Question: 1. Anne Able, an employee of Corp. A, uses her personal automobile each day to drive to and from Corp. A's bank where she

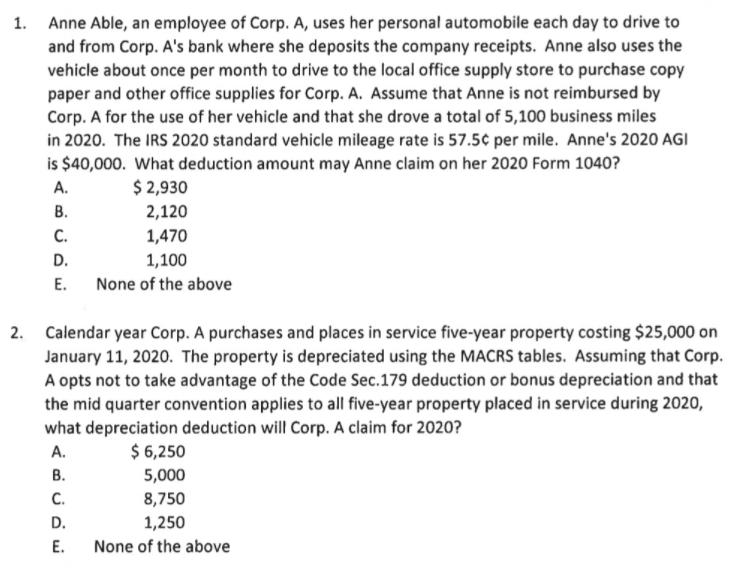

1. Anne Able, an employee of Corp. A, uses her personal automobile each day to drive to and from Corp. A's bank where she deposits the company receipts. Anne also uses the vehicle about once per month to drive to the local office supply store to purchase copy paper and other office supplies for Corp. A. Assume that Anne is not reimbursed by Corp. A for the use of her vehicle and that she drove a total of 5,100 business miles in 2020. The IRS 2020 standard vehicle mileage rate is 57.5 per mile. Anne's 2020 AGI is $40,000. What deduction amount may Anne claim on her 2020 Form 1040? . $ 2,930 . . 2,120 1,470 D. 1,100 . None of the above 2. Calendar year Corp. A purchases and places in service five-year property costing $25,000 on January 11, 2020. The property is depreciated using the MACRS tables. Assuming that Corp. A opts not to take advantage of the Code Sec.179 deduction or bonus depreciation and that the mid quarter convention applies to all five-year property placed in service during 2020, what depreciation deduction will Corp. A claim for 2020? A. $ 6,250 . 5,000 . 8,750 D. 1,250 E. None of the above Do not assume that a taxpayer makes an IRC 179 election or uses bonus depreciation unless a problem so states. For each question you answer, insert in the appropriate space on the separate answer sheet the letter which indicates the correct response. Please note than all final answers have been rounded to the nearest $10.

Step by Step Solution

There are 3 Steps involved in it

Answer 1 The correct option is A i If employer does ... View full answer

Get step-by-step solutions from verified subject matter experts