23,750 Total equity 50,000 $ Total assets 23,750 Total liabilities and equity $ 50,675

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts