Question: Please be sure of your answer before posting Plz...... Load the Assignment 2 dataset as2_sleep.csv in R. Run the following regression: - Regression 1 -

Please be sure of your answer before posting Plz......

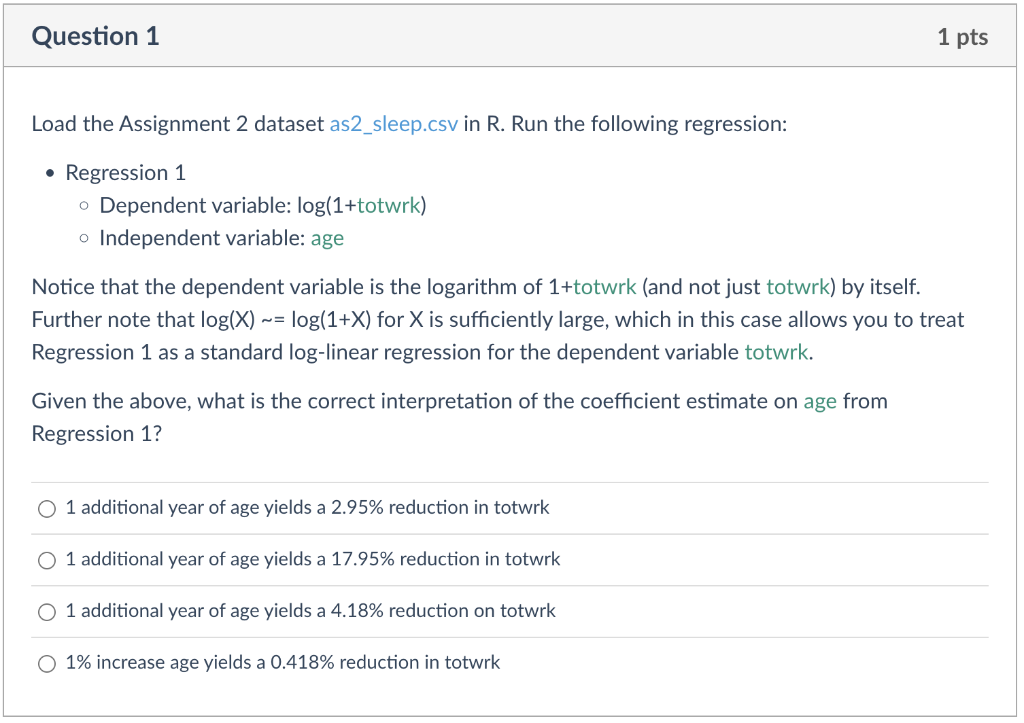

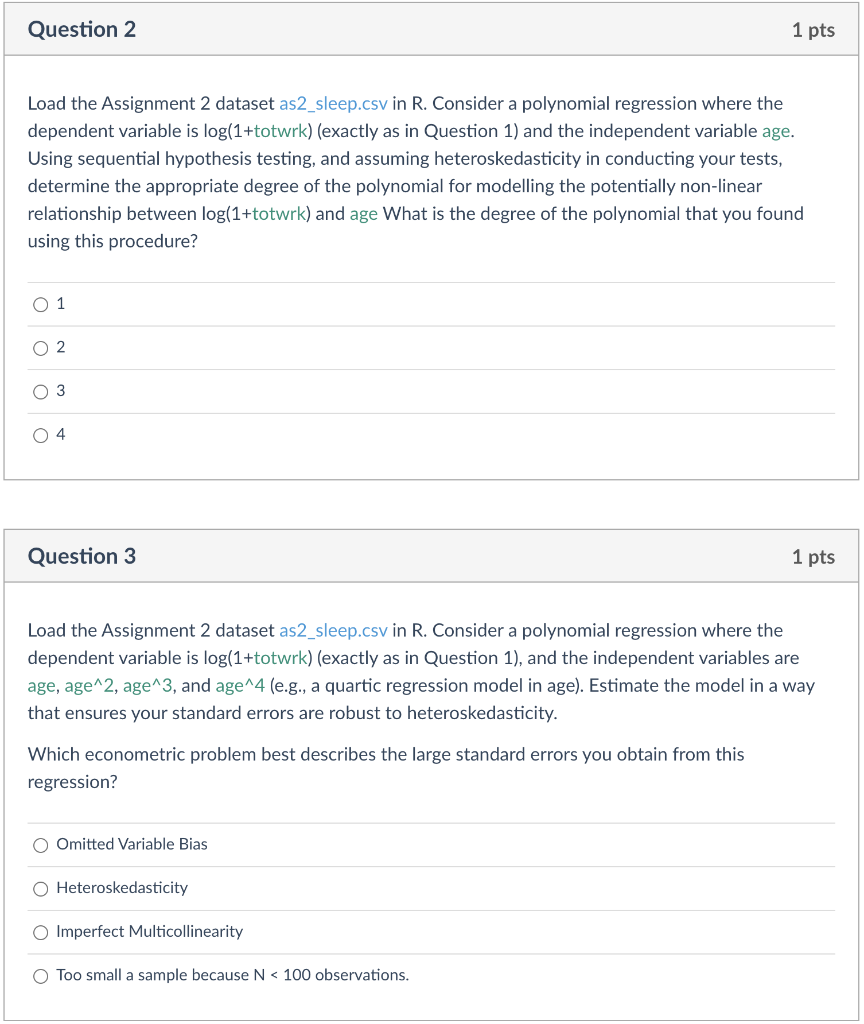

Load the Assignment 2 dataset as2_sleep.csv in R. Run the following regression: - Regression 1 - Dependent variable: log(1+totwrk) - Independent variable: age Notice that the dependent variable is the logarithm of 1+totwrk (and not just totwrk) by itself. Further note that log(X)=log(1+X) for X is sufficiently large, which in this case allows you to treat Regression 1 as a standard log-linear regression for the dependent variable totwrk. Given the above, what is the correct interpretation of the coefficient estimate on age from Regression 1? 1 additional year of age yields a 2.95% reduction in totwrk 1 additional year of age yields a 17.95% reduction in totwrk 1 additional year of age yields a 4.18% reduction on totwrk 1% increase age yields a 0.418% reduction in totwrk Load the Assignment 2 dataset as2_sleep.csv in R. Consider a polynomial regression where the dependent variable is log(1+totwrk) (exactly as in Question 1) and the independent variable age. Using sequential hypothesis testing, and assuming heteroskedasticity in conducting your tests, determine the appropriate degree of the polynomial for modelling the potentially non-linear relationship between log(1+ totwrk) and age What is the degree of the polynomial that you found using this procedure? 1 2 3 4 Question 3 1pts Load the Assignment 2 dataset as2_sleep.csv in R. Consider a polynomial regression where the dependent variable is log(1+ totwrk) (exactly as in Question 1), and the independent variables are age, age 2, age 3, and age^ 4 (e.g., a quartic regression model in age). Estimate the model in a way that ensures your standard errors are robust to heteroskedasticity. Which econometric problem best describes the large standard errors you obtain from this regression? Omitted Variable Bias Heteroskedasticity Imperfect Multicollinearity Too small a sample because N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts