Question: Please answer within the proper format with all working Please provide working in detail Use commas and dollar sign in figures Assume that on December

Please answer within the proper format with all working

Please provide working in detail

Use commas and dollar sign in figures

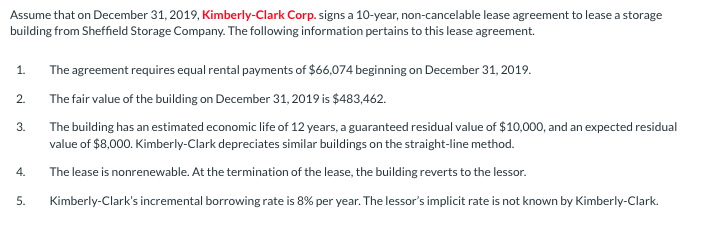

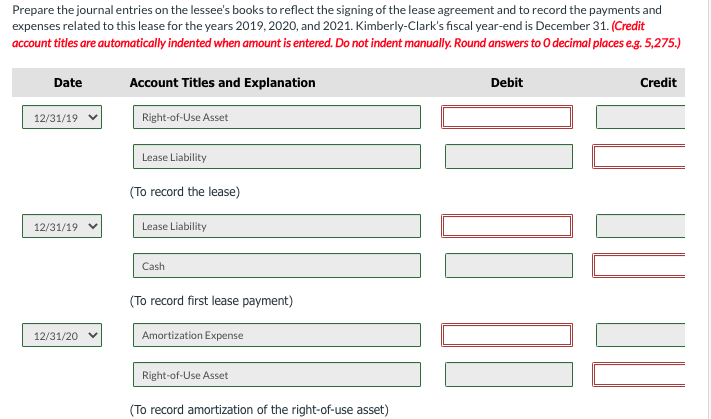

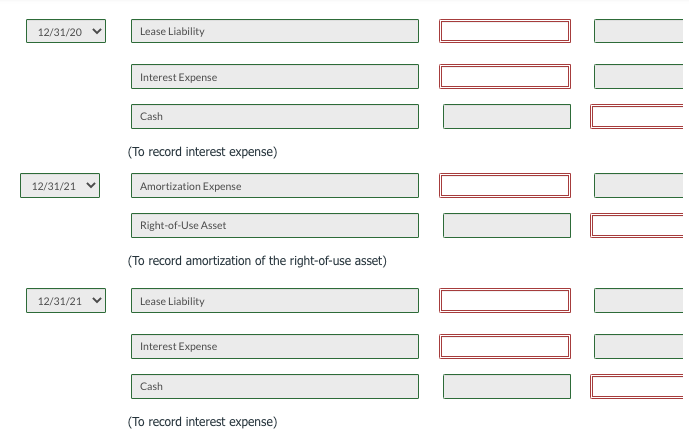

Assume that on December 31, 2019, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sheffield Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66,074 beginning on December 31, 2019. 2. The fair value of the building on December 31, 2019 is $483,462. 3. The building has an estimated economic life of 12 years, a guaranteed residual value of $10,000, and an expected residual value of $8,000. Kimberly-Clark depreciates similar buildings on the straight-line method. 4. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. 5. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark.Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019, 2020, and 2021. Kimberly-Clark's fiscal year-end is December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit 12/31/19 Right-of-Use Asset Lease Liability (To record the lease) 12/31/19 Lease Liability Cash (To record first lease payment) 12/31/20 Amortization Expense Right-of-Use Asset (To record amortization of the right-of-use asset)12/31/20 Lease Liability Interest Expense Cash (To record interest expense) 12/31/21 Amortization Expense Right-of-Use Asset (To record amortization of the right-of-use asset) 12/31/21 Lease Liability Interest Expense Cash (To record interest expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts